Short sellers — who profit when stocks decline — held sway this past week.

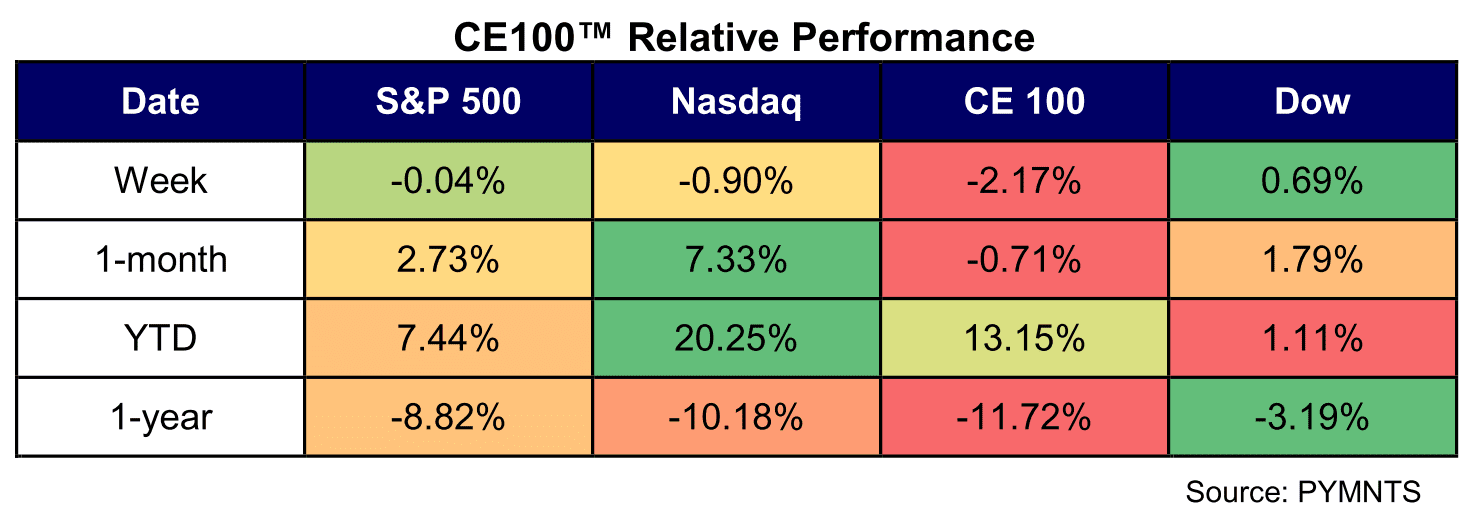

The CE 100 Stock Index slipped 2.2% as only one pillar gained ground in a holiday-shortened week.

The Move segment, work pillar and Enablers group were all down a respective 4.7%, 4% and 3.6%.

Within the Enablers segment, C3.ai plunged nearly 32%. As reported in recent days by sites including Bloomberg, the shares plunged, then rebounded a bit, in the wake of a short-seller report from Kerrisdale Capital that alleged that the AI-focused firm had engaged in “aggressive accounting” to “inflate its income statement.” Management from C3.ai this week refuted the letter, as CEO Tom Siebel said that the report was, as he told Bloomberg, “stock price manipulation.” The letter also alleged that the company’s business is skewed more toward lower-margin consulting business than has previously been disclosed.

In that same group, Google parent Alphabet gained 4.7%, blunting some of the C3.ai impact. The company reportedly plans to add conversational artificial intelligence (AI) to its search engine amid a challenge from Microsoft. Sundar Pichai, CEO, outlined the company’s plans in an interview published last week with The Wall Street Journal. He said artificial intelligence would boost Google’s search functions.

“The opportunity space, if anything, is bigger than before,” Pichai told the Journal.

WeWork led the work-focused names lower, giving up 15.2%. The company announced that it has adopted what we note is commonly known (as reported by sites such as Reuters) as a “poison pill” to limit its shareholders from increasing their ownership stakes. By increasing those stakes, the company can use its net operating loss (NOL) carryforwards to reduce taxes. The announcement comes several weeks after the company reached a deal with SoftBank and other backers to restructure its debt and secure other avenues of financing.

In the “Move” segment, Airbnb lost 11.8%. A short-seller report from the Bear Cave Newsletter (short-sellers are known in Wall Street parlance as “bears”) said that “Airbnb’s top professional hosts are building out their own booking platforms and offering cheaper deals to cut out Airbnb, growing their own email lists and distribution, and offering loyalty discounts to book off of Airbnb,” as Yahoo Finance reported. “In short, Airbnb’s future will look a lot different than its past as the company will now need to compete against its best and largest hosts,” Dorsey wrote.

As reported separately by PYMNTS in recent weeks, Airbnb has said that hosts are using the service to cope with the rising cost of living.

The online marketplace for short-term home rentals has found that 62% of hosts in the United States plan to use their earnings to cover the higher cost of living, 44% use it to cover the cost of food and other needs, and 42% said it has helped them stay in their home, Airbnb said, per stats released last month.

These losses were only partially offset by the gains in the “Be Well” vertical.

Johnson & Johnson gained 6.6%. The stock got a lift in the wake of news that the company struck an $8.9 billion settlement to resolve litigation over its talc-based baby powders. As reported in a filing with the Securities and Exchange Commission, the payments would be made over the span of 25 years.