Despite a few fizzles, post-earnings relief rallies drove a spate of double-digit percentage point swings and dominated the ConnectedEconomy 100 Index’s performance over the past week.

As if anyone needed a reminder that investors have been mercurial over the past several trading days, shares of Snap gained 30% for the week following a nearly 23% decline the week before.

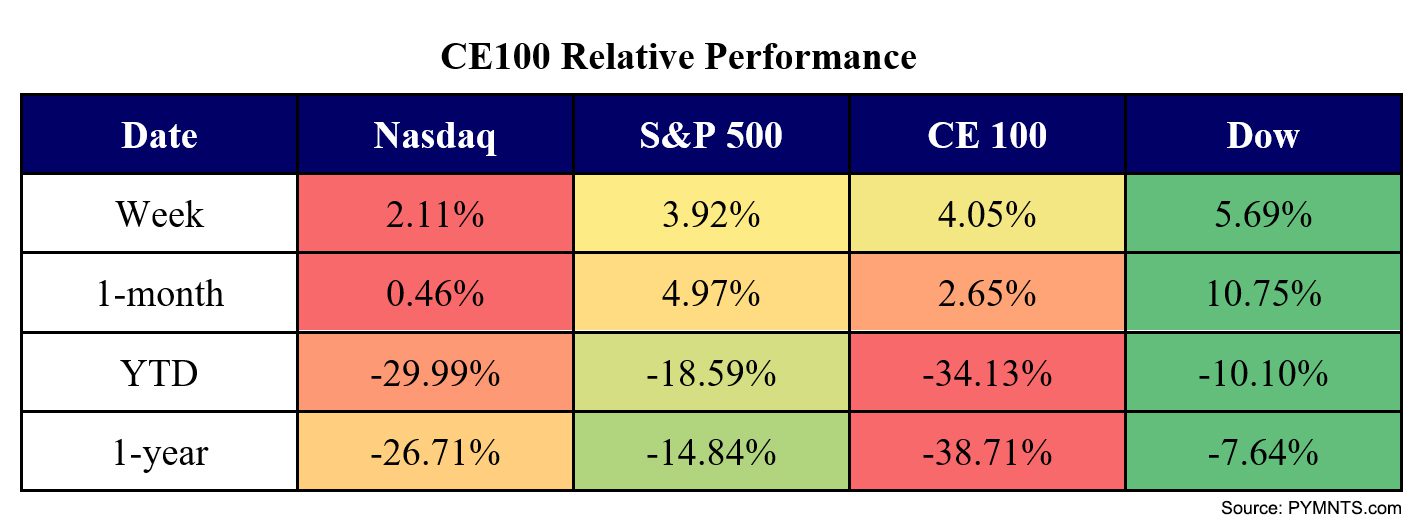

That rally was enough to help to send Snap’s pillar — the Communications Pillar — up 11.9%. The CE100 Index rallied 4% overall.

As to why Snap suddenly curried investor favor, it may be the case that investors, in a week that saw a monster rally (the NASDAQ was up 2.9% on Friday), were looking to bid up beaten-down names.

Snap, of course, said in its earnings report it has been seeing “macroeconomic headwinds and increased competition,” adding that, “We are finding that our advertising partners across many industries are decreasing their marketing budgets, especially in the face of operating environment headwinds, inflation-driven cost pressures, and rising costs of capital.”

Zoom was up 4%. Google said in a blog post on Wednesday (Oct. 26) that users will be able to join Google Meet calls from Zoom.

Payments Networks Paint Rosy Picture on Consumer Spend

The Pay and Be Paid segment was up 5.7%, buoyed by Mastercard and Visa, which, of course, are marquee names in the sector, and which painted a sanguine portrait of consumer spending and the multi-trillion-dollar opportunity that lies in transforming B2B payments.

Visa, by way of example, said on its call that it logged nearly $1.5 trillion in payments volume for the full year, growing 30% in constant dollars. Mastercard CEO Michael Miebach took particular note on that company’s call that consumer spending is resilient and cross-border travel “continues to recover.”

The Communications and Payments sector gains were more than enough to blunt the losses seen in Live Index, which sank 1% in the week. Stride lost 28%, as revenues grew to $425.2 million, compared with $400.2 million last year. Loss from operations of $28.7 million, compared with $7.0 million, was “due to increased instructional costs from earlier hiring, and inflationary pressure on salary and marketing expenses, and continued investments in new products,” the company said in its earnings release.

Platforms Sputter

Tech platforms, at least as far as earnings season has been concerned, have been having a tough time of it, and the Enablers group was off 0.6%. As noted in PYMNTS’ own coverage of earnings, Meta slipped 23%. The company continues to invest billions in its Metaverse offerings and during the most recent quarter net income dropped 52%, and spending rose 19%. Revenue was down 4%.

Amazon sank 13.3%, as revenues surged by 15%, but in a nod to macro pressure, the company said “we’re taking actions to tighten our belt,” Amazon CFO Brian Olsavsky told analysts. And that means “pausing hiring in certain businesses” and “winding down products and services” as operating margins have slipped from 6.8% to 3.2%.

For earnings season, we’ve only just begun, but buckle up — it’s going to be a bumpy ride.