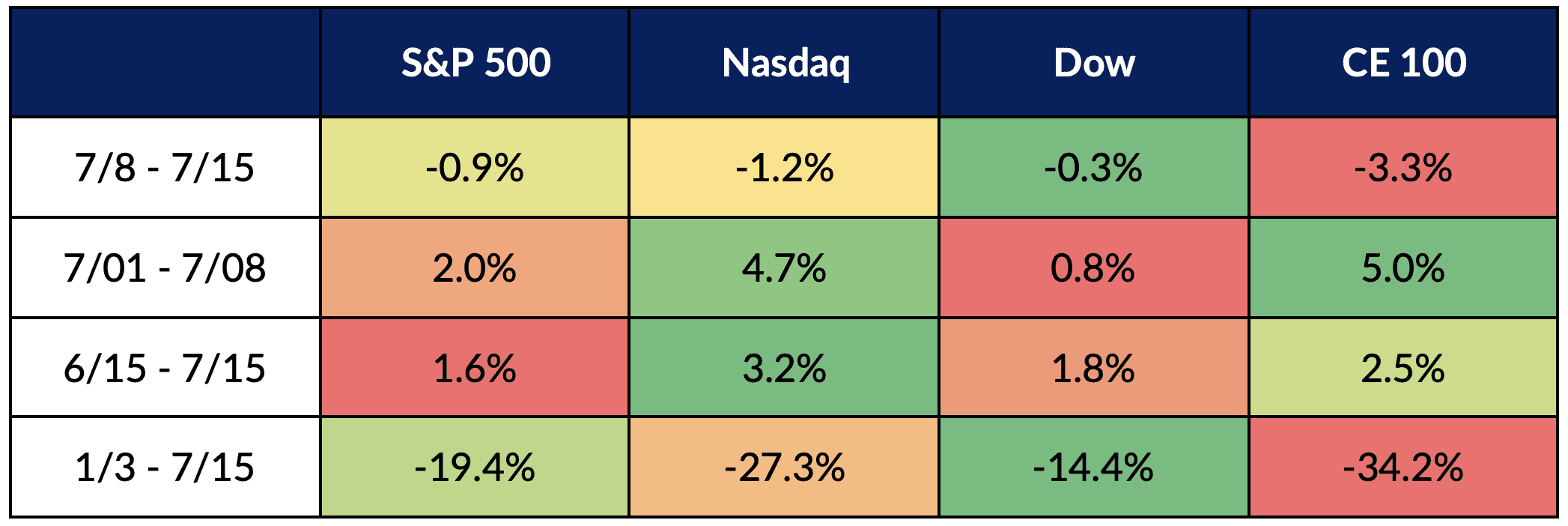

The Connected Economy 100 (CE100™) Index continued its dip, and one wonders if earnings season will offer any respite.

For the week, the group was down by 3.3%, and now stands off 34.2% for the year to date.

CE100 Relative Performance

Source: PYMNTS

Source: PYMNTS

The decline was led by the Communications pillar, which lost 10.8% (led by Zoom’s 16% decline), followed by the Pay and be Paid pillar, which slid 6.5%.

Banks’ Reports Kick off Earnings Season

As for earnings — and some bright spots: Bank names have traditionally kicked off the slew of reports that detail top and bottom lines, with commentary on the state of the consumer and the state of the economy at large.

Citigroup was up 6.7%, boosted by its earnings report on Wednesday. That report showed that consumer spending is still robust, though the company mirrored J.P. Morgan and Wells Fargo in boosting its loan loss reserves, which would act in part as a buffer against macro shocks.

As detailed in this space, Citi’s net build-on allowance for credit losses in the period came to about $375 million, compared to a net release of $2.4 billion last year. This comes even as CEO Jane Fraser said on the call that “little of the data I see tells me the U.S. is on the cusp of a recession.”

See also: Loan Loss Reserves Creep Up at Cautious Wells and Citi

Consumer spending, she said, remains above pre-pandemic levels, especially in travel and entertainment with household savings providing a cushion for future stress. Any recession would not be as sharp as we’ve seen in the past, said Fraser. Spending was up 10% on the company’s branded cards, and consumers are continuing to pay those obligations.

Citi’s positive performance was countered a bit by J.P. Morgan, which lost 1%. As noted in the company’s earnings supplements and in our take on earnings, we’re seeing evidence of consumer resilience, at least for now, as debit and credit card volumes were up 15% year over year to $397 billion. Average deposits gained 13% year on year to $1.2 trillion.

Related: JPMorgan Says US Consumer in ‘Great Shape’ but Macro Is Deteriorating

Shifting away from earnings reports and into individual company news, Qualcomm surged 6.1%, having said this past week that its Snapdragon chip, which is designed for smartwatches, is “coming soon.”

Sezzle Leads the Downside

But those gains were more than offset by double-digit declines seen in Sezzle, which lost nearly 57% through the week, and which brought the Pay and Be Paid pillar down. Fiverr gave up 20.6% through the past five sessions.

As has been widely reported, Australian buy now, pay later (BNPL) company Zip has jettisoned plans to buy rival firm Sezzle weeks after saying the deal was proceeding.

Zip said it and Sezzle agreed to walk away from the deal due to “current macroeconomic and market conditions,” adding the decision was “in the best interests of Zip and its shareholders, and will allow Zip to focus on its strategy and core business.”

Read more: Zip Abandons Plans to Buy BNPL Rival Sezzle

As recently as June 22, Zip — which also owns the United States BNPL provider Quadpay — said its shareholders would vote on acquiring Sezzle by the end of the year.

The only surety is that for the CE100, amid earnings season, things are going to get … interesting.

For all PYMNTS EMEA coverage, subscribe to the daily EMEA Newsletter.