How Consumers Live In The Connected Economy

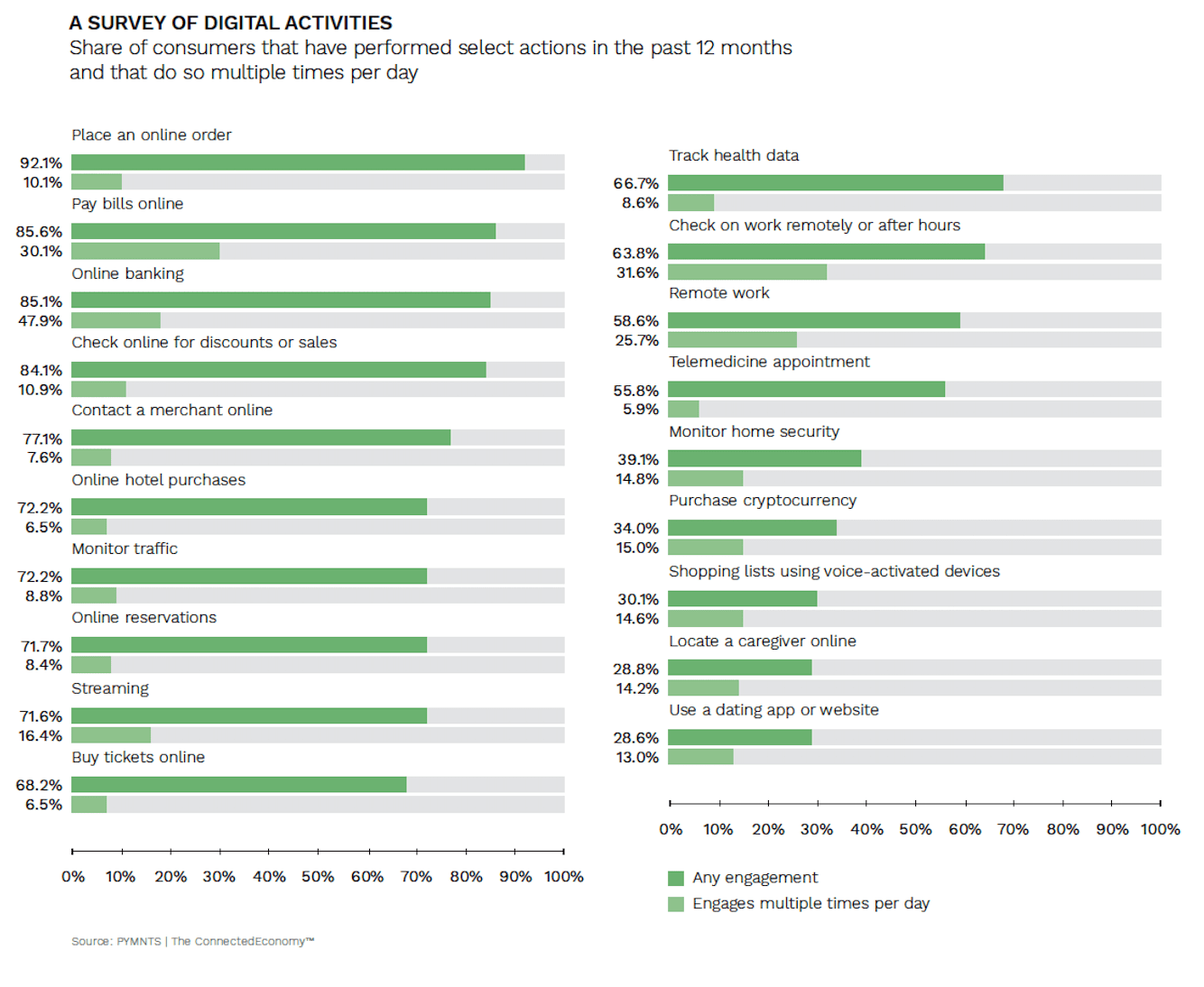

Over the last year, nearly everyone — 92 percent of consumers — went online to make a purchase, and more of them made online purchases (75 percent) than made them at a physical store (64 percent). Sixty-seven percent of all consumers went online to make a purchase several times a month.

Eighty-six percent of consumers went online to pay a bill at least once, while 70 percent did so several times a month. Seventy percent of consumers went online to make restaurant reservations or order food.

Almost as many American consumers used connected devices to track their personal health data (67 percent) as they did to book a trip online (75 percent). Nearly three-quarters of the population (72 percent) streamed music over the last year, and 16 percent did that every day.

