Over the past several months, we at PYMNTS have tracked the habits and tech preferences of several “connected personas” forming the bedrock of the connected economy that is currently taking shape.

See also: 73 Million US Consumers Are Already Living in the Connected Economy

Sift through the data a bit, though, across more than 3,100 responses, and there are nuances and even stark differences tied to what devices people own, who owns them — and indeed, what they do with those devices that are in hand.

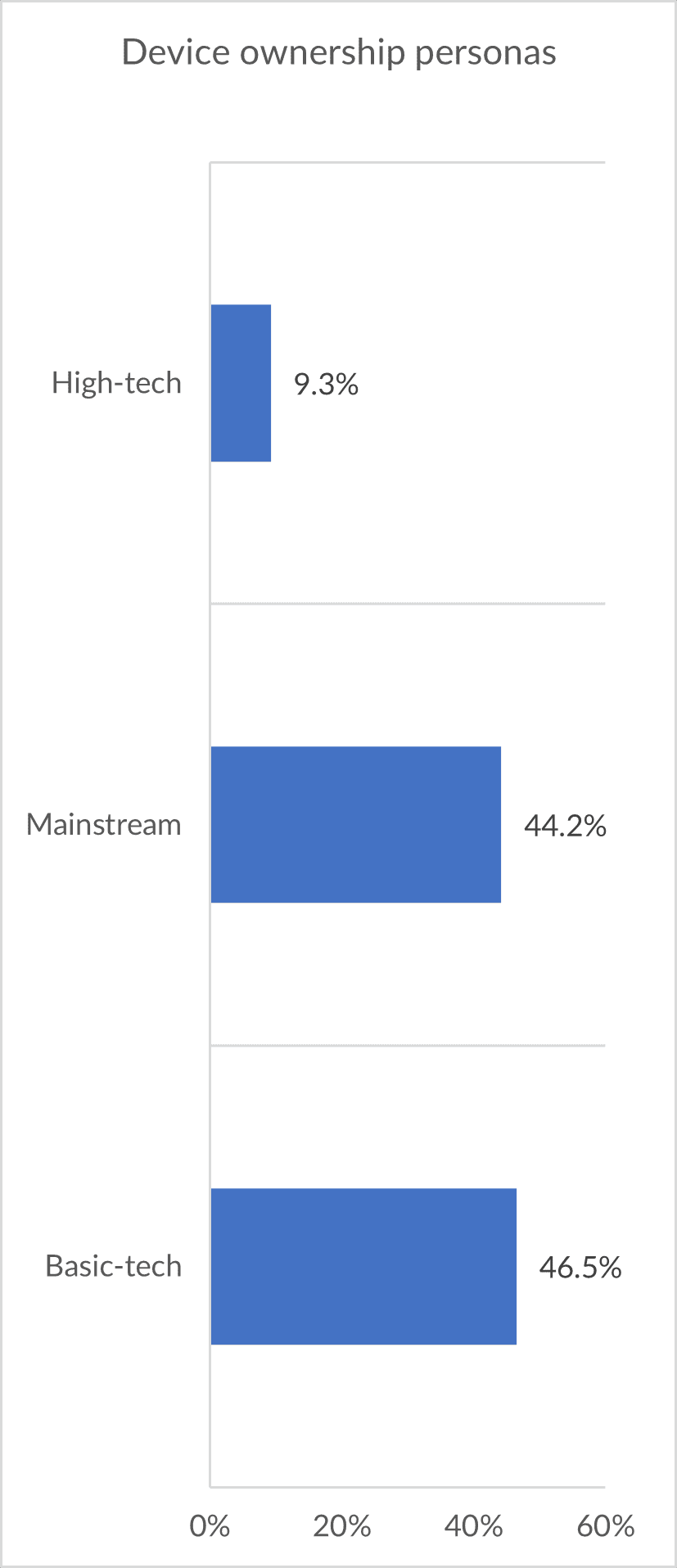

The groups boil down to basic-tech consumers: Consumers who own a computer and a smartphone, at 47% of the tally; Mainstream consumers: Consumers who own an average of 6.8 devices (44% of respondents), and High-tech consumers (9% of the total respondent pool): Consumers who own an average of 12 devices.

