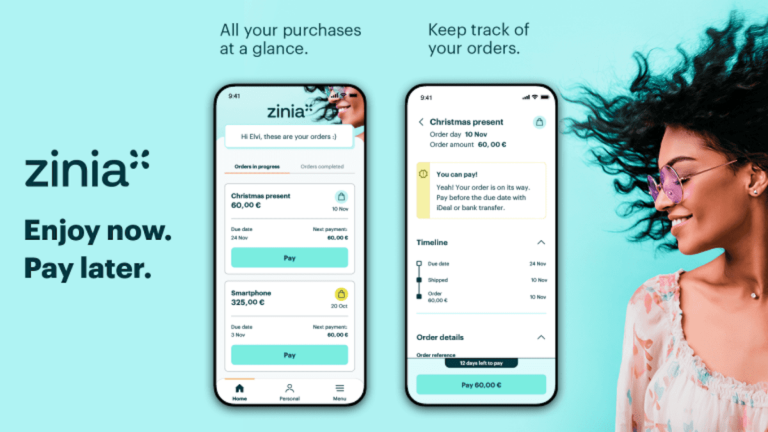

Santander Bank’s buy now, pay later (BNPL) product, Zinia, is expanding to the Netherlands and plans to grow its footprint across Europe as it moves to become a leader in the BNPL market, according to a Wednesday (Jan. 26) press release.

The bank launched the technology behind Zinia last year in Germany, where it has 2 million users, making it among the leading BNPL providers, the release stated. Zinia falls under Santander’s digital-only bank, Openbank, which has a presence in five countries and sersves an estimated 1.7 million people.

Zinia is the first project developed by Santander’s Digital Consumer Bank (DCB), which combines Santander Consumer Finance (SCF) and Openbank.

“Today we are launching a new platform that offers consumers a convenient and flexible payment option with the security and trust provided by a large financial group like Santander,” said Ezequiel Szafir, Santander’s CEO of Openbank and Santander Consumer Finance, in the release.

Zinia extends interest-free installment payments to customers shopping digitally or in person, according to the release. Zinia also evaluates people’s credit using artificial intelligence (AI) that is in step with the lending standards of regulated financial institutions (FIs).

Earlier this month, Santander acquired a 30% stake in Atempo Growth, an independent venture debt manager, in a bid to expand its commitment to financing high-growth European tech companies.

Read more: Santander Buys 30% Stake in Atempo Growth to Fund Tech Startups

Atempo will bring its management team led by Luca Colciago, Jack Diamond and Matteo Avramov Giulivi. Together, they have 20 years of experience in venture debt and have completed the financing of more than 100 European technology companies.

In other news, both Santander and billionaire Ricardo Salinas are among the players considering acquiring Citibanamex, Citigroup’s Mexican retail banking business.

See more: Santander, Billionaire Salinas Express Interest in Citibanamex Acquisition