Over the last year, four in 10 consumers went online to buy grocery products, and today 17 percent of consumers are shifting digital for groceries, doing more of their grocery shopping online than in the physical store. Forty-four percent of consumers used mobile wallets to receive money from family, friends or employers — roughly 20 percent more than those who used them to make purchases.

Almost everyone in the U.S. today participates in the connected economy – and across every single one of the pillars that define it.

Participation in the connected economy isn’t about whether one is old or young, rich or poor, high-tech or low-tech, or how many connected devices they may own. It’s about having at least one piece of tech — the smartphone — that has democratized access to the connected economy.

This is one of the many things we learned from the landmark national study of 15,094 U.S. consumers that PYMNTS conducted between April 14 and May 19 of 2021.

With this consumer research, we wanted to examine how connected consumers are now and want to be in the future, where and why they see opportunities to aggregate activities into a single “digital ecosystem,” and what they want to keep separate and distinct (and why). It’s a question that’s top of mind as all business executives wonder how much of a consumer’s digital persona is fleeting, and how much of those habits will recede as life in the physical world starts to resemble what it was like in 2019.

What we learned is that consumers like being connected, and most want to streamline multiple activities into a single digital channel for ease and convenience. Our insights provide a foundational understanding for every business interested in knowing how to adapt their strategies to take full advantage of this very digitally engaged consumer.

What is the ConnectedEconomy™?

Let’s do a bit of level-setting first.

As I wrote today, PYMNTS developed a new framework for examining the evolution of the businesses that rely on the internet to provide goods and services. We call this the ConnectedEconomy™.

To organize and keep track of the developments in the ConnectedEconomy™, PYMNTS has divided it into eight pillars, each of which represents a building block of the global digital economy that is rapidly taking shape. Together, these pillars represent the segments that will define its future by the activities that represent the consumer’s day-to-day life: how consumers work, pay and are paid, shop, eat, bank, travel, connect with others, have fun, stay well and live.

To organize and keep track of the developments in the ConnectedEconomy™, PYMNTS has divided it into eight pillars, each of which represents a building block of the global digital economy that is rapidly taking shape. Together, these pillars represent the segments that will define its future by the activities that represent the consumer’s day-to-day life: how consumers work, pay and are paid, shop, eat, bank, travel, connect with others, have fun, stay well and live.

The pillars go well beyond the classic way that businesses are categorized and measured today. Each one represents a set of broad-based activities in which people and businesses engage to accomplish a discrete goal. More importantly, the pillars are where digital is radically redefining the activities and the outcome.

The pillars aren’t standalone verticals, but intertwined with each other, in ways that often complement one or more other pillars.

The pillars aren’t standalone verticals, but intertwined with each other, in ways that often complement one or more other pillars.

Take grocery – a vertical defined by the set of stores that people visit to buy their food.

Take restaurants – a vertical defined by the set of establishments that prepare food and serve it to consumers on or off-premises.

Take eat – a pillar that reflects the blurring of the lines between the verticals that people use to buy, prepare and consume their food. Eat is a new ecosystem that reflects how businesses and people use connected devices, apps, payments and other technologies to satisfy the consumer’s very basic need to get and consume food.

For the purposes of this study, we consolidated travel and fun into a single pillar. We also learned that consumers regard payments as the pillar that enables many of their activities within and across each of them.

