How TD Bank Uses Voiceprints To Personalize — And Secure — Call Center Interactions

Artificial intelligence (AI) remains one of the most interesting technologies to call centers that are looking to better support and engage customers across their many channels.

Artificial intelligence (AI) remains one of the most interesting technologies to call centers that are looking to better support and engage customers across their many channels.

Whether bank or business, call centers need to make sure they’re providing an innovative, robust experience for the customer online,  over the phone, through mobile apps and on social media. That can make the authentication process tricky when it comes to satisfying consumers who want things done quickly.

over the phone, through mobile apps and on social media. That can make the authentication process tricky when it comes to satisfying consumers who want things done quickly.

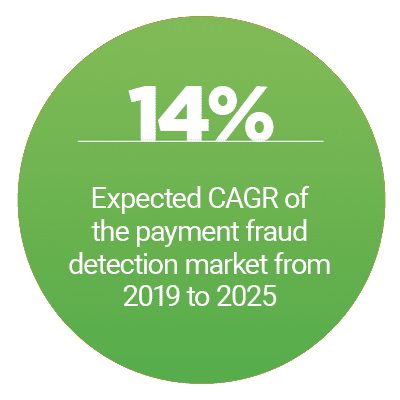

In the latest “Call Center Commerce Tracker,” PYMNTS examines how contact centers are using technologies like AI, biometrics and multifactor authentication (MFA) to keep customers satisfied and, most importantly, safe.

Around the Call Center Commerce World

Call center technology providers are relying on AI-enabled tools to make sure call centers can match changing customer preferences. Visual assistance company TechSee is among those deploying AI, recently launching a product called TechSee Smart that uses the technology to better process images. Human agents can rely on the AI to pinpoint a problem in a picture, leading to greater accuracy and less time spent determining such issues on calls.

Other providers, such as cloud communications service Vonage, are also integrating more AI into their products for contact centers. The communications service has acquired both the team and the technology of Over.ai, a conversational AI startup based in Tel Aviv, Israel. The acquisition will allow Vonage to access Over.ai’s natural language processing algorithms, among other features.

Other providers, such as cloud communications service Vonage, are also integrating more AI into their products for contact centers. The communications service has acquired both the team and the technology of Over.ai, a conversational AI startup based in Tel Aviv, Israel. The acquisition will allow Vonage to access Over.ai’s natural language processing algorithms, among other features.

Meanwhile, Google is moving forward with integrating a new feature to its Contact Center AI platform. The company is adding speech recognition technology as a way to streamline customer calls. The technology will enhance the language tools of Google’s AI, allowing it to better differentiate between common words for more helpful solutions.

TD Bank on the Importance of AI, MFA in Call Center Channels

Businesses must ensure that the customer service experiences they are providing are safe and seamless, no matter the channel. Mobile app users may have different authentication preferences than those who call the contact center, for example, which could lead to frictions if companies are not prepared.

That’s why banks, such as TD Bank, are approaching call center security needs with tools like MFA, said Lindsay Sacknoff, head of U.S. contact centers for TD Bank. In a recent PYMNTS interview, Sacknoff explained why call centers need to be sure to approach fraud holistically, which means relying on tools like AI. However, that also means developing an omnichannel strategy that can best fit the modern customer’s needs.

To learn more about how TD Bank is innovating its call center experience, visit the Tracker’s Feature Story.

Deep Dive: Call Centers Move Away From KBA With the Help of MFA

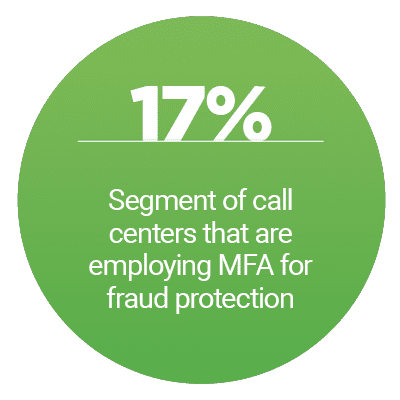

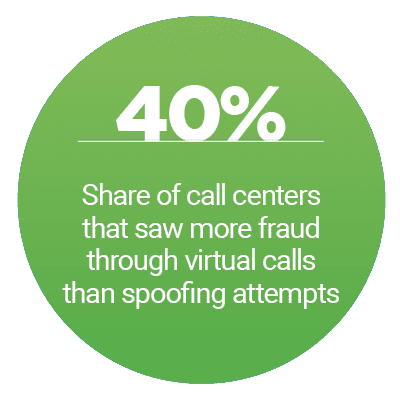

The advancement of fraud also means call centers are leaving m ore traditional authentication methods behind. Knowledge-based authentication (KBA) methods like passwords and PINs may be fast, but they can also be hard to remember and cause friction, no longer meeting the security needs of the modern call center. Therefore, many contact centers are looking to replace KBA with more strident MFA tools — or at the very least, match MFA verification modes like biometrics with a password for better security.

ore traditional authentication methods behind. Knowledge-based authentication (KBA) methods like passwords and PINs may be fast, but they can also be hard to remember and cause friction, no longer meeting the security needs of the modern call center. Therefore, many contact centers are looking to replace KBA with more strident MFA tools — or at the very least, match MFA verification modes like biometrics with a password for better security.

To learn more about how contact centers are using MFA, visit the Tracker’s Deep Dive.

About the Tracker

The “Call Center Commerce Tracker” offers monthly coverage of the most recent call center commerce news and trends. It also includes a provider directory highlighting the ecosystem’s key players.