In “Banking on Buy Now, Pay Later: Installment Payments and FIs’ Untapped Opportunity,” a PYMNTS and Amount collaboration, we found that 50 million consumers used BNPL through 2022. And the appeal of paying by installments, as relayed to us by more than 2,200 consumers, cuts across demographics and income levels.

The impetus is there, then, for traditional financial institutions (FIs) to make inroads into the space. PYMNTS research showed that a significant percentage of consumers want access to BNPL plans offered by banks rather than FinTechs, at 70% of respondents. Thirty-six percent of respondents who were not currently BNPL users said they would opt for one offered by a bank over a FinTech.

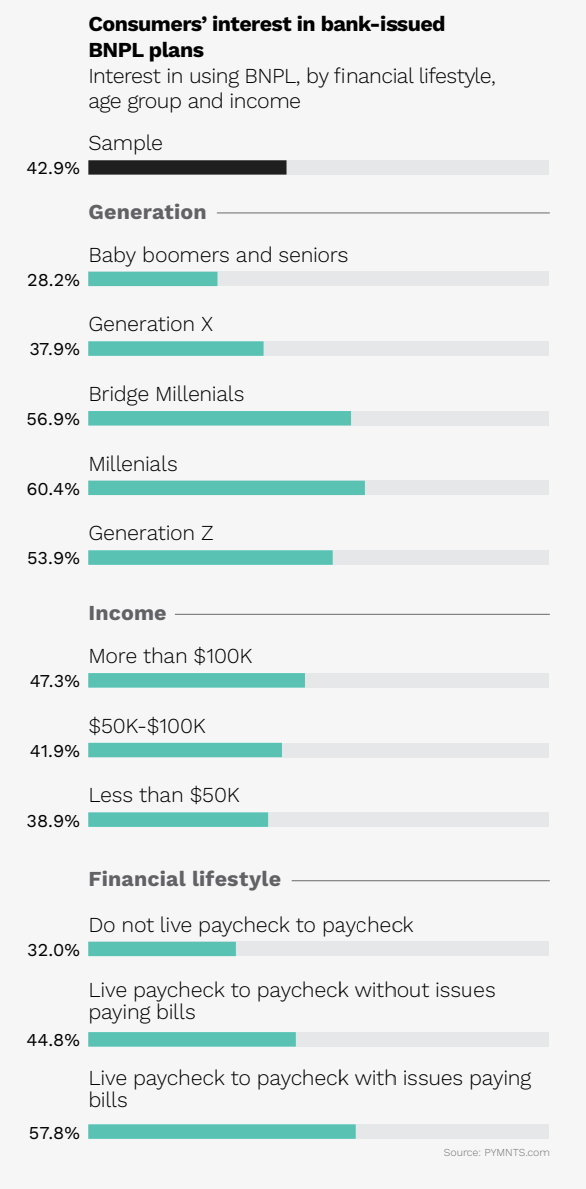

There are varying levels of interest among generations and income levels. More than 60% of millennials fall into the camp of consumers who would use a bank-issued BNPL plan. Sixty percent of consumers who live paycheck to paycheck and have trouble paying their bills are interested in the option to pay over time, as are 46% of consumers who live paycheck to paycheck and have no issues paying bills. More than half of consumers earning over $100,000 annually said they would be keen to embrace a bank-issued BNPL option.

Trust Is a Key Element

Consumers who plan to use BNPL products also want to trust their credit provider, which is where the banks may hold some advantage. Twelve percent of consumers cited trust as the most important factor in selecting a credit product, and 20% cited it as a factor.

For the FinTechs, the competitive landscape may heat up a bit. Seventy-nine percent of Afterpay’s users, 84% of PayPal Pay in 4 users and 82% of Klarna users would be more interested in a bank-issued BNPL product, the report found.

Advertisement: Scroll to Continue