From country stores to online marketplaces, virtually all commerce is a multifaceted relationship built on trust, value exchange and leaving all feeling good about their bond.

As commerce moves more from face-to-face in-store transactions to purchases made online and at a distance, expectations around retail relationships are changing. Leading that charge, as they so often have in the digital shift, are millennials and slightly older bridge millennials.

We examined this in the study “Relationship Commerce: Building Long-Term Brand Engagement,” a PYMNTS and Ordergroove collaboration that surveyed over 2,800 consumers and found these two trailblazing cohorts once again at the head of the pack in terms of their retail rapport.

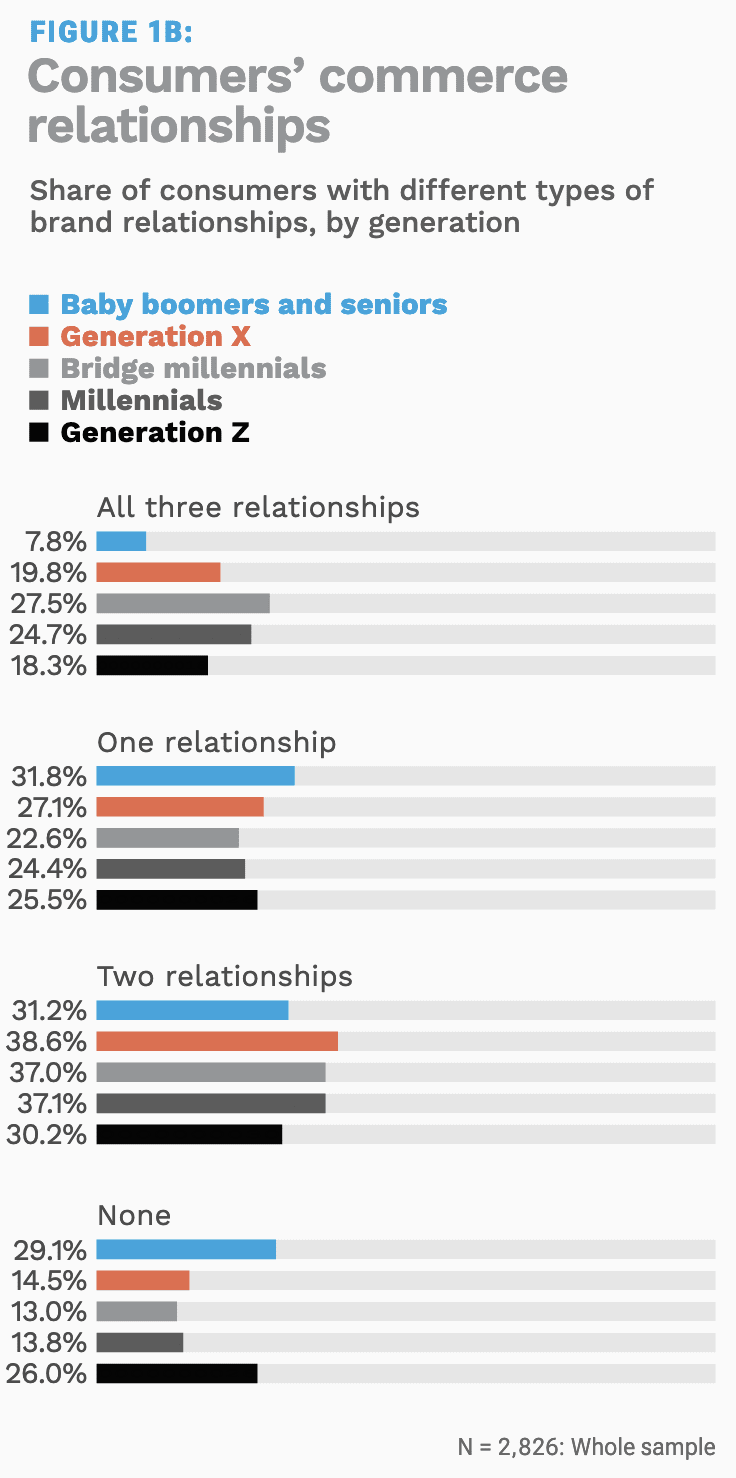

Of the three primary ways merchants nurture customer relationships — loyalty programs, membership programs and subscriptions — it’s high-earning bridge millennials taking the lead in using all methods. Overall, 79% of consumers use at least one of the three types.

“Bridge millennial and high-income consumers who earn more than $100,000 annually are the demographics most committed to building relationships with multiple brands,” the study states, as 28% of bridge millennials maintain all three types of relationships, and 37% have two.

Get the study: Relationship Commerce: Building Long-Term Brand Engagement

More Relationship, More Commerce

Entire sectors are learning that relationship commerce culminates in the most desired outcomes from any loyalty-style investment: Those who engage buy more, and more often.

Here again, it’s the millennial and bridge millennial demographics wading deepest into relationship commerce, seeking that reciprocity of experience from their favorite brands and merchants.

We found that 80% of millennials are likely to buy more from brands they have relationships with, while Gen Z consumers and people earning under $50,000 are less likely.

