Gender equality hasn’t yet reached the digital economy — and retailers can capitalize on this divide.

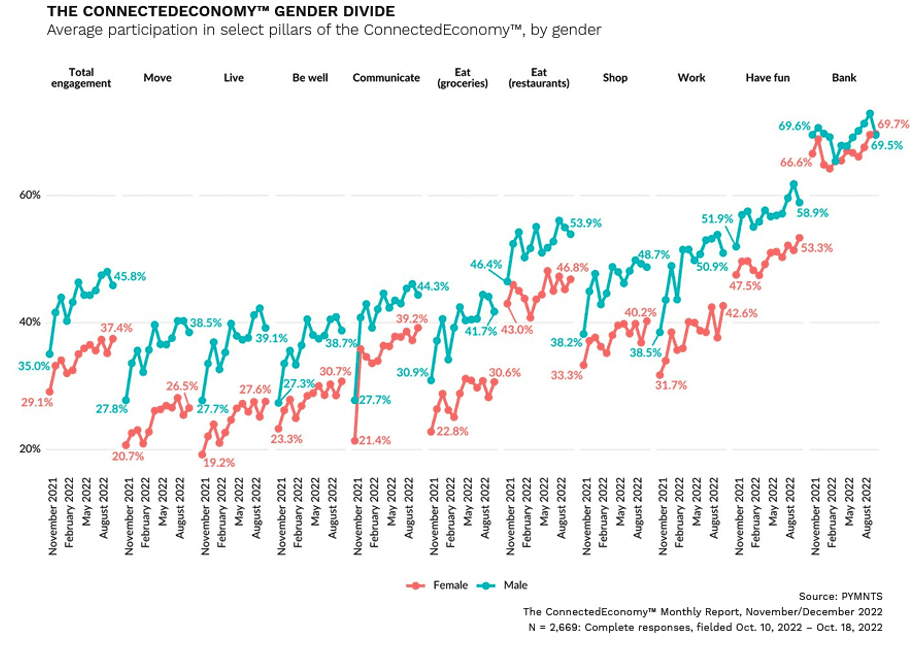

PYMNTS research has found that women overall make fewer transactions than men in nearly every category of the digital economy. The only exception is in digital banking, where approximately 70% of both genders engage. On average, men are 34% more likely to participate in online transactions than women. In October, men made 14.3 different online transactions compared to 11.5 for women. Additionally, men showed higher levels of engagement across all areas of the connected economy, including communicating, buying groceries and eating at restaurants.

The biggest gender gap for digital transactions is seen in buying groceries and food from restaurants. Among men, 52.4 million ordered part or all of their groceries via same-day delivery in October, versus 36.6 million women. Men also were 15% more likely to make online restaurant orders than women.

The biggest gender gap for digital transactions is seen in buying groceries and food from restaurants. Among men, 52.4 million ordered part or all of their groceries via same-day delivery in October, versus 36.6 million women. Men also were 15% more likely to make online restaurant orders than women.

This may present an opportunity for retailers and other merchants to better identify and engage with their target audience based on gender and other demographic information. For example, major grocery chains currently use data to tailor and personalize digital rewards, discounts and coupons to individual shoppers.

Some retailers with a brick-and-mortar presence are using data and analytics to increase customer loyalty in a shift from personalization to individualization, designed to offer a lower-friction shopping experience across all channels, including mobile apps, in-store digital coupons, and barcode and QR code scanner apps.

Another approach is using item-level data. In an interview with PYMNTS’ Karen Webster, Banyan CEO Jehan Luth explained its impact for retailers.

“[T]he overlaying of SKU-level data or item-level data in rewards and offers makes card-linked offers a much more versatile and powerful tool in the toolkit for retailers,” he said. “Now I can drive traffic to certain categories within the store or certain items within a store.”

In a real-world example, candymaker Mars announced in October an initiative to use item-level data as a consumer loyalty strategy. Through a partnership with consumer rewards app Fetch, customers are eligible to earn points toward Mars products after sending in pictures of receipts for related items. This program gives the company insights into customer behaviors, such as time of day for transactions or items commonly purchased along with the Mars product(s). This information could help the company more effectively target its marketing efforts.

There’s no one-size-fits-all approach to data use. The most effective method will vary according to the size, readiness and capability of a retailer or merchant. The only wrong approach is failing to tap into this treasure trove of insights.