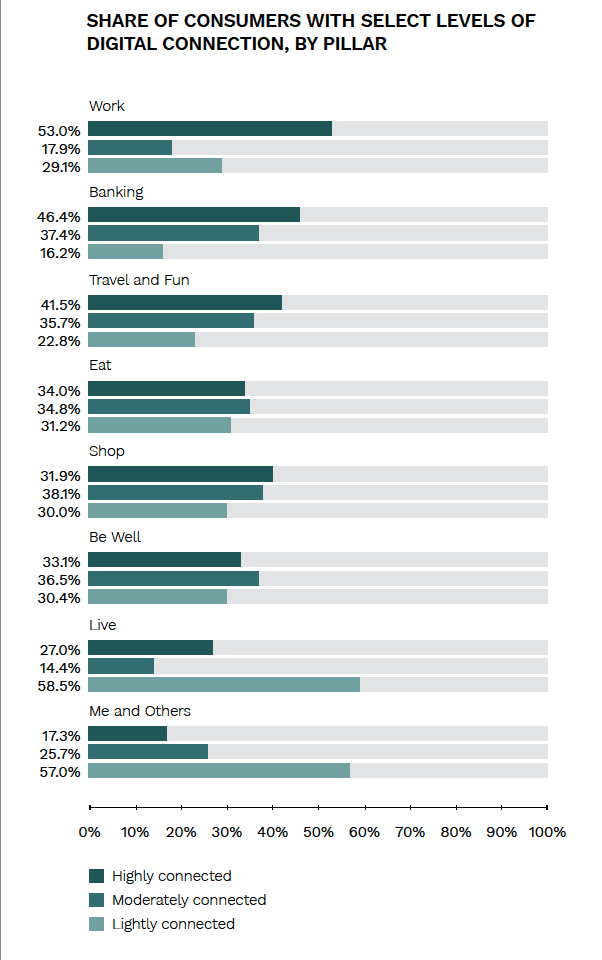

Fifteen thousand consumers and millions of data points later, we have the first comprehensive assessment of how consumers want their connected future to look. We analyzed consumers by traditional demographic cuts as well as by the number and types of devices they own. We categorized consumers into low, moderately and highly connected – to understand the intensity of their digital connections to these pillars, using those persona classifications to report some of our preliminary findings.

Highly connected consumers are the 29 percent of the population who use connected devices to perform a substantial portion of activities within the pillars. Moderately connected consumers are the 47 percent who occasionally use digital tools to perform some but not all activities. Lightly connected consumers are the 24 percent who use connected devices to occasionally perform a fraction of activities within the pillars.

The full report with supporting charts and graphs can be found here.

Being Connected Is Just the Starting Point

Nearly three-quarters (72 percent) of all consumers frequently use a connected device to engage in at least one aspect of their daily lives. The smartphone has democratized access to digital outlets for the most vital of all human activities: eating, shopping, banking and even monitoring their health.

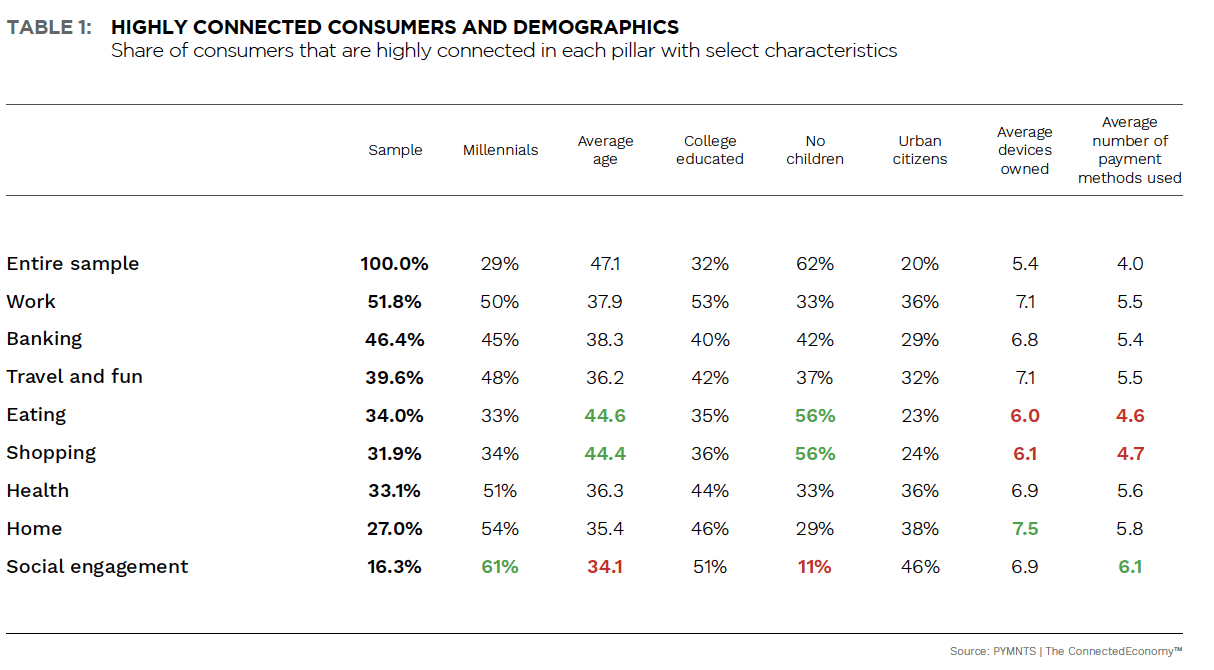

Clearly, the number of connected devices a consumer owns doesn’t limit participation in the connected economy – but other factors including age, income and geography may influence the intensity of engagement using those devices within and across each of the 10 pillars. Owning more connected devices simply gives consumers different options and different ways to perform activities within each of the pillars.

Forty-five percent of consumers own many more devices than a smartphone or PC – six devices on average, up 33 percent over the last two years. In addition to laptops and phones, these consumers own any combination of tablets, smart TVs, gaming consoles and/or smartwatches, using them to get different connected experiences.

