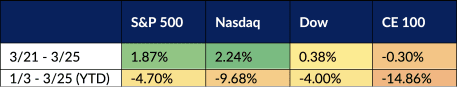

There was not much movement in the CE100™ Index this past week. The rather muted downdraft — 30 basis points — trailed the broader indices, where the Standard & Poor’s 500 gained about 1.9%, and the tech-heavy Nasdaq measure was up 2.2%.

A deeper dig into the CE100’s™ performance for the year reveals some significant underperformance, year to date. The CE100™ is off nearly 15% for the year, so far, well below the roughly 10% decline for the Nasdaq and the roughly 4.7% slide for the S&P 500.

CE100 Performance Vs. Broader Indices (Week ended 3/25 and Year to Date)

Source: PYMNTS

The Move index was the best performer for the week, up a bit more than 2%, followed by the Work index (up 1.2%). The worst performers were the Shop index, down 3%, and the Eat index, slipping 2.9%.

The Move index got a boost from Tesla, which gained a bit more than 11.6%. Tesla said last week that it had opened a new European factory in Germany and is targeting 500,000 vehicles for the plant’s annual production. The company has also been raising prices on several models.

IRobot’s shares, as part of the Live index, gained just about 10%. Earlier in the month, iRobot released its Genius 4.0 Home Intelligence software update for its Roomba robot vacuums. Among the new features: smart management capabilities that let users customize maps of their homes.

Some Double-Digit Declines

Shopify sank 12.9% through the week, as Google launched more deeply into eCommerce, and into logistics. Google is seeking to streamline and improve last-mile delivery with the launch of an integrated suite of mapping, routing and analytics capabilities that assist fleet operators from the initial eCommerce order to the final doorstep delivery.

The infrastructure is scalable and offers predictable pricing for each delivery. The solution also complements Google’s “On-demand Rides & Deliveries” tool, which is used by several global ride-hailing and on-demand delivery operators.

Read also: Google Launches Integrated Last Mile Fleet Solution

Porch, which provides a platform for home services sourced online, was down about 11.8%. At least some of the pressures on names like Porch may be tied to the volatility in the housing market, and rising interest rates.

That decline followed its report earlier in the month that it had released audited results for its fourth quarter. The company said its revenue remained unchanged between unaudited reports at the beginning of the month and the latest, audited results, to $51.6 million, up 177% year on year.

Operating losses improved a bit between the two reports, having come in at $18.3 million in the latest report, where losses had been $20.8 million in the previous, unaudited report. Looking ahead, the company projects that revenues will gain 66% year on year in 2022 to about $320 million.