Recession fears mounted this past week, and stocks tumbled.

2022 is largely in the rearview mirror, and in looking ahead, investors — and some heavy hitters on Wall Street and in the payments sphere — do not necessarily like what they see.

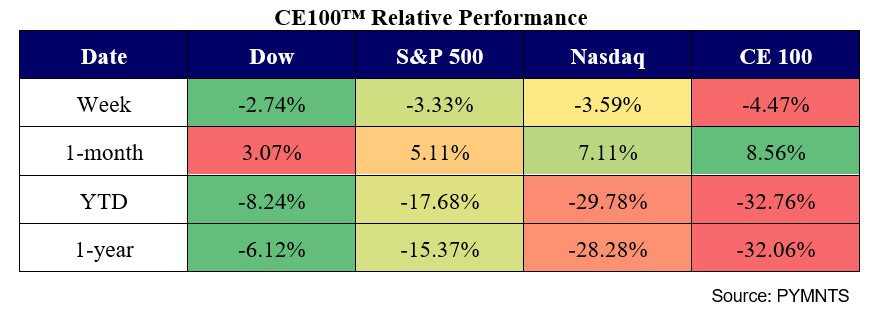

To that end, the CE 100 Index sank 4.5% on the week, led by the Work pillar, which lost 7.2%.

Research from the likes of Citigroup, through its Global Wealth Investments 2023 outlook, posit that we’re headed into a “mild recession” that will see unemployment rates increase. Elsewhere, and as also spotlighted here this past week, the Mastercard Economics Institute said in its Economic Outlook 2023 that macro pressures are squeezing consumers and companies alike. Larger companies can absorb these shocks, according to Citi, while smaller firms will likely struggle.

And the Federal Reserve seems on track to keep pushing interest rates higher — which may indeed tip the U.S. into a recession. The central bank is slated to meet next week; we’ll see then if there’s a 0.5% or 0.75% increase in the cards.

Given those outlooks and events, it may come as no surprise that worries over employment trends would hit the work-related names within our pantheon with force.

Advertisement: Scroll to Continue

Businesses Are Pulling Back

WeWork lost 23.9% as Bloomberg reported earlier in the month that the company was downgraded by Fitch Ratings to CCC. The downgrade noted that “companies continue to evaluate their real estate footprints in light of hybrid workplaces as an ongoing result of the pandemic.”

Salesforce gave up 9.3% in the wake of high profile management changes. Slack Technologies founder and CEO Stewart Butterfield is departing next month (the company was bought by Salesforce in July 2021). And co-CEO Bret Taylor announced his own resignation earlier this month, effective January 2023, after just over a year in the role.

Business software providers including Salesforce — as reported earlier this month — are seeing longer sales cycles as enterprise clients grow more cautious in the current macro environment. CrowdStrike, which has reported longer sales cycles, slipped about 7% on the week.

These losses were more than enough to offset MongoDB’s gains in the Enablers segment (offering a glimpse into where companies are spending time and money: scaling applications and on the Cloud), where the name soared 19.7% on the heels of earnings results. The company said this past week that revenue of $333.6 million was up 47%.

Pressures on the Consumer, Too

The overall caution is not just confined to the business sector. On the consumer side of commerce, consumer spending is slowing, as noted by the heads of two major banks, per reports via CNBC. The slowdown was noted by Bank of America CEO Brian Moynihan, as November card spending was up just 5% in November, where the growth rate had been double digits. Wells Fargo CEO Charlie Scharf said separately that credit card spending was slowing and debit card transaction volumes had flattened. The Pay and Be Paid segment slid 4.7% on the week.

And within that segment, Affirm lost 22.4%, as news came this week that Walmart reportedly plans to offer a buy now, pay later (BNPL) option through FinTech venture ONE. As reported, Walmart also uses Affirm to offer a BNPL option to shoppers, and it’s not known how a ONE offering would affect that partnership.