Last week was a stellar one for tech stocks — if you weren’t in cryptos — and especially for names driving the digital transformation of everyday life.

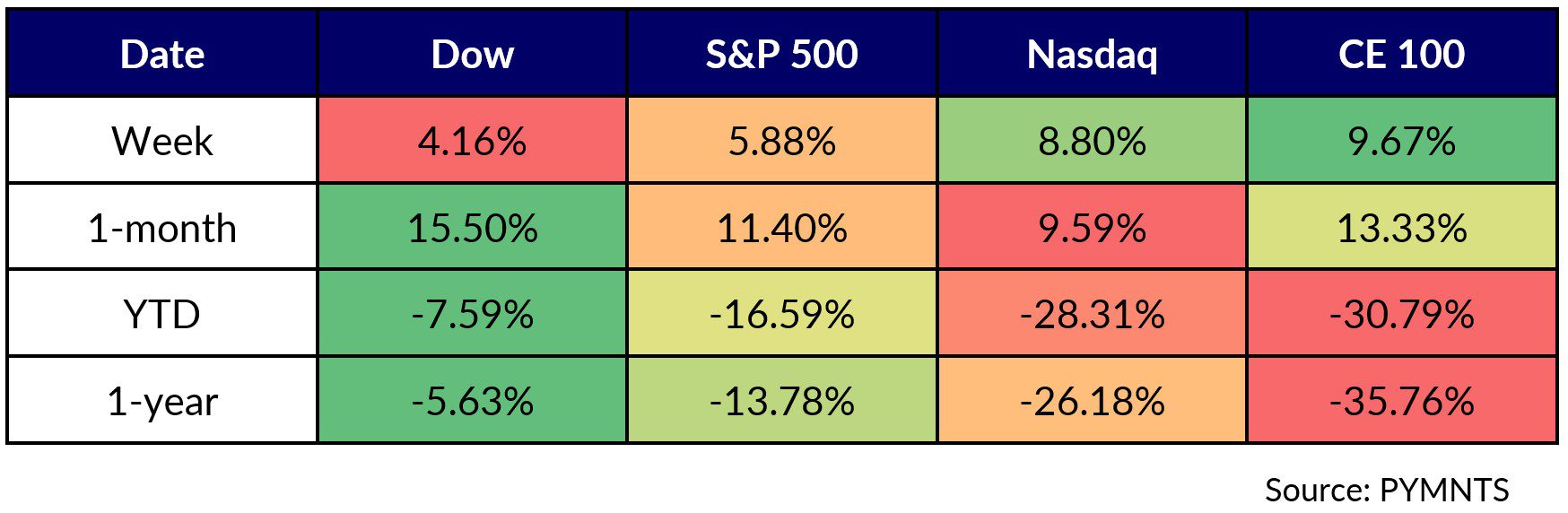

The CE 100 Stock Index roared ahead 9.7%, outpacing even the tech-heavy NASDAQ’s 8.8% rally.

And with that rising tide, nearly all boats got a lift. Observers and investors cheered hints of slowing inflation. Three pillars notched double digit percentage gains: The Communications pillar was up 14.5%. The Work pillar rallied 14.1% higher. Shopping-centered names, as a sector, surged 13.8%.

We mentioned earlier that nearly all boats got a lift last week – there were, of course, some names that didn’t rally. Porch lost 33% on the week, as the company’s earnings results showed growth in the third quarter, but reduced top line guidance reflected lower than expected home sales.

The Fed, we note, may be poised to recalibrate its stance on interest rates — but the impact to the housing sector will prove long-lasting as mortgage rates remain elevated.

CE 100 RELATIVE PERFORMANCE

Looking for — and Finding — Some Positives

By and large, investors had been looking for a reason to bid beaten-down stocks back up. And they found that reason in the inflation data, where the Consumer Price Index fell to a nine-month low of 7.7% in October. The greatest threats to consumer spending — and the global economy at large — may be abating, at least a bit. If the Fed slows or pauses rate hikes, the hard economic landing that many fear may not come to pass; individuals and families would keep spending.

Regardless of how the next few months shake out vis-à-vis the macro picture — data is nothing if not volatile — real change is in the works as the CE continues to take shape, spurred by those macro pressures. We’re seeing that change reflected in earnings reports and management commentary looking for significant growth whenever the economy does rebound.

Gig Economy Here to Stay

Fiverr stands out here, having gained more 41.5% on the week, leading the CE 100’s memorable five days, pushing the Work group higher, and offering up a snapshot of the continued shift to the gig economy. The freelance marketplace firm reported revenue growth of 11%, and spend per “buyer” of freelance workers’ services was up 12%. The company said in its presentation materials that active buyers grew 3% through the trailing 12 months to 4.2 million.

CEO Michael Kaufman said in his remarks to analysts that “freelance demand is expected to be the first to recover as we climb out of the downturn, and the rebound is typically of a bigger magnitude compared to full-time employment and the GDP growth itself.”

Ocado was 33.3% higher, at the vanguard of the Shopping segment, and continued to ride a wave of positive sentiment in the wake of the British online supermarket firm’s logistics deal with Lotte Shopping, the supermarket arm of South Korea’s biggest retail group.

Ocado, as had been reported, will be building out a network of customer fulfilment centers. The continued shift to eCommerce in the grocery space is echoed in other markets and PYMNTS’ own recent data that show that in the U.S., mobile devices were used by 15% of consumers for non-grocery shopping and 9.8% of consumers for grocery shopping.

DraftKings gained 31%, significantly retracing share price losses after its own earnings report earlier in the month. The data showed the number of monthly unique payers (MUPs) rose 22% year over year, and the average revenue per MUP leapt 114%.

The roller coaster ride is proof positive that investors are fickle, to put it mildly. We expect significant ebbs and flows in the CE 100’s performance as time goes on. But the one constant is the digital shift.