CE100 Down 1.9%, Caps Dismal September as Nike Sinks 14%

It could have been worse.

Significantly worse.

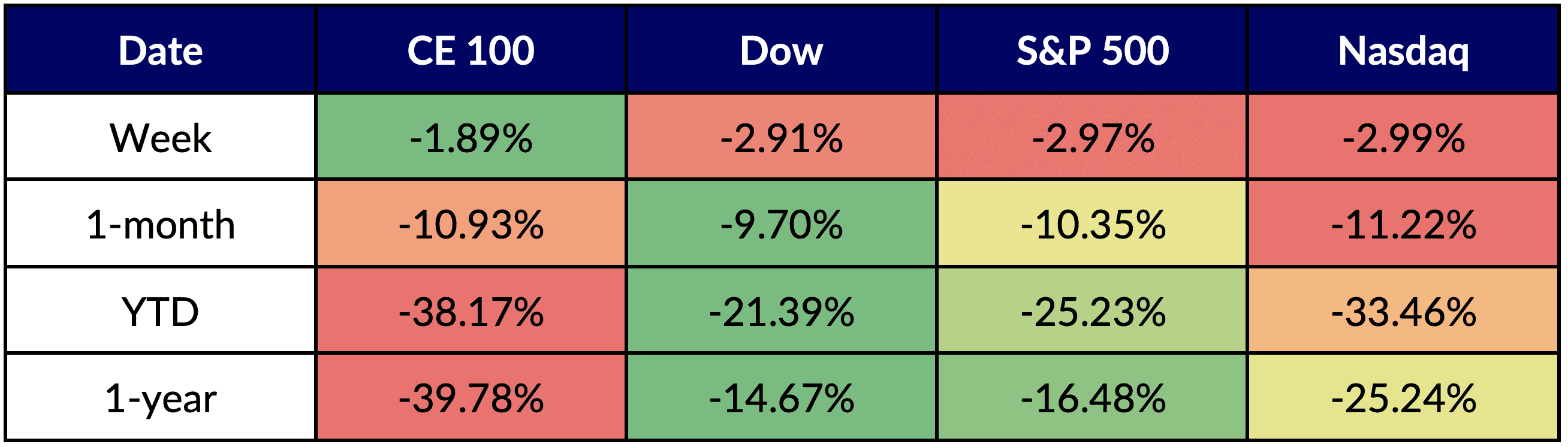

The ConnectedEconomy™ (CE100) Stock Index sank 1.9% in a week that saw the broader markets decline by about 3%. The week ended a third quarter that brings the YTD performance to a dismal negative 38.2%. September wound up being a brutal month, as the Index was 10.9%.

CE100™ Relative Performance

Source: PYMNTS

And this time around, at least for the week, there were some pillars that had positive showings over the past five days.

Well, one, anyway — and that would be the Live pillar, which gained almost 1%. The subset was led by Porch Group, which gained about 12%, having announced some leadership changes and a new partnership with the National Association of Mortgage Brokers (NAMB).

But the Banking pillar sank 5%, followed by the Eat segment, which gave up 3.3%. We might surmise that the continued worries about consumer spending would hit both pillars and credit losses would be key drivers to the downside, despite individual company announcements that showed evidence that the connected economy continues to gain ground in consumers’ everyday lives.

J.P. Morgan shares were down by about 4%. That’s despite news this week that the company’s digital bank, Chase UK, is closing out its first year with £10 billion in deposits and 1 million customers.

See also: JPMorgan Retail Arm Chase UK Crosses £10B in Deposits in First Year

Nike Offers a Microcosm of Pressures

In terms of individual company performance, as it stares down some additional competition, Peloton lost 18.6% following news that Lululemon rolled out lululemon Studio, a new platform offering more content and products for members.

And though it wasn’t the worst performer of the bunch, we can see some crystallization of a number of issues confronting our CE100 names, regardless of pillar, in Nike, which slipped 14.4%.

Learn more: Nike Promises ‘Decisive Action’ on Inventory, More Investment in D2C

“We face a new degree of complexity,” Nike Chief Financial Officer Matthew Friend told analysts on the earnings call. Nike is facing pressure as sales fall in China by 16% and the dollar hits sales. Additionally, its supply chain remains uneven (at best) and its transition to a direct-to-consumer model will take time.

Meanwhile, Ocado lost 12% as the company continues to face an inflationary landscape in Britain that has not been seen in decades.

There are no signs that the pressures in place are going to let up, given the slew of economic data that has come out in the past week. In the Eurozone, inflation has topped 10%, underpinned by soaring energy prices.

In the U.S., while consumer spending was up a bit in August, there are signs that consumers’ cash cushions are dwindling — and disposable income, as measured over time, is dwindling too. Data from the Commerce Department’s Bureau of Economic Analysis (BEA) showed that personal saving as percentage of disposable income is 3.5%, down from 4.7% as recently as the beginning of this year.

Since the paycheck-to-paycheck economy now includes the majority of Americans across all income levels (the Commerce Department’s data also is all-encompassing), the pressures are universal. PYMNTS’ data also shows that 40% of consumers have spent more than they have earned in the past six months.

That means there may be a pullback in the works for so many of our CE100 companies that depend on the consumer for top-line growth. The connected economy’s rise may be unstoppable, but the path will be anything but smooth.