NEW REPORT: 84 Pct Of Consumers Value Digital Security Over Checkout Friction When Shopping First Time Merchants

Data security — and the robust infrastructure to support it — is much more than a barrier that can prevent costly cyberattacks. PYMNTS’ research shows that data security is an essential component of customer service, signaling trustworthiness to consumers who want safe customer experiences as much or even more than they want frictionless checkouts, especially when it comes to mobile devices.

Data security — and the robust infrastructure to support it — is much more than a barrier that can prevent costly cyberattacks. PYMNTS’ research shows that data security is an essential component of customer service, signaling trustworthiness to consumers who want safe customer experiences as much or even more than they want frictionless checkouts, especially when it comes to mobile devices.

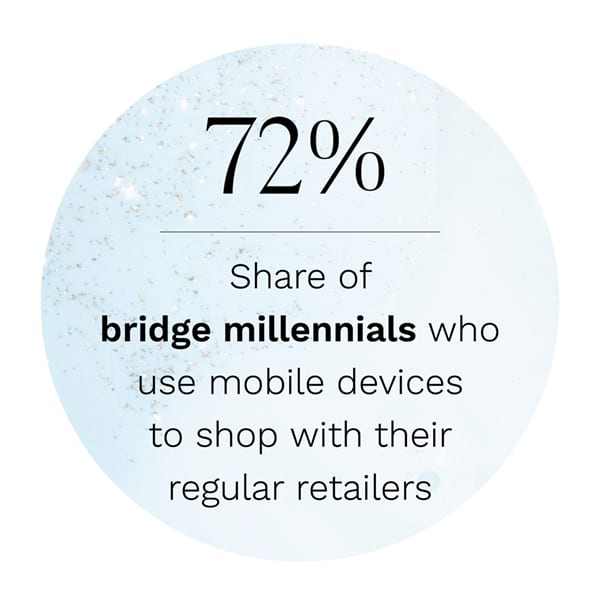

Mobile has become the go-to channel for the overwhelming majority of millennials, with more than 75 percent using mobile devices to shop with their favorite retailers and 64 percent using it to discover new ones. That means merchants with limited expertise in mobile eCommerce must quickly adjust to the nuances of a positive mobile customer experience — from a mobile-friendly payments experience to a data security approach that scales easily for mobile devices.

Today’s consumers are not only well aware of the potential security risks of shopping on a mobile device — they want their chosen merchants to be proactive about protecting their personal information and payment details.

The Digital Security Playbook: Building Trust And Loyalty Online, a PYMNTS and Sift collaboration, is based on a survey of 2,563 United States consumers and examines the trust signals that influence consumers’ retailer choices. It uncovers the unique risks facing mobile and other eCommerce consumers and how merchants can protect consumers’ data and win their trust.

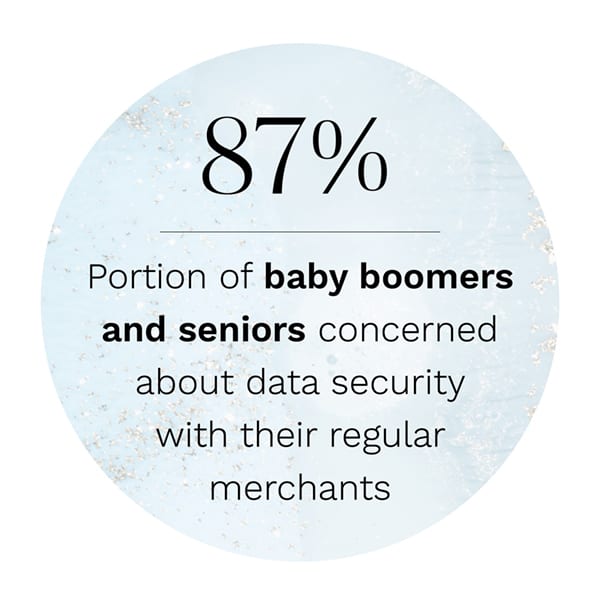

PYMNTS’ findings reveal that the majority of adult consumers are highly concerned about the security of their data, especially when it comes to shopping with small online stores. More than 80 percent of first-time shoppers with small merchants want those sellers to take on any measures available to them to protect their data, even if it causes friction at checkout.

findings reveal that the majority of adult consumers are highly concerned about the security of their data, especially when it comes to shopping with small online stores. More than 80 percent of first-time shoppers with small merchants want those sellers to take on any measures available to them to protect their data, even if it causes friction at checkout.

Consumers face risks that range from identity theft “phishing” schemes to data compromises through insecure apps. This means that companies seeking to ensure that consumers enjoy seamless experiences must balance seamless performance with robust security practices.

Customers also want to know that merchants are putting the security of their data first. Merchants, especially smaller retailers with a growing audience of new customers, should “signal” trustworthiness by being open about the steps they are taking to prevent compromised data. That means businesses seeking to stoke customer loyalty must not only protect their data but also ensure that their data security measures are visible and easy to  follow.

follow.

An imbalanced approach to security can be detrimental to customer experience, however. It is thus essential for merchants to choose the right partner or platform to manage their fraud protection efforts, as outdated security approaches can block legitimate consumer traffic and result in costly false declines.

To discover more about how merchants can use advanced data security methods to cultivate customer trust, download the report.