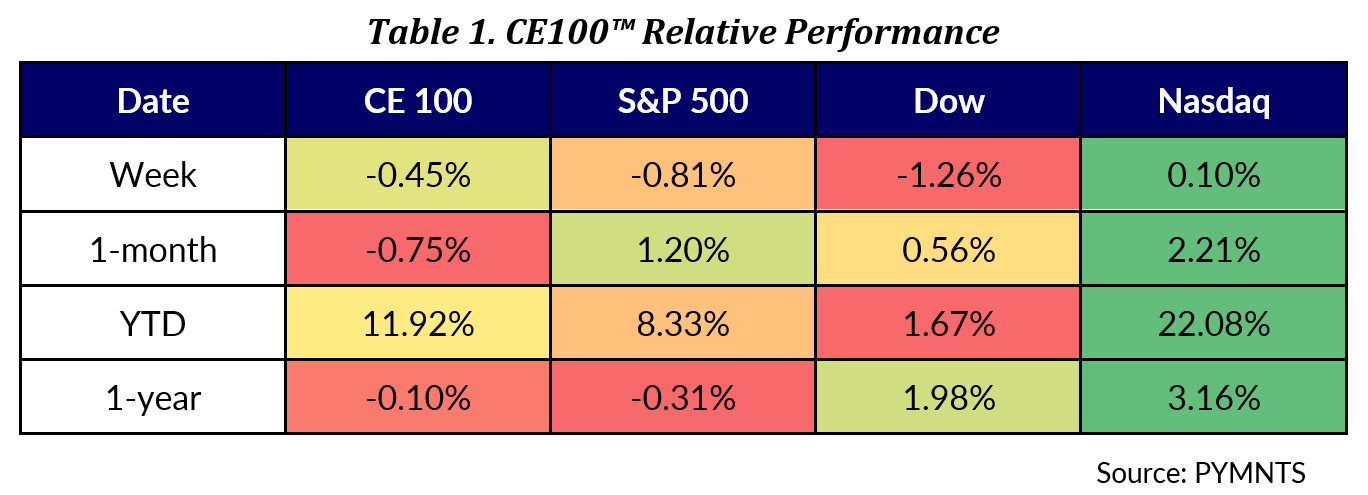

The CE 100 Index lost 0.5% in a week crowded with earnings reports.

Shopify’s corporate transformation, and resulting 28% gain in share price, was overshadowed a bit by investor concerns over slowing growth in the gig economy and by the threat AI may pose to other sectors.

The “Work” pillar slid 5.2%.

Fiverr plummeted by 26.6%. The company said late last week that it was unveiling Fiverr Enterprise. The platform, the company said, and as we reported, gives businesses an all-in-one tool to source, onboard, manage and pay freelance workers while also simplifying budget tracking, tax, legal and workforce classification and compliance.

The new platform is a function of the company’s integration of Stoke Talent, which Fiverr acquired in 2021 for $95 million, into its business.

While Fiverr is set to report quarterly results this week, investors have seemingly painted the gig economy sector with a broad brush, sending shares across the vertical down sharply.

Upwork, for example, reported first-quarter results that showed macro pressures coming to bear on the gig economy. Gross services volume (GSV) — the amount that clients spend on Upwork’s offerings and fees charged by the company for other services — in the first quarter of 2023 was flat year over year at $1 billion. GSV was down approximately 3% quarter over quarter, which the company said was “primarily driven by continued impacts from the macroeconomic environment.” GSV growth rates for the company had topped 50% year over year by mid-2021.

During the conference call with analysts, CEO Hayden Brown said that “we saw some unanticipated deterioration in certain client metrics due to macroeconomic uncertainty, which was most pronounced with our enterprise customers and large businesses in the self-service marketplace.”

Elsewhere, and within the Work segment, Coursera shares sank 11.8% in the week. The for-profit education sector (Coursera offers online courses and certifications) has been hit over several trading days over concerns AI is hurting company growth rates, torching stocks in that pantheon.

Chegg, which is not part of the CE 100, shares declined 40% in the wake of earnings, where, CNBC reported, CEO Dan Rosensweig said during the company’s conference call with analysts that “since March we saw a significant spike in student interest in ChatGPT. We now believe it’s having an impact on our new customer growth rate.”

Ceridian shares were down 10.7%. The company reported revenues in the latest quarter of $370.6 million, an increase of 29.3% on a constant currency basis. In the wake of earnings, Wells Fargo maintained an “equal-weight” rating on the name but lowered the price target from $75 to $65.

Elsewhere, and beyond the “work” segment, shares in Fastly sank 20.3%, leading the Enablers segment down 1.3%. The company reported that total revenue of $117.6 million was up 15% year-over-year growth and represented a 1% sequential decrease. The company also said that its railing 12-month net retention rate decreased to 116% in the first quarter from 119% in the fourth quarter of 2022.

Peloton, which was 12% lower through the week, fell in the wake of earnings. As noted here, Peloton is tackling a rebranding effort. And as part of that effort, various app tiers will have different content levels depending on price points. The earnings data show that in the fiscal third quarter, membership rosters were flat quarter on quarter, down 5% year on year and total revenues were down 22% to nearly $749 million, as measured from the same period last year.

The losses, as noted above, were enough to send the CE 100 Index lower for the week, despite the fact that Shopify shares soared 28%.

Shopify announced Thursday in tandem with its results that it would sell its logistics and fulfillment operations to Flexport. In a letter to employees, in which the company also announced plans to lay off 20% of company-wide staff, Shopify CEO Tobias Lütke made the distinction between the “main quest” of the company and “side quests.” The main quest is, of course, eCommerce.

“Side quests are always distracting because the company has to split focus,” he said in the letter. “Sometimes this can be worth it, especially when engaging the side quest creates the conditions by which the main quest can become more successful.”

For the three months that ended March 31, the Shopify Payments penetration rate was 56%, resulting in gross payments volume (GPV) of $27.5 billion that was facilitated using Shopify Payments. That’s up from a penetration rate of 51% resulting in GPV of $22 billion that was facilitated using Shopify Payments in the same period in 2022, per the company documents.