Thirteen percent of consumers own even more: 12 on average. They aren’t gadget collectors, since they don’t buy multiple devices that do the same thing. Their connected device purchases are more deliberate and purposeful, connecting them to different experiences and for specific purposes.

These consumers have full-on embraced the notion of connecting digitally to multiple pillars for ease, convenience and security, and they want a portfolio of connected devices to make that possible.

That said, just being connected isn’t the whole story – there’s also the intensity by which consumers use connected devices within each of the pillars. This “effective connectivity” — the intensity as measured by frequency of use of connected devices to carry out their activities — is independent of device ownership, but highly correlated to age, income and where people live.

Younger, more affluent consumers are more highly engaged with banking, shopping and travel apps. More than half of all consumers who are connected to the work pillar are millennials. A third with high levels of engagement in travel and leisure live in big cities. Nearly half of those highly connected to banking via digital channels earn more than $100,000 per year. Forty-five percent of affluent consumers living in urban centers have ordered groceries online, while fewer (30 percent) who live in more rural locations have done the same. Although the degree to which consumers are connected to shopping and eating is the most consistent across all populations, the intensity of usage skews younger and more affluent.

The intensity of use may be influenced by other factors as well. More people living in rural locations may want to order groceries or other products online, but last-mile logistics problems may prevent that, as the necessary applications are not available or the cost of delivery is too high.

A family using online travel sites who lives in the suburbs probably has different travel needs and far fewer trips to plan than the younger, more affluent consumers living in cities and large towns. Ditto for the differences in wants and needs for ride-hailing or micro-mobility services – particularly now that more people own cars, and fewer of them will return to a Monday-through-Friday office commuting schedule.

The correlation between age, income and the use of banking services may be as much about the lack of complexity of a consumer’s financial situation as their interest in (or need for) digital access to them.

The correlation between age, income and the use of banking services may be as much about the lack of complexity of a consumer’s financial situation as their interest in (or need for) digital access to them.

The area where we find the most acute disparity in connected activities is in the work pillar.

Although two-thirds of consumers would like to have the ability to more distinctly connect to their place of work remotely to do their work, just a third of all consumers say that’s an option today. Those who are largely without that access tend to be older, lower-income consumers.

Participation in the connected economy currently tracks the evolution of digital more broadly, as well as the widespread availability of efficient digital options.

Amazon is 26 years old. It’s been 15 years since 80 percent of banks in the U.S. turned on internet banking. Spotify launched in 2008 and Netflix started streaming in 2007. Starbucks introduced the world to online ordering and order-ahead six years ago. Expedia introduced consumers to online travel bookings without a travel agent in 1999.

Consumers have had more than two decades to hone their digital shopping skills online, more than a decade to get proficient in downloading and using apps on their mobile devices, and more than five years to try new apps that blend the digital and physical worlds, like online ordering for pickup or delivery. Their use of connected experiences reflects the maturity of those digital platforms, and the ability for consumers to access them without the need for anything other than a smartphone (which is essential for some activities) or a PC connected to broadband (which is good enough for many). The ease with which consumers can use digital payments removes much of the friction from those online experiences. Intensity of use isn’t device-dependent, but rather age-, income- and lifestyle-driven.

Over this same period of time, user experiences across each of these basic pillars – shopping, banking, eating, travel and leisure – have improved, as has the availability of the apps and sites that enable them. It’s why so many new-to-the-internet users, particularly older people, have been able to navigate their way online during the pandemic to order food and retail products and to conduct more of their banking activities.

As our survey data suggests, for three-quarters of the population, going online using connected devices is how consumers now manage so many of their day-to-day activities.

Not surprisingly, shopping activities are those that all consumers – regardless of their intensity of use – are the most likely to conduct digitally. Half of all consumers make an online purchase every week or every month. Meanwhile, 86 percent of lightly connected consumers have ordered something online at least once over the last year.

Not surprisingly, shopping activities are those that all consumers – regardless of their intensity of use – are the most likely to conduct digitally. Half of all consumers make an online purchase every week or every month. Meanwhile, 86 percent of lightly connected consumers have ordered something online at least once over the last year.

Remarkably, over the last year, two-thirds of American consumers have gone online to book an appointment with their doctor at least once, and 75 percent of consumers have used digital channels to access medical records or wellness data. More than half (55 percent) have ordered prescriptions online, had a telemedicine appointment and used an online portal to pay a doctor’s bill.

At the other end of the spectrum is the connected home. Here, we see a bifurcation of consumer interest and the use of a more connected home, largely because it requires the purchase of additional connected devices.

Roughly a quarter of all consumers (24 percent) use connected devices to monitor home security, even though 40 percent of consumers say they’d like to.

