As PYMNTS Intelligence clarifies in its third edition of the 2024 Certainty Project, “Heads of Payments Zero In on Customer Behavior in Uncertainty Debate,” the responsibilities that accompany being a chief financial officer (CFO) are very different from those that head of payments must manage.

CFOs are typically in charge of an organization’s overarching financial strategy and management tactics; these can include identifying capital and risk strategies along with broader investor and financial reporting. They are also concerned with macroeconomic factors in operational areas like staffing and inventory management.

Heads of payments, meanwhile, are asked to oversee payment processing, technologies and regulatory compliance. They also must manage errors, delays and client turnover. Some are tasked with managing vendors.

PYMNTS Intelligence found that these distinct responsibilities tend to color their perspectives; however, both CFOs and heads of payments are expected to be alert to missed opportunities brought on by operational uncertainty.

High levels of uncertainty are common in most smaller revenue middle-market firms. In firms with annual revenues between $100 million and $250 million, 55% of heads of payments we surveyed report seeing high uncertainty levels in the current market, while a smaller share of CFOs (47%) share this view.

However, executives operating in both roles agree on what the top three areas of uncertainty currently are: supply chain integrity, customer behavior and competitive positioning.

But, because their roles hone different perspectives, heads of payments and CFOs each deploy different mitigation techniques to address these areas of uncertainty.

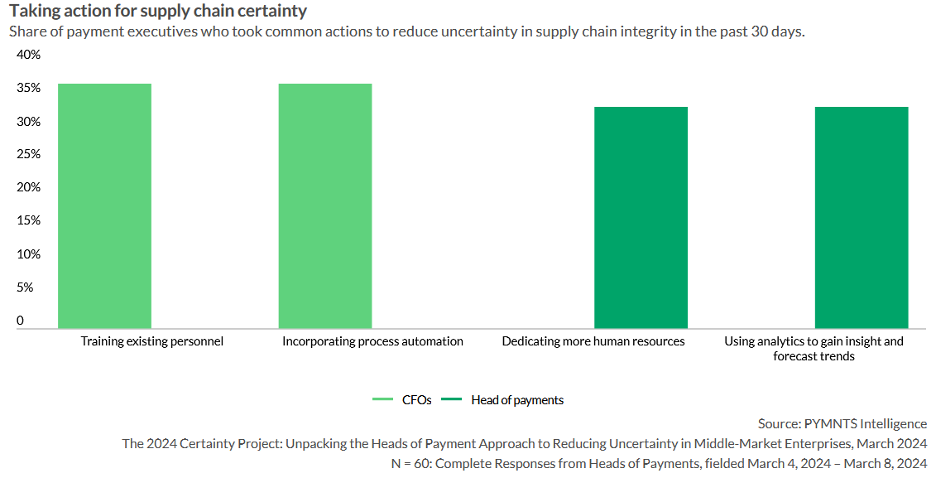

For example, consider supply chain integrity.

Among the CFOs we surveyed, 37% mitigate supply chain uncertainty by leveraging skill-based enhancements, training and using process automation. The heads of payment we surveyed took a different tack, deploying more technological resources to ease supply chain uncertainty. One-third dedicated more staff members to addressing supply chain uncertainty. In addition, they used data-intensive insights and analytics to better forecast trends.

This is just one example. Our report found similar gaps when looking at actions to ease overall uncertainty.

Heads of payments are more likely than CFOs to turn to their business networks for informal advice, for example. They are also more likely to use human resources to reduce uncertainty, with 30% relying on this strategy. As we saw in their approach to easing supply chain uncertainty, CFOs are more likely to focus on skill enhancement and technological advancement. Half of CFOs opt to further train existing personnel, while 48% hire people with specific skills to help reduce uncertainty.

But technology bridges the gap between these two approaches.

Heads of payments and CFOs both employ analytics and process automation extensively, with 47% of heads of payments adding automation and 96% of executives in both roles saying analytics significantly enhance predictability. These tools help to not only manage the volatile business environment but also shore up the foundation for future growth and stability.