As many of us live so much of our daily lives online, data security remains top of mind.

Eighty percent of consumers have saved their payment details online, whether on merchants’ websites or apps, indicating a willingness to get what we need and have as much of a frictionless experience as possible. Not having to enter personal, card-level and bank-level details over and over again saves time — and cements customer loyalty.

In the report, Payments And Credentials Vaults: Gauging Consumer Interest, a PYMNTS and FIS collaboration, more than 2,000 U.S. consumers said they valued the ease promised by storing payment credentials with retailers. We found that 56% of consumers have between one and 10 stored credentials, and nearly one-quarter have more than 10 credentials stored. Just 20% of consumers do not use any stored credentials. Doing so is especially prevalent in the subscription economy, where 61% of consumers recently paid for their subscriptions or online purchases using stored credentials.

And yet pain points are prevalent. We found that 55% of consumers who store payment credentials have experienced checkout disruptions, such as expired or stolen cards.

There’s growing familiarity with payments/credentials vaults. Those vaults are the online apps that store and encrypt a consumer’s payment credentials and provide these details at the time of payment. A credentials vault, we noted in the report, also provides a single point of contact for consumers to update their personal or account information as needed — and they don’t need to interact with their merchants to do so.

As to why merchants should link to those vaults: As the PYMNTS/FIS data show, an overall 58% of all consumers are at least somewhat likely to switch to merchants that link their services to a payments and credentials vault. The willingness to switch is especially prevalent among younger consumers. Our survey showed that 44% of millennials and 43% of bridge millennials are very or extremely likely to switch merchants for this reason, but just 12% of baby boomers and seniors are as likely to switch.

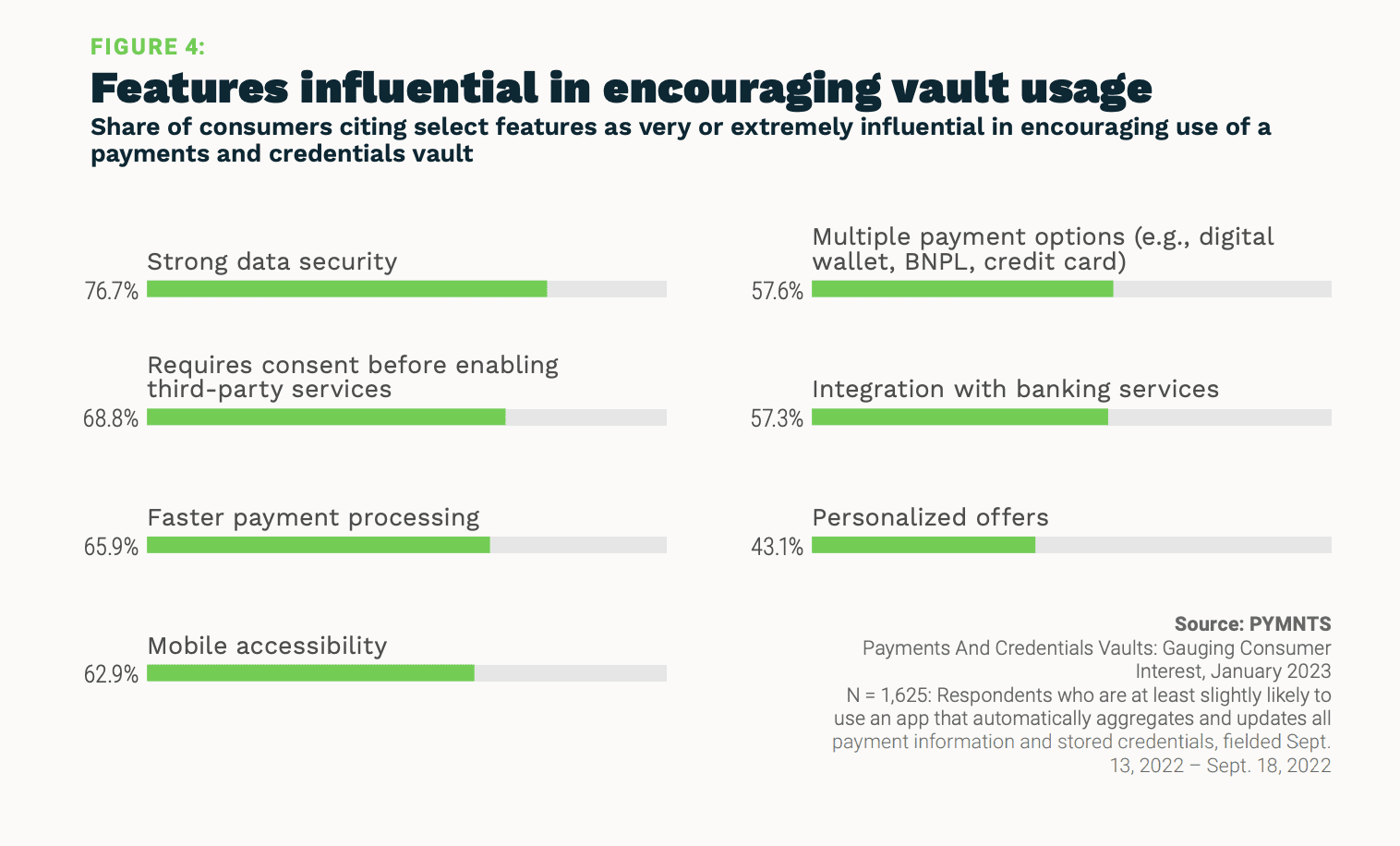

Strong data security tops the list of features that consumers say might encourage them to use a payments/credentials vault — and 77% of them say that netter security would be “very or extremely” influential in encouraging their embrace of the vault.

More than 58% also said that they’d value having multiple payment options in the mix — spanning digital wallets, BNPL and cards.