For connected economy and tech stocks, the good news is that 2022 is finally over.

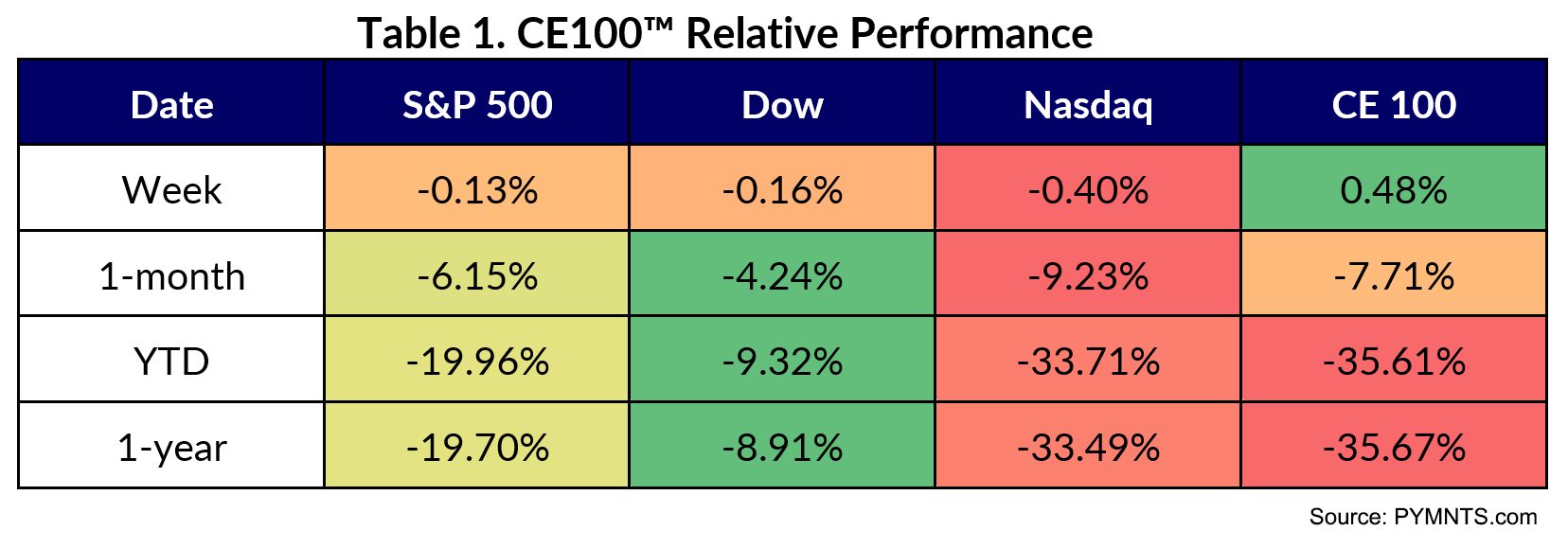

The CE 100 Index managed to eke out slight gains in the final five trading days, up 0.5% but finished the year 35.7% lower. The dismal performance outpaced even the 33.5% loss seen in the tech-heavy NASDAQ Index, in a rough patch that marked the worst overall market performance since the financial crisis of 2008.

All pillars tracked by PYMNTS finished in the red for the year — and a few select pillars and individual stock performances capture 2022 in a proverbial nutshell.

Drilling down into the pillar-by-pillar performances, three sectors spotlight the seemingly relentless macro pressures over the past 52 weeks. The Communication sector was the biggest laggard, losing 51.1% in the year. The Eat pillar lost 41% through 2022. The Shop vertical slipped by 40.5%.

We note that though the stocks themselves are volatile — indeed, trading has been turbulent — the move toward greater connectivity is inexorable. As reported just this past month by PYMNTS in the report, “How The World Does Digital: Different Paths To Digital Transformation,” we see that there had been a 4% rise in digital wallet usage in Q3 across 11 major economies and a 7% overall increase in digital transformation in the U.S.

Inflation and the Great Reopening Are Headwinds

But nothing travels in a straight line. As for the pressures that wound up hitting CE 100 stocks: Inflation ran rampant this past year and the rate hikes pressured businesses and consumers alike, leading to Wall Street worries over spending, profits and slowing top-line growth, and how the great reopening might affect it all. The Communications sector got a bit of reprieve through the last week of the year, gaining 2.3%. In many cases, communications-related names were decimated as firms saw pullback in their own enterprise clients’ spending.

Snap was up 4.2%, leading the group to a positive return for the last few trading days. But the name was down 81.4% by the end of the year, buffeted by concerns over the fact that during past earnings calls, management noted that advertising partners across many of the company’s key verticals are pulling back on their own advertising and marketing spend. Zoom gathered 2.8% but lost 64.4% as there’s been a slowdown in the company’s online business.

Worries Over Consumer Spending

Within the Eat group, DoorDash lost 3.6% for the week and ended 2022 with a 67.9% loss. During the pandemic, the company saw triple-digit revenue percentage growth rates in 2020, which dropped to 69% in 2021, and now is about half that rate. In the meantime, as PYMNTS has reported, the aggregator space has been busy innovating through subscriptions and new grocery partnerships. But macro pressures remain, as DoorDash said late last year that it would lay off 1,250 staffers, which equates to about 14% of its worldwide roster. The push to broaden reach across the aggregators bumps up, at least a bit, against PYMNTS’ separate findings that there was a 4.5% sequential reduction in grocery subscription engagement in the third quarter of 2022 versus the second quarter.

No surprise, consumers are re-examining what’s essential and affordable even as they return to in-store transactions. Shopify sank 75% as its growth slowed and it announced layoffs. As disruptor models see slowdowns and outright top-line declines, the focus now is on profitability. Vroom was 90% lower as 2022 drew to a close, and as spotlighted here, in the most recent quarter, the used vehicle eCommerce firm saw a 28% decrease in revenue and a 30% decline in eCommerce units sold. Vroom attributed these drops to its new focus on operational improvement over sales volume.

A new year brings a new start — and for the CE 100 Index, 2022 boils down to two words: Good riddance.