All of the pillars are down — again.

Companies are seeing double-digit plunges — again.

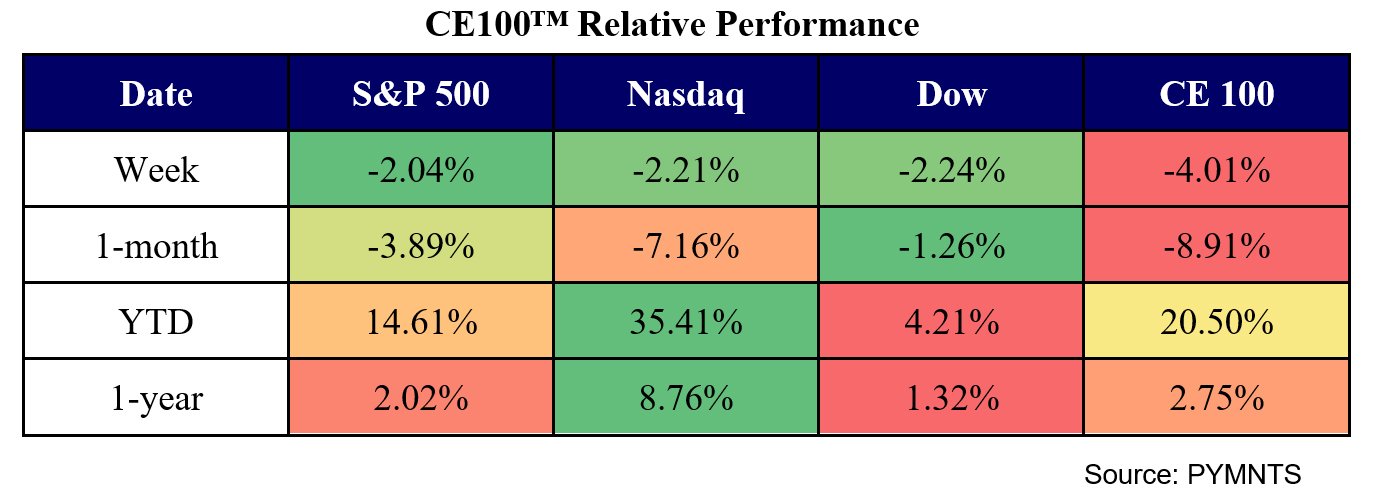

The CE 100 Index continued its slide, where all segments were lower, and ended the week down another 4%.

But despite the weekly decline, the overall Index is still positive for the year, up 20.5%, though the year-to-date performance trails the broader, tech-heavy NASDAQ, which is up more than 35% through 2023.

Adyen’s shares sank 44%, leading the Pay and Be Paid segment 6.4% lower. As noted in the company’s earnings report, the Dutch payment company has shown slowing growth. In its half-year earnings report issued Thursday, the company said hiring costs and slower growth in America — where it faces competition from companies like PayPal — caused it to miss its internal targets.

“In some areas the business grew at a lower rate than anticipated,” the company said in a letter to shareholders. “This was the case for our North American net revenue … an increasingly important contributor in recent years.”

In terms of slowing growth, the company’s revenue climbed 21% to 739 million euros, lower than its own mid-term forecasts of upwards of 25% growth. The earnings report shows Adyen’s EBITDA margin declining from 59% to 43%, due to the increased cost of hiring (EBITDA is a rough measure of cash flow).

In a nod to the stepped-up pace of hiring, Adyen hired 400 workers in the first six months of last year, half of them for tech roles.

At the time, Chief Financial Officer Ingo Uytdehaage — who has since been named co-CEO — said these hirings were an investment in the company’s future.

“It is a longer time horizon before you see a product like the embedded financial products turning into significant revenues, but that’s an investment that we want to make because we have seen in the past … that it really pays off,” he said.

Within the Shopping vertical, which lost 6%, Vroom sank 14.7%, continuing a slide that began after the company’s earnings report earlier in the month. As we noted in our coverage earlier in the month of the latest quarterly report, Vroom has been shedding its aged vehicles, which accounted for 80% of sales during its second quarter, compared to 77% in the previous quarter.

Management detailed that the 80% tally should drop by roughly half in upcoming quarters and keep declining.

MercadoLibre was 9.8% lower in the wake of management changes.

The company said last week that it had appointed a senior vice president Martín de los Santos, as its new chief financial officer.

Beyond Adyen and the impact of the Shopping vertical, the CE 100 Index was dragged lower by WeWork’s 31.5% loss.

This past week, the company said it plans to effect a 1 for 40 reverse stock split. The split will become effective on Sept. 1, the company said.

The action is being taken, per the announcement, to maintain listing requirements on the New York Stock Exchange, which require that a company’s stock must trade for at least $1.

Porch Group shares dropped 20% through the week. The company posted earnings on Aug. 8 that showed that revenues were up 39% in the second quarter of the year to $98.8 million. But, per management commentary and company data, Porch and other home services and insurance players faced the headwinds of extreme weather events and the impact of a declining housing market.