The past week’s rout in the stock market — pick your market, any market, it seemed — continues into a new month and into a shortened holiday trading week.

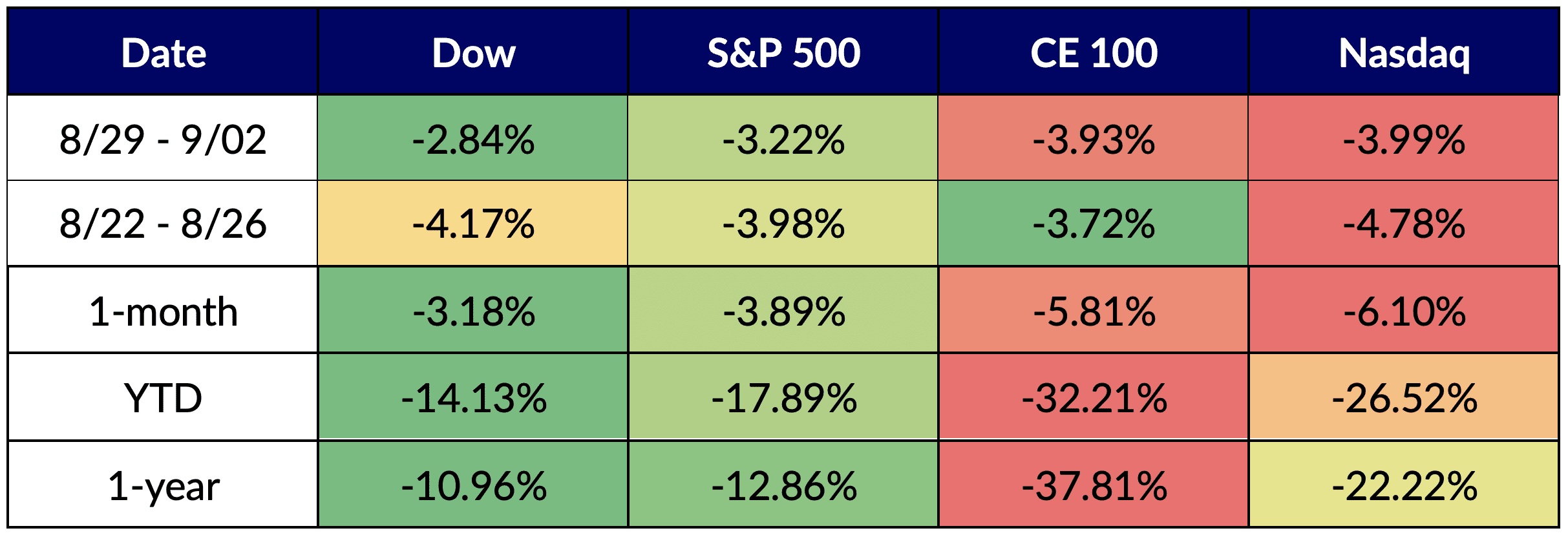

The Connected Economy 100 (CE100™) Index names followed suit, and to that end, the CE100 Index lost 3.9% on the week, pacing the nearly 4% loss seen with the broader, tech-heavy Nasdaq.

CE100 Relative Performance

Source: PYMNTS.com

Source: PYMNTS.com

That decline was led by the “Enablers” segment, which lost 8.7%, followed by the “Work” vertical, which lost 5.3%. All in all, nine sub-indices were in the red, with only the “Shop” segment ending in the black.

Earnings season is lurching to its inevitable conclusion, and this time around, it seems that investors remain wary about slowing growth for the “pick and shovel” players that enable enterprise clients to adopt advanced technologies and transform their own operations.

By way of example, MongoDB lost more than 30.7%. The enterprise technology provider said last week that total revenue was $303.7 million for the second quarter of fiscal 2023, an increase of 53% year over year. Subscription revenue was $291.6 million, an increase of 52% year over year, according to a company release.

But during the conference call with analysts, Chief Financial Officer Michael Gordon said, “Our expectation [was] that the mid-market slowdown we saw in Europe in Q1 would become global in Q2.”

“This is what we experienced, but the slowdown was more significant than we had expected,” he continued, noting that enterprises’ underlying consumption growth of MongoDB also slowed.

Meanwhile, C3.ai was down by nearly 23% as the enterprise artificial intelligence software provider reported revenues of $65.3 million, up 25% year over year. The stick plunged as management lowered its revenue growth expectations, adding that it is changing its business model to a consumption-based model, rather than a subscription model.

CEO Tom Siebel stated during the earnings call that “it is clear that the commentary that we have all been hearing in recent earning announcements about market uncertainty, budget cuts and lengthening sales cycles as the market anticipates economic downturn is real. This was our experience in the last quarter also.

“Our customers and prospects appear to be expecting a recession, and we are seeing customer purchasing behavior consistent with that expectation.”

Additionally, Nvidia lost 16.1%, having disclosed this week that the company could lose as much as $400 million in revenues quarterly, as the United States has imposed new licensing requirements on chips sold and shipped to China.

Within the Work names, even positive results were not enough to gain investor favor. CrowdStrike lost 11.4%, having just reported second quarter fiscal year 2023 results that showed that revenues were $535.2 million, a 58% increase.

On a conference call, George Kurtz, CrowdStrike’s co-founder and CEO, told analysts that growth came from customers looking to build up their security under one cloud-based platform, adopting more modules of the company’s Falcon security platform.

Kurtz said, “We added over 1,700 net new customers, another first for the company. Gross retention climbed to a new record for the second consecutive quarter, and dollar-based net retention reached its highest level in seven quarters.”

Only One Pillar Gains

These losses swamped the relatively meager gains seen in single pillar that had positive returns, the Shop segment, which gained 1.8%.

See also: Chinese eCommerce Firm Pinduoduo Launches US Offshoot

Drilling down into that group, Pinduoduo was the standout, rocketing up 25% on the week. As reported this past week, the Chinese eCommerce firm has debuted an online shopping site in the U.S., marking its first major expansion overseas. The site, known as Temu, launched at the beginning of the month.