Source: PYMNTS.com

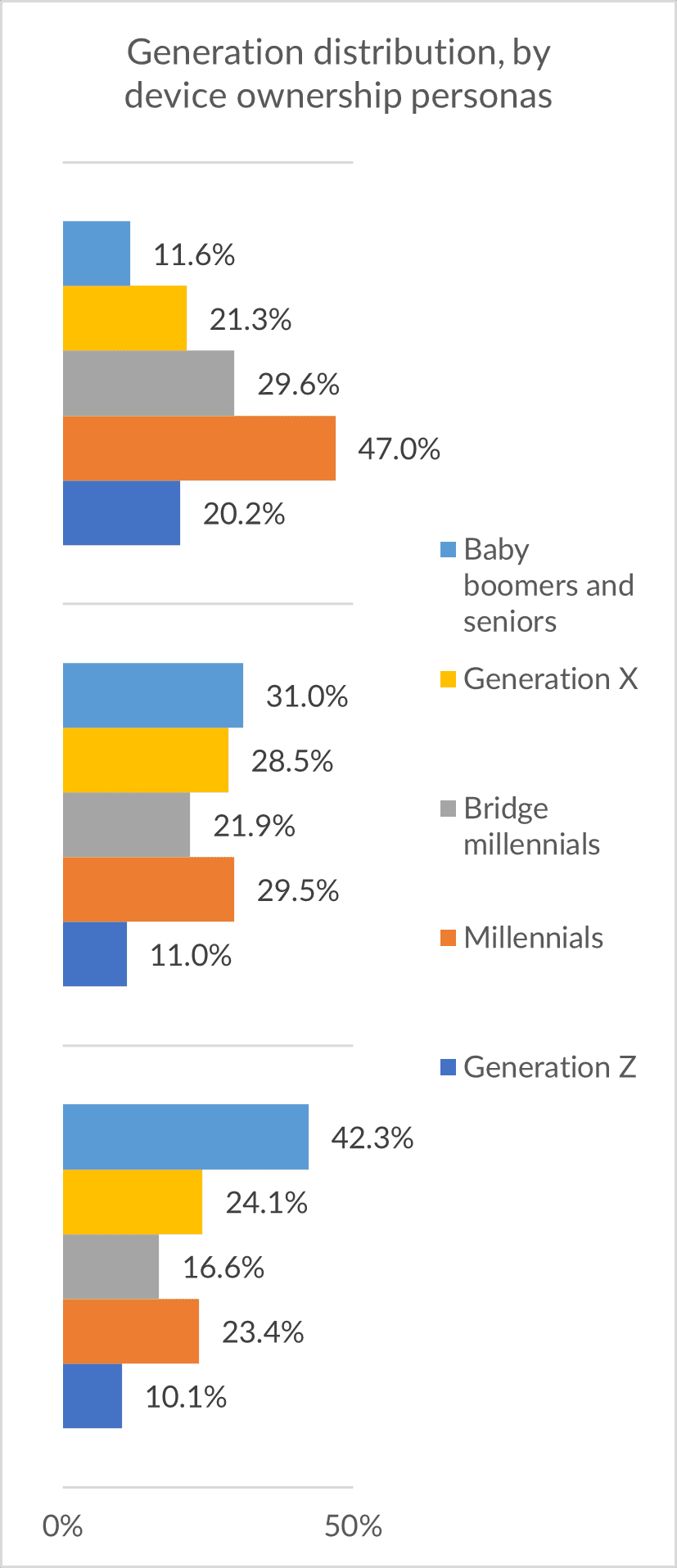

Drilling down, demographics skew differently, depending on which “bucket” you’re examining. The chart on the right shows the bifurcations among the high tech, mainstream and basic tech segments.

The high-tech segment, we found, skews younger. Forty-seven percent of consumers in the high tech group are millennials, followed by bridge millennials (nearly 30%), and Gen X (21%). The basic tech users, on the other hand, are more commonly baby boomers and Generation X consumers.

The mainstream group is reasonably evenly distributed across baby boomers, Gen X and Millennials, at about 30% each.

Among the three groups, a larger share of high-tech users earns higher incomes, with 57% of them earning more than $100,000 annually and nearly 33% earning between $50,000 and $100,000. It follows that the more connected consumers, the ones with more devices at their disposal, have more money with which to buy those devices, and of course, subscribe to data plans and streaming media and all manner of apps that keep things humming.

