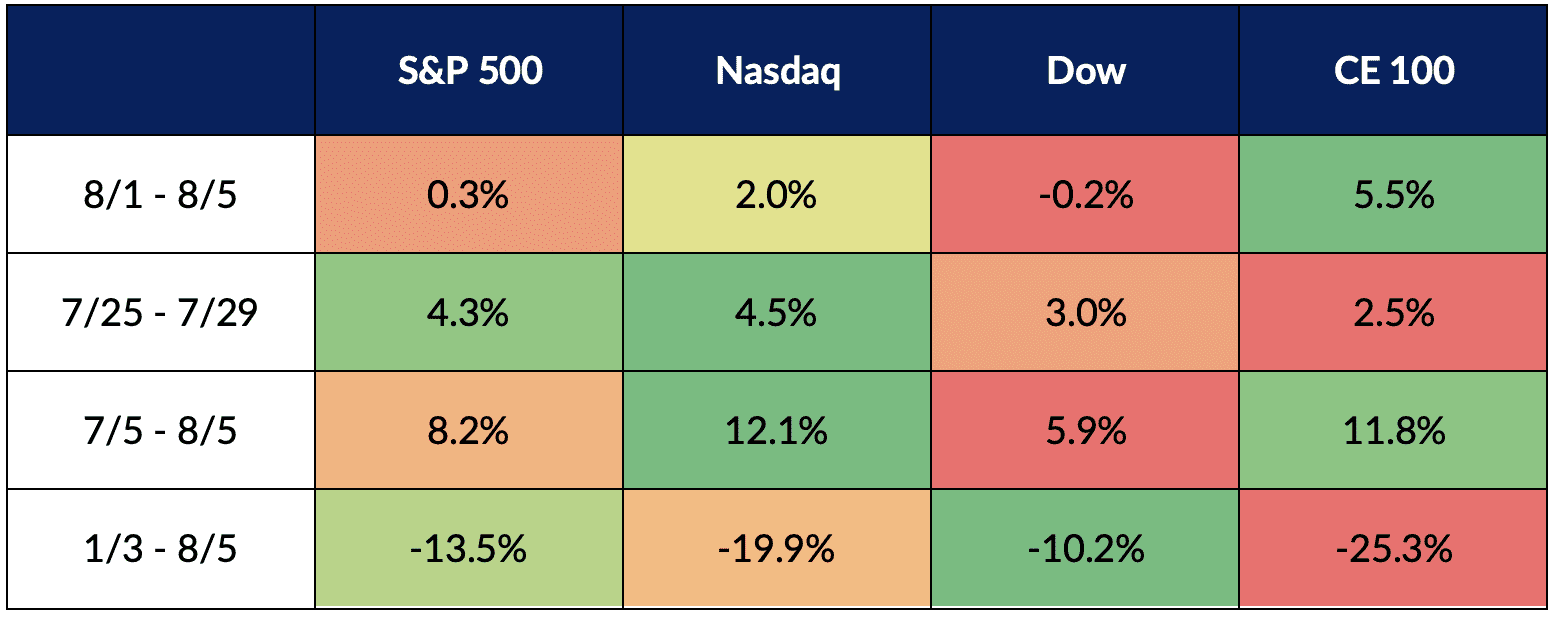

PYMNTS’ Connected Economy™ 100 Index (CE100 Index™) marched upward by 5.5% this past week, continuing a streak that now has extended to three straight weeks.

CE100 Stock Performance

Source: PYMNTS

Source: PYMNTS

The top performing sector was the Shop pillar, which surged by 13.3% through the past five sessions.

Vroom was the standout here, having rallied by 55%. Though there was no company-specific news driving the name, Wall Street-focused sites such as Benzinga noted that there had been significant call options trading — usually a sign of bullish sentiment from at least some investors — ahead of the Monday (Aug. 7) earnings call.

Following the call, we’ll know more from the company about the state of online car buying, and, specifically, the demand that’s out there for pre-owned cars. But beyond that name, earnings dominated the past week, with individual names outperforming the broader indices and the CE100’s five day returns, too.

Uber Skyrockets

Uber rocketed ahead by 36.7% in the wake of its own earnings report. As noted in this space this past week, the company’s gross bookings were up 33% year over year.

The Delivery segment saw 12% growth in its gross bookings to $13.9 billion, which in turn powered a 43% gain in its revenues from that unit to $2.7 billion, as measured in constant currency. Uber has said that nearly a third of its delivery orders are coming from members of its paid Uber One membership program.

Read more: 1 in 3 Uber Eats Orders Come From Paid Subscribers

DraftKings gained 30.8%, buoyed by earnings that topped estimates. The company said in its report that monthly active users reached 1.5 million in the second quarter. Against that backdrop, average revenue per customer was up 30% year over year.

Meanwhile, Block, the parent company of Square, posted a 15.3% gain. The company said during its latest quarterly release that for Block, Cash App was a notable positive performer, far outpacing the drag from bitcoin. In June, there were 47 million accounts that transacted on Cash App, up 18% year on year.

See also: Block’s Bet on BNPL and Cash App Offsets Beating From Bitcoin

Chief Financial Officer Amrita Ahuja said on the call that “we’ve seen continued momentum in food and drink, which has delivered the fastest gross profit growth of any square vertical on a five year CAGR basis.”

In the wake of the Afterpay deal that was consummated at the beginning of this year, Block’s buy now, pay later (BNPL) platform contributed $104 million of revenue and $75 million of gross profit to Square in the second quarter of 2022.

CEO Jack Dorsey said on the call that the company is still in the midst of bringing Afterpay’s “discovery capabilities into our system” and that Afterpay is “the omnichannel tool in our ecosystem” that helps sellers grow their own top lines.

Bitcoin-related sales were down by more than a third, to $1.8 billion. While GPV for the company’s Square business grew 25% on a year-over-year basis in the second quarter, the company anticipates 18% growth on the metric for the month of July.

These additions were more than enough to offset the 7.6% loss see in in Cogent. The ISP provider’s results showed service revenue decreased from Q1 2022 to Q2 2022 by 0.5% and increased from Q2 2021 to Q2 2022 by 0.4%.