Per the study, “Approximately one-third of consumers will spend more with brands with which they have relationships. Stronger subscription relationships amplify this effect. Forty-five percent of consumers with retail subscriptions who feel closely connected to these brands because of these relationships expect to increase the value of their purchases, as do 33% of consumers with memberships and loyalty programs.”

Getting to Know You

Getting to Know You

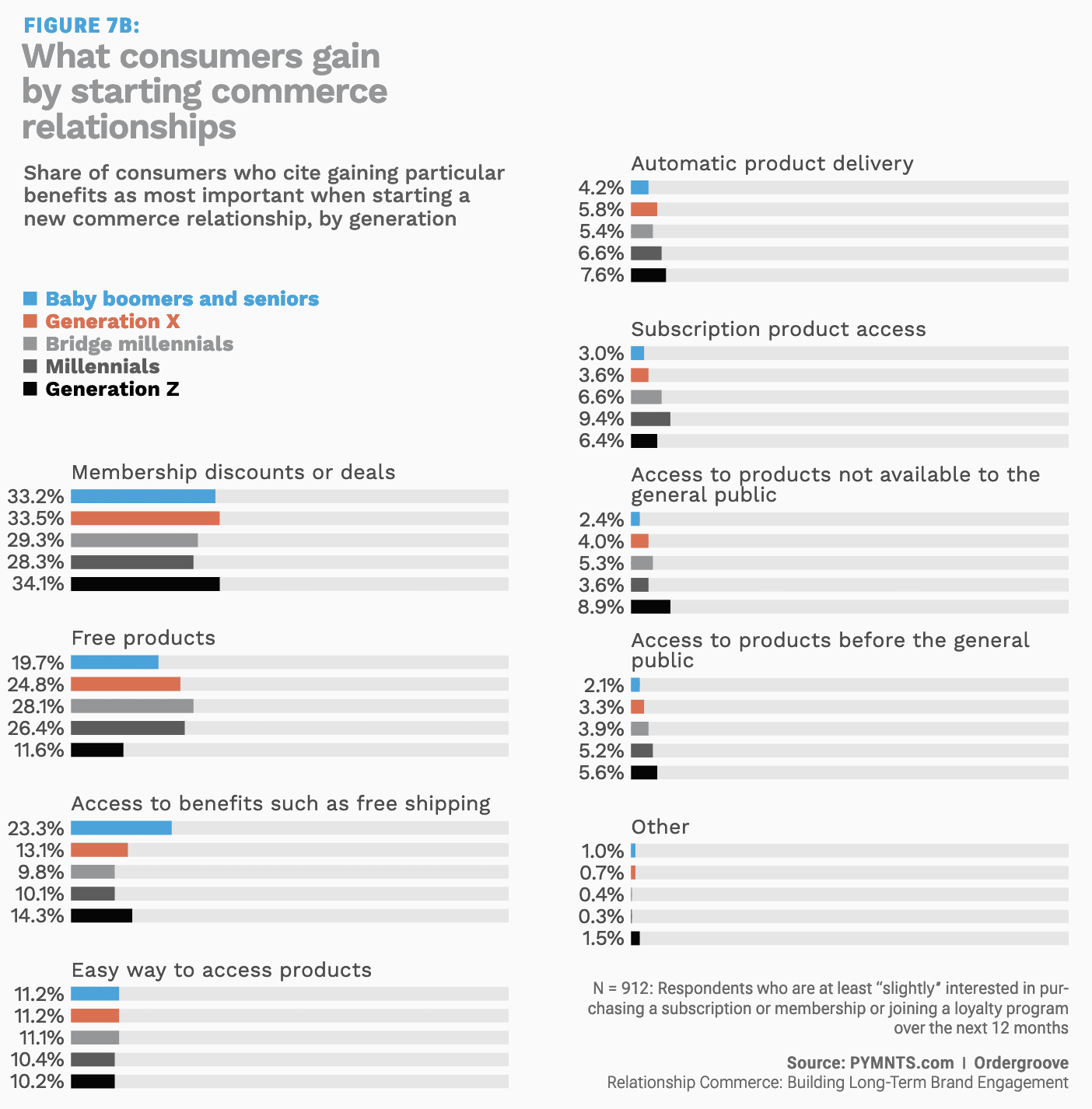

Even commerce relationships aren’t purely about money. Consumers want to feel known, appreciated and connected to merchants and brands with which they’ve formed an affinity.

Noting that consumers enter commercial relationships hoping “to partner with companies that understand their current needs, anticipate future preferences and can push exclusive, tailored offers to them based on those data points,” the study finds good relationships being rewarded.

“Approximately 30% of consumers currently participating in brand membership and loyalty programs are ready to increase their number of commerce relationships,” PYMNTS found.

Illustrating the trend, the study states that “millennials with retail subscriptions are the most likely to seek out such additional relationships as loyalty programs. Our data shows that 73% of millennials are ‘very’ or ‘extremely’ likely to enroll in a loyalty program with a brand where they already have a retail subscription.”

Get your copy: Relationship Commerce: Building Long-Term Brand Engagement

Get your copy: Relationship Commerce: Building Long-Term Brand Engagement