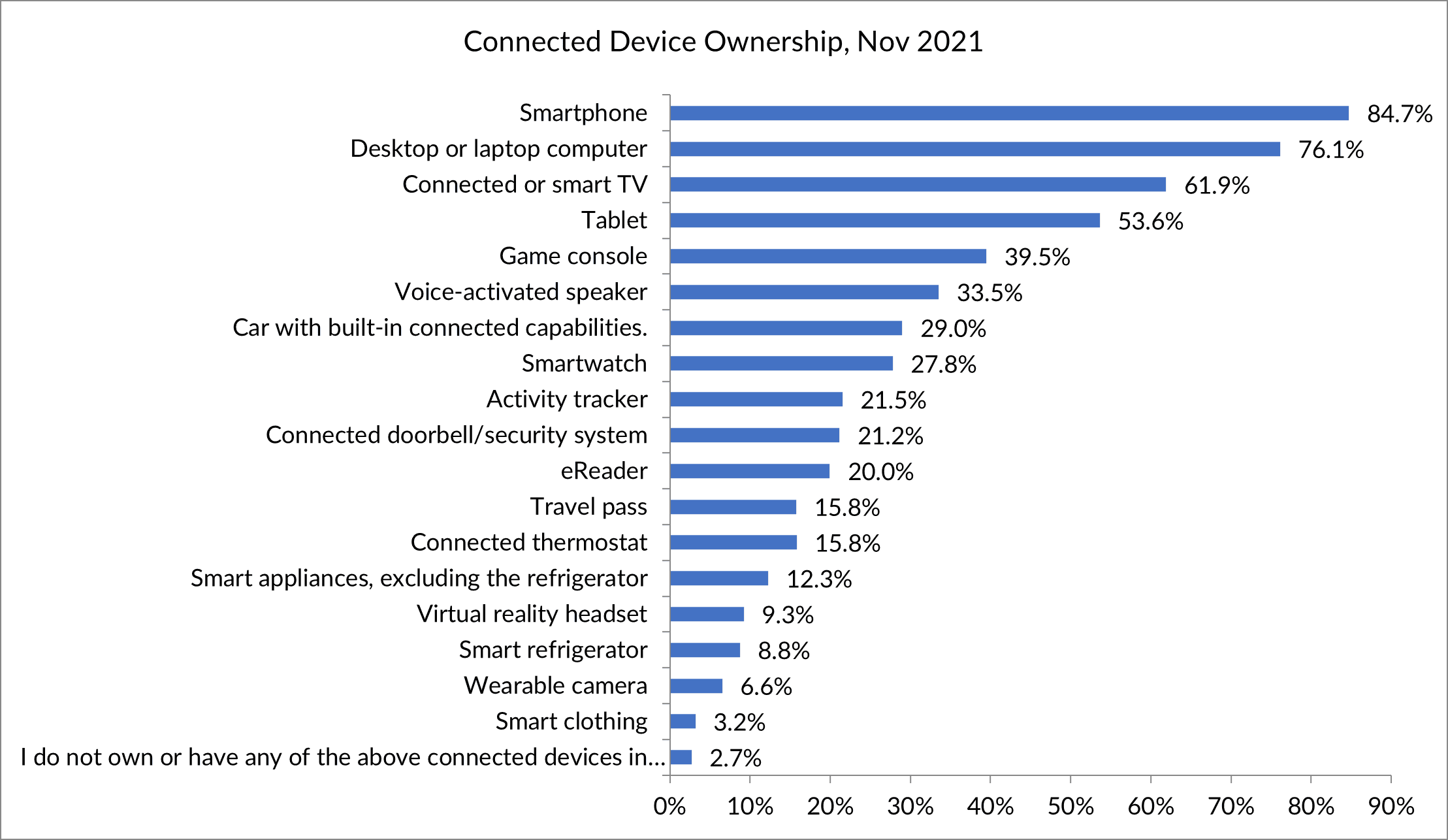

As to the devices that help consumers engage in the connected economy, smartphones, laptops/desktops, TVs and tablets come out on top.

Source: PYMNTS.com

The overwhelming majority of consumers have smartphones today, with more than 90% of Gen X consumers and more than 80% of consumers from other generations owning one.

It’s clear that even with the proliferation of devices that is mounting, there’s no mere vanity play at stake — the smartphones and the tablets are used, increasingly, as tools to navigate daily tasks that are immediate and vital.

