According to a joint PYMNTS Intelligence-AWS study, credit card installments are currently used more frequently and for larger purchases compared to BNPL because they offer features that BNPL currently lacks.

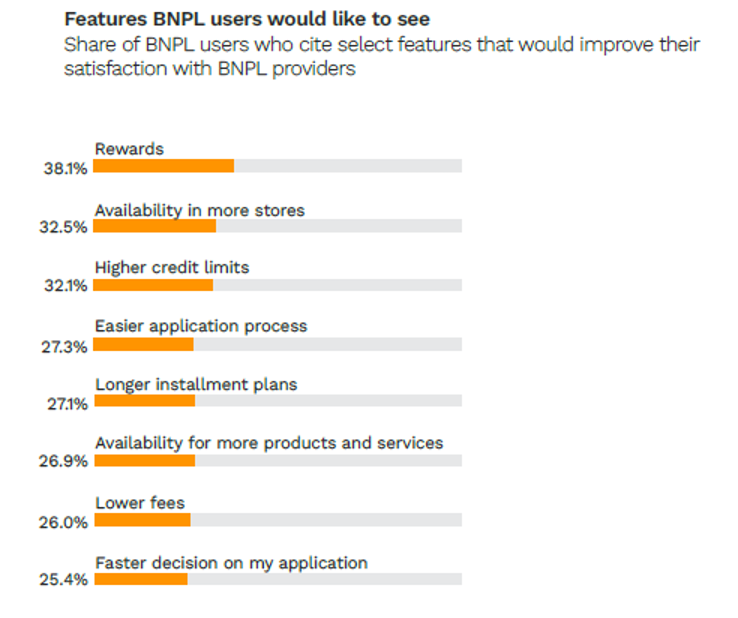

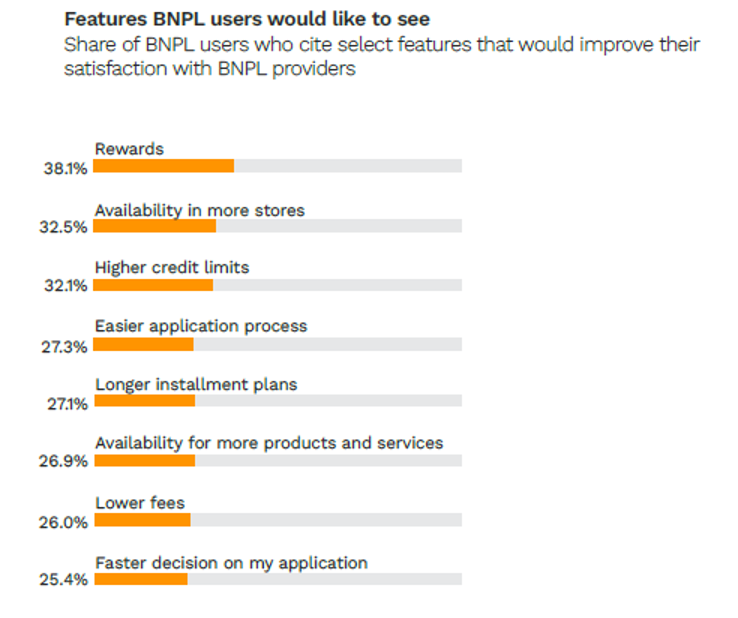

In fact, consumers expect BNPL to offer the same features as credit card installment plans, with most BNPL users (38%) citing rewards as the top feature that would improve their satisfaction with BNPL lenders.

More in-store availability and higher credit limits came up next, with about 32% of BNPL users citing each feature as key to enhancing satisfaction with BNPL providers. This was followed by demand for easier application process and longer installment plans, both at approximately 27%.

That said, the study found that consumers plan to use BNPL more in the next year, especially those who are already using it. In fact, 43% of current BNPL users plan to continue using it in the next year, while 15% of non-users plan to start using it — an indication of a growing interest in BNPL as a credit alternative.

The study also found that the usage patterns of credit card installments and BNPL vary across different demographic groups. Older and high-income consumers tend to use credit card installments more frequently, while millennials and Generation X consumers are the most frequent users of BNPL.

Advertisement: Scroll to Continue

Drilling down into the data reveals that consumers use both BNPL and credit card installments for a variety of purchases — credit card installments are slightly more popular for grocery purchases and non-grocery retail products, while clothing, beauty products, and appliances are the most common retail items purchased with deferred payment plans.

Overall, consumers who use BNPL are highly satisfied with their options, with three-quarters of BNPL users reporting being very or extremely satisfied. However, satisfaction levels vary among different demographic groups, with younger and low-income consumers being slightly less satisfied.

Ultimately, to fully unlock BNPL’s potential, providers must provide the features they desire, such as rewards programs, higher credit limits, and more availability in-store. By doing so, BNPL can become a lucrative tool for retailers to boost sales and cater to customers’ financial needs.