Forward-looking firms that had previously pivoted to accommodate sudden shifts brought on by the pandemic just a few years back are rethinking their tech investment budgets.

Tailoring their spending to meet the new “new normal” of economic uncertainty and ongoing digital adoption, CFOs are seeking to modernize business processes and reduce operating costs. Strategies include methods toward remote workforce optimization, moving certain legacy systems to the cloud and automation of formally manual tasks.

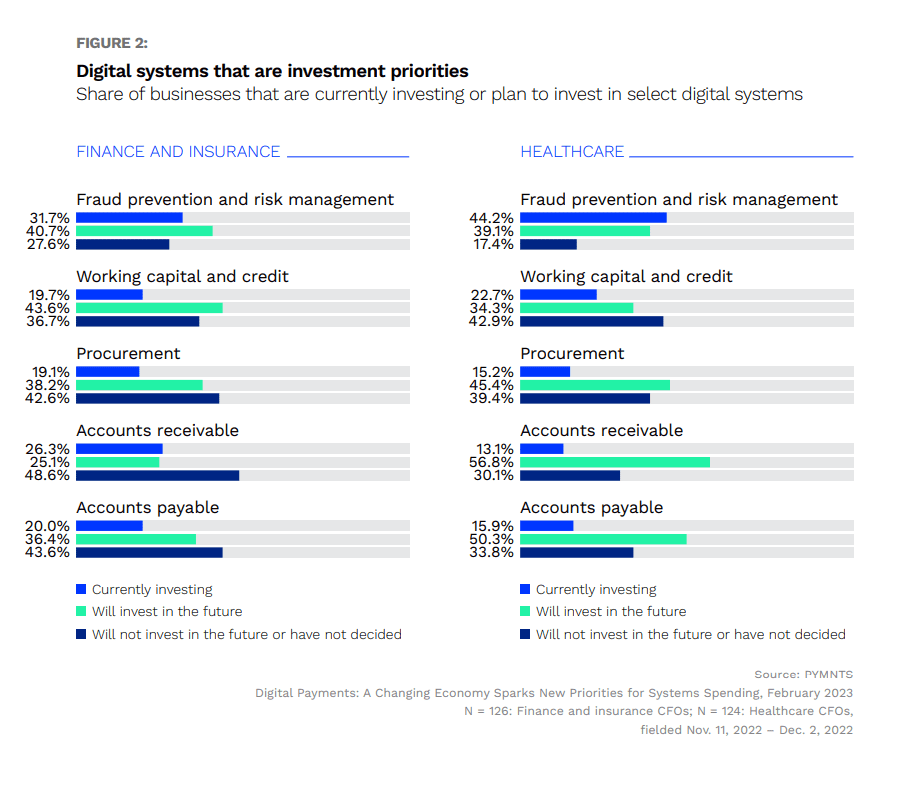

The February PYMNTS collaboration with Corcentric, “Digital Payments: A Changing Economy Sparks New Priorities for Systems Spending,” reveals the systems that are modernization priorities for surveyed CFOs in finance and insurance, along with other select industries. One of the systems cited as a priority is working capital, the funds necessary to conduct day-to-day business.

Nearly two-thirds of finance and insurance firms say they are investing or plan to invest in modernized working capital and credit, second only to fraud prevention and risk management. The report’s research further found that of sector businesses that had already modernized, 73% said their working capital and credit systems improved from digital technology investments.

Finance and insurance firms seeking to modernize without the in-house resources of major competitors may instead tap the many partner and platform options to meet their needs. In September, Payoneer hired industry veteran Assaf Ronen as the company’s first chief platform officer to lead its division integrating Payoneer’s technology into high-value service offerings, including B2B accounts payable, accounts receivable and working capital.

Another major payments player, Plastiq, has been fine-tuning its offerings to ensure that the digital tools aimed at large firms can be utilized by smaller businesses’ CFOs as well. Plastiq’s embedded finance model helps enable an all-in-one bill pay solution offering working capital through short-term financing. The technology allows a small business paying a vendor bill to use the credit card of its choice while simultaneously ensuring the vendor is paid via wire transfer or ACH.

Overseas, smaller partners have met the calls of CFOs by entering the working capital facilitation space. In January, Columbian FinTech KLYM reported raising $27 million to expand its offerings in Latin America. Focused on providing working capital to small and medium-sized businesses (SMBs), KLYM plans to use the funds to expand in Brazil, Chile and Colombia, as well as start in Mexico. The firm offers receivables finance and other working capital after approving a borrower’s invoices, tax forms and other data. KLYM’s strategic alliance with JPMorgan enables it to handle 25 currencies.

Servicing the U.K. and Germany, embedded lending firm iwoca in February raised new finance to meet rising demand after the number of SMBs it funded grew by 54% in 2022, representing 15,429 customers. Small business loans have become harder and more expensive in the United Kingdom. The company’s embedded lending technology allows SMBs and their CFOs to access loans through platforms that include accountancy software apps and access to neobanks.

Finance and insurance firms have more options than ever to modernize their business processes. When it comes to enhancing working capital and credit, a path toward growth may start with just a few clicks.