Twenty-three percent of consumers would like to use voice-activated speakers to build their shopping lists, nearly twice as many as those who actually do so today.

Interestingly, a quarter of all consumers say they’d like to make a payment using a voice-activated device, including 30 percent of those who only own a smartphone. Voice-activated apps are available today, but are perhaps not as familiar to consumers as the experience provided by a smart speaker. User experience and provider availability may contribute to the lack of usage and the subsequent lack of ownership of those devices.

Cards – physical or virtual – also still rule in the connected economy. Although the consumer’s activities may be trending more toward digital, the use of general-purpose mobile wallets to enable those transactions remains relatively low across the population, with more consumers using mobile wallets to receive money than to make a purchase using one at least once over the last 12 months. Consumers’ use of the general-purpose “Pays” lags behind the use of PayPal by a factor of five to one. More of those consumers use Venmo than Apple Pay, Google Pay and Zelle for P2P payments.

The exception are the 29 percent of highly connected consumers who regularly use a diverse set of six payment methods versus four for most other consumers. These consumers use credit cards (80 percent), followed by mobile wallets and debit cards (65 percent) and PayPal (62 percent).

The 47 percent of consumers who are moderately connected are more credit-centric (78 percent) and debit card-centric (68 percent), with mobile wallet usage at 11 percent for Apple Pay and 6 percent for Google Pay. PayPal usage by this group is 50 percent. In contrast, lightly connected consumers tend to rely mostly on credit cards, debit cards and cash, while just 10 percent make payments with mobile wallets and 32 percent use PayPal.