Read also: Regulators Look to New Tools, Tactics to Keep Pace with Innovation

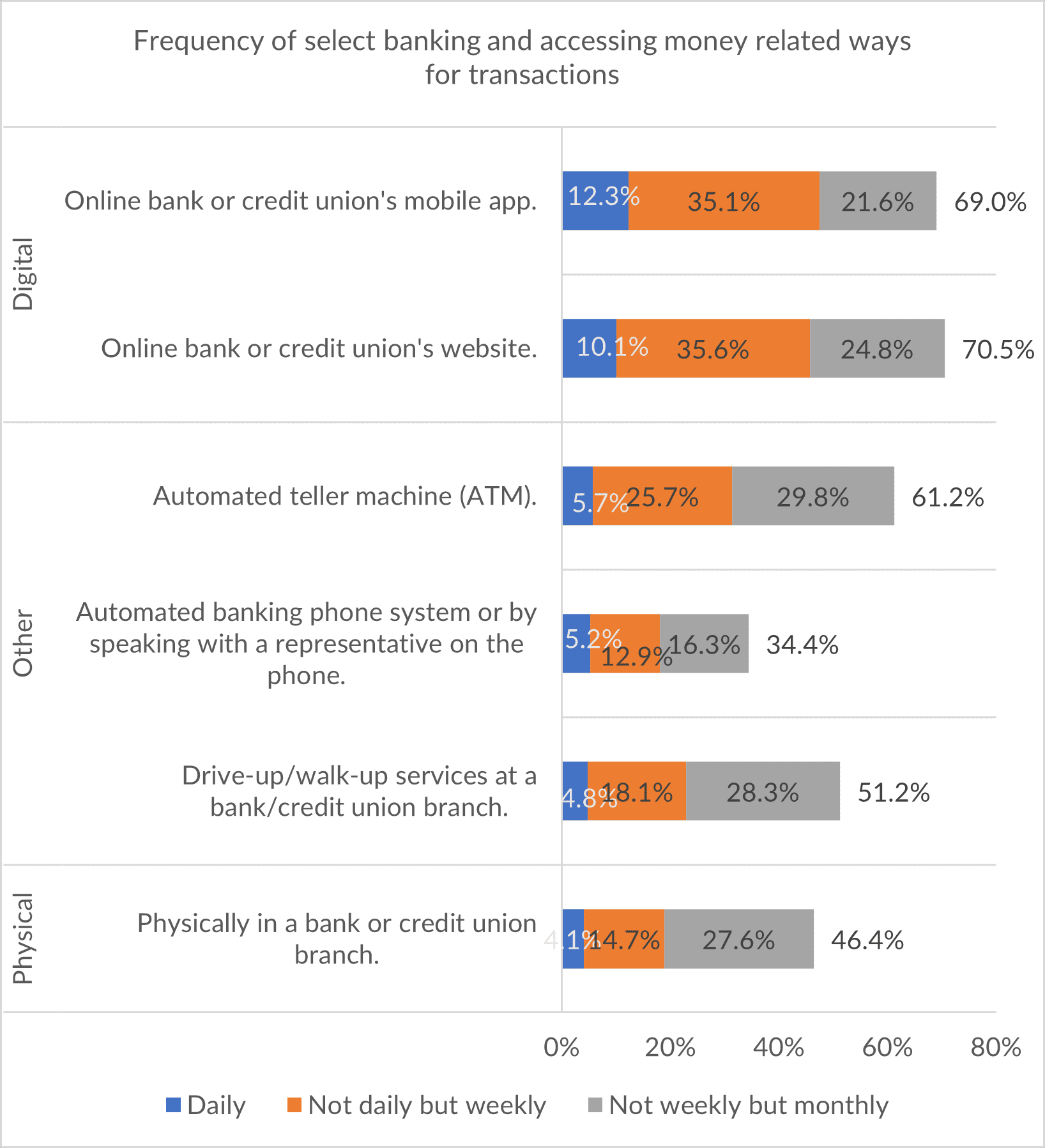

Consumers are today using these devices to engage in digital activities more than ever, especially when it comes to their banking needs. PYMNTS research shows that 70% of consumers performed a banking transaction digitally at least one time in the last month. Thirty-five percent of these consumers did so on a weekly basis, using both their desktop computers and mobile devices.

The use of smartphones and computers for conducting banking transactions is even higher among high-tech consumers. PYMNTS’ data shows that 92% and 88% of users in this segment conducted a transaction using mobile app or website during November last year, respectively.

That is not to say that consumers are not using physical branches anymore. Forty-six percent of consumers conducted a transaction by attending physically to their bank or credit union branch at least one time in the last month.

Source: PYMNTS.com

Media and Meals Too

The use of streaming services and other online resources for accessing TV and movies has become the most common way of entertainment, with nearly 80% of consumers using it at least once in the last month.

Consumers’ use of digital tools for entertainment, naturally extends to how they order food, whether it is from a restaurant or a grocery store. Thirty-six percent of consumers ordered their groceries online for curbside pickup, while a quarter of them obtained their groceries through online subscriptions that deliver on a regular basis.

When it came to ordering food from restaurants, 56% of consumers used a restaurant´s website or app for picking up or getting their meals delivered during the last 30 days, at least once.

For the high-tech consumers, this number rises to 86%, while the share of basic-tech consumers stands at 46%.

PYMNTS research shows that today’s connected consumers want to streamline how they go about navigating their various daily activities. In fact, the majority of them want to consolidate their digital experiences into a single interface, with 67% of all consumers interested in integrating at least two areas of their digital lives into a single app — paving the way for the super app.

Read Here: 67% of Consumers Want a Super App to Manage Their Digital Activities