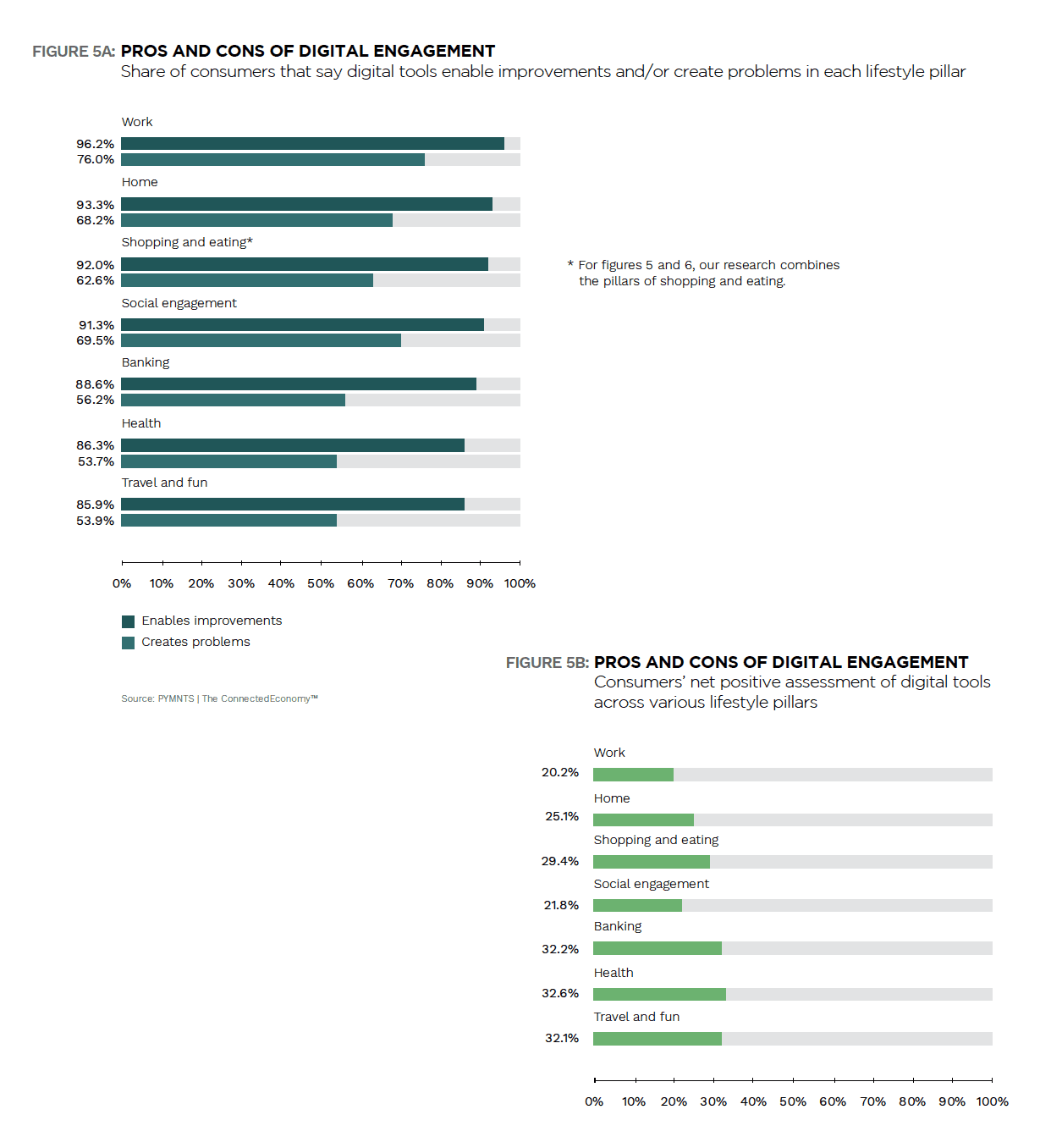

Consumers participate in the connected economy because the convenience and time savings vastly outweigh any problems, such as those involving privacy and security.

Consumers have reevaluated many aspects of their daily lives over the last 18 months, but none more so than the value of their time. Connected devices and apps have given consumers the freedom to decide how to use their time to accomplish routine tasks.

American consumers say they like being connected because it saves them time and makes it more convenient to accomplish activities that are largely routine and transactional in nature.

American consumers say they like being connected because it saves them time and makes it more convenient to accomplish activities that are largely routine and transactional in nature.

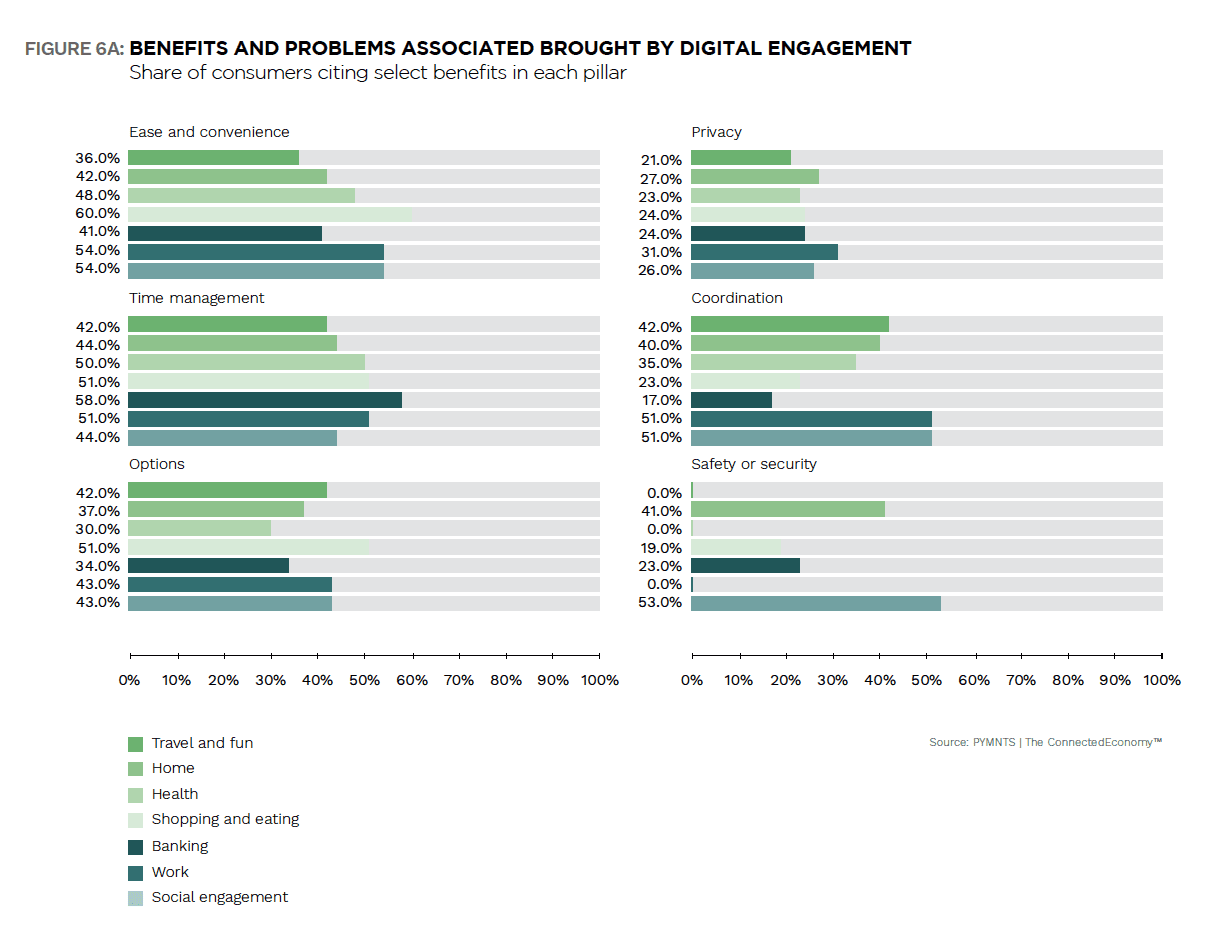

The net benefits of being connected to leisure, health and banking pillars are the greatest. Nearly 60 percent of consumers cite convenience as a benefit of introducing connected devices in their shopping routines. When it comes to banking, time management leads as the most valuable benefit of being digitally connected, at 58 percent. Transacting online is better than going to the branch.

Nearly 90 percent of consumers using connected devices for banking-related tasks cite one or more benefits from doing so, while only 56 percent say that using digital channels causes problems.

Consumers also seem to be quite realistic in assessing the downside of being connected. For consumers across all of the connected economy pillars, the benefits of convenience outweigh their concerns over security or privacy. Just as many consumers say they are worried about how much time they might waste playing around on the internet as those who worry about whether their digital interactions across most of the pillars are safe and secure.

It’s an interesting finding, particularly when considering the macro conversations taking place about privacy and security today. Of course, consumers in our study did express concerns over privacy and security. Only 20 percent of consumers said that being connected has improved their privacy and security – but it’s not the determining factor for why or why not consumers want to be even more digitally engaged. Consumers seem to trust that their current digital relationships are secure and that their data is private, making decisions to engage based on those criteria.

That could explain why the time savings and convenience factors outweigh issues related to privacy and security by almost two to one – particularly for the shopping, banking and eating segments. Overall, 84 percent of consumers cited time savings and convenience as a benefit at least once across all pillars, while 50 percent of consumers cited privacy and security as a concern.

That’s not to say that privacy and security aren’t important. As you will see later, those two concerns have a measured impact on which of the pillars consumers want to be separate from any larger ecosystem that connects multiple pillars into a single point of access.

Most consumers are connected to multiple pillars – and those connections are influenced by lifestyle and other natural synergies.

We learned that the average consumer is highly connected to 2.7 out of the eight pillars we studied. (P.S. we consolidated travel and fun into a single pillar and considered payments separately.)

The more transactional an activity, like an online ordering experience, the greater the potential for all consumers – not just those who are highly connected – to perform those activities using digital methods.

Online ordering – whether for food or retail products – is highly correlated. Ninety percent of consumers who engage in digital shopping behaviors also do so when buying food at grocery stores or restaurants.

Consumers who connect digitally to those activities are making appointments online with their healthcare providers – another online ordering-like behavior.

That said, we observe that highly connected consumers are connected to more pillars, and different patterns overlap that tend to be less transactional in nature and more lifestyle- and social-centric. These high-income, younger and urbanized consumers show a high degree of overlap in the work, banking, travel/fun, be well and communicate with family/friends pillars.

Sixty-eight percent of highly connected consumers who use digital channels to manage their money (the banking pillar) show a high degree of connected behaviors in the work pillar and be well pillars. And because many of their activities also include others, they are highly connected to apps that enable more efficient, real-time communication with friends and family.

For most consumers, digital connections are about making transactions more efficient, which saves time and money. For the highly connected consumer, it is much more driven by lifestyle and the interactions that support a more efficient way to live their life. It is an important insight into how connected ecosystems, and the super portal concept, is likely to evolve.

Two-thirds of consumers see value in a “super app” concept, largely because they don’t like having their personal information all over the web.

Most consumers believe that having more activities consolidated into a single digital app or ecosystem would be more secure and private than engaging with the multitude of discrete apps and activities that represent their digital lives today. Today’s consumer is connected individually to roughly three of the eight pillars we studied, but want more of those activities connected inside of a single ecosystem, or “super portal.”

For the average consumer, that magic number is five. Shopping, eating, travel/fun and communicating with family and friends are the pillars that most consumers would like assembled into a single digital experience. That experience is also one where consumers expect payments to be an embedded part of that engagement.

Perhaps more interesting than the desire to assemble five activities into a super portal-like concept are the reasons why.

Consumers report that having so much of their personal information stored all over the web is a problem: 60 percent cite that as their top concern about engaging on the internet. Half of these consumers describe this problem as “huge.”

Also concerning is the privacy of their data when it is stored with many different digital endpoints. Consumers perceive a super portal as a digital outlet that would provide more control over their data and their engagements – a single place that’s easier to track and manage. The need to remember logins and passwords for all of the digital relationships they have on the web is a related friction.

At the same time, consumers expressed a keen interest in keeping certain activities separate from a super portal, even as they want a more efficient way to digitally access them.

Banking and healthcare are the two pillars that all but the highly connected consumer say they’d like to have aggregated as part of a single, super portal ecosystem. Sensitivities over access to confidential financial and health data, stored in the cloud and commingled with other activities, appear to be large and legitimate barriers to consumer interest and likely adoption.

That’s not to say that consumers don’t want to be connected to a more robust and efficient be-well and banking ecosystem – just not as part of a larger, single digital ecosystem.

The 73 million highly connected consumers who drive roughly 36 percent of online spend are the connected economy pioneers.

Twenty-nine percent of American adults appear to be super enthusiastic about the notion of a super portal that assembles most of their digital lives. These consumers want a single ecosystem that connects six of the eight connected economy pillars, including banking and healthcare.These are also the consumers who connect more intensely to more pillars today and who drive roughly 36 percent of online spend, not including healthcare and automotive-related spend.

Sixty percent of the highly connected consumers already use devices to track their health data at least a few times a month, and nearly half (45 percent) would engage in video telehealth consultations with a similar frequency. Thirty percent use or have used voice-controlled assistants to create shopping lists. They have enabled their homes to be smart, and they use digital devices to perform work.

These consumers are not only the early adopters of digital experiences – and, when needed, the connected devices that enable them – but they are also more likely to be the early adopters of new payment methods.

These highly connected consumers use a diversity of payment methods – an average of seven payment types, compared to four for the average consumer. They’ve also made purchases in each of the connected economy pillars, including payments to family and friends. These consumers have over-indexed in their use of merchant-centric mobile wallets, PayPal and the general-purpose Pays over the last 12 months.

Consumers trust the brands that have enabled digital commerce innovation to provide a single access point to their connected economy future.

Brands that are – or are perceived to be – central players in today’s digital commerce ecosystem are those that consumers report as the most trusted to provide a single connected experience. Amazon and PayPal are highly regarded by American consumers as players to enable those experiences – perhaps not surprising, given the frequency with which consumers engage with those brands today, and the diversity of goods and services they can procure when using them. Card networks in the aggregate are as well, given the consumer’s brand association and familiarity with the logos on the card products they use to pay for their connected experiences. Social networks, such as Facebook or Instagram, are low on the list, as are most merchants. Banks rank near the middle of the pack, slightly ahead of Apple Pay.

This finding reflects a few different things.

The average consumer has a desire to aggregate transactional activities – shopping, eating, travel/fun, and messaging – into a single platform. When consumers think about making a purchase, booking a trip or making a restaurant reservation, they go to a merchant, Amazon, a marketplace or Google to get the job done. The highly connected consumer wants even more points of connection – the integration of health and work into a single point of access.

For all consumers, banks and banking are a plug-in to an experience enabled by another commerce-centric front-end provider. It’s not that banks and the connected banking pillar aren’t important to consumers – it just isn’t where they engage when accessing the majority of the connected activities unrelated to tracking and managing their money today.

What Matters

Smartphones are the consumer’s remote control to the connected economy. The last 18 months have given the U.S. consumer both the experience and the confidence to leverage connected devices and digital channels to accomplish a number of routine, transactional tasks. Although different in intensity and frequency, all consumers have engaged in digital behaviors across all of the pillars that represent our digital economy. In some cases, the use of these digital channels has complemented the consumer’s use of physical channels – while in others, it has replaced them.

The last 18 months have also sharpened how consumers would like to use digital channels to save time and gain greater convenience. All consumers see the value in consolidating commerce-related activities into a single ecosystem that simplifies how they access those services and use digital payment methods to enable those transactions. Early adopters of an even more tightly integrated connected ecosystem see the opportunity to take that engagement to another level, aligning how they live, work, play, bank, travel, have fun and stay well with how and where they shop and spend their money. These will be the most coveted of the connected consumer, given the spending power they will wield over the next several decades.

We will see innovators continue to leverage the existing, cloud-based tech and payments tech infrastructure created and refined over the last decade – as well as new tech like 5G and artificial intelligence (AI) – to rapidly accelerate participation in those segments where digital connections are not as well-adopted by providers and consumers. Consumers have the devices – and, in most cases, the only device they need – to enable that engagement, along with the appetite and confidence to do so.

Banking and healthcare are both pillars where the potential exists to create more robust – yet for most, separate and distinct – digital ecosystems.

The question for businesses isn’t whether consumers want to live in a connected economy, as there’s no going back to how consumers engaged in 2019. Instead, it’s whether living there influences their use of physical channels and their choice of providers that enable a new, better way to access this dynamic, interconnected world.