The third quarter winds its way into the last few weeks of its final month.

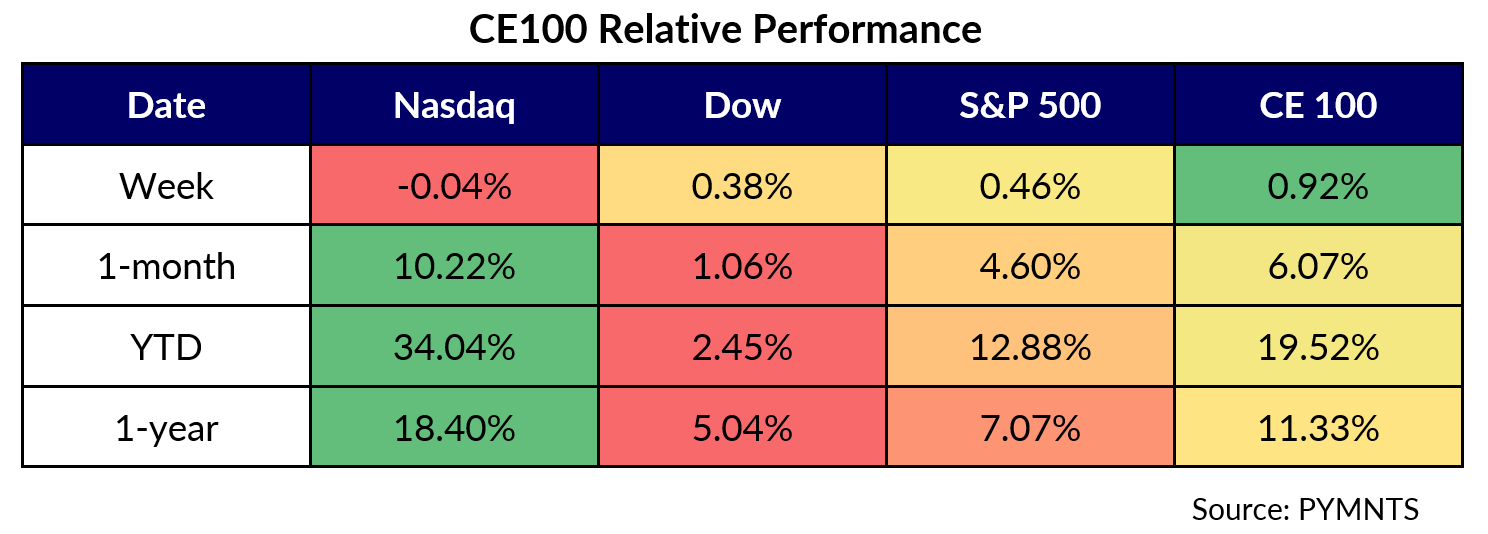

And in the latest weekly showing, the CE 100 Index gained 0.92%, buoyed by the Shopping segment, which gathered 4.2%.

The shopping-related names lead all verticals on a trailing-12-month basis, surging more than 30% over that timeframe.

All told, the CE 100 Index is up 19.5% for the year, which still trails the tech-heavy NASDAQ’s YTD showing, up more than 34%.

It seems to be the case that investors, in recent weeks and months, have been cheered by the resilience of consumer spending. The Fed, of course, has been widely reported as being on track to pause its interest rate hikes as early as its next meeting next week.

And through the past few days, and within the “Shop” segment, Vroom shares gained 18.5%. At a macro level, companies including Vroom would ostensibly benefit from interest rates stopping their seemingly inexorable rise.

As we spotlighted in this space after last month’s earnings, Vroom’s results showed a continued focus on profitability and eCommerce units slid nearly 80% to 3,933. Tom Shortt, CEO, said on the conference call that 77% of units sold were held greater than 180 days compared to 49% in the third quarter of last year.

“We expect a significant portion of our sales in the second quarter to be from aged units, which will put significant pressure on GPPU [gross profits] in the second quarter. We expect the back half of the year to show improved GPPU, as we sell a higher mix of unaged units.”

PDD Holdings (which, as part of its portfolio of holdings operates Pinduoduo and Temu) was up a bit more than 1% in the shopping segment.

The slight gains came despite some mixed sentiment on the Street. As reported by Bloomberg, short interest in budget shopping app PDD Holdings Inc. has returned to levels “not seen since mid-March, with bearish positions accounting for about 8% of total shares outstanding,”

In one note from the sell-side on Wall Street, from Goldman Sachs, the analysts reiterated their neutral rating, noting that competition has been on the rise, and so has discounting, in a bid to lure shopping activity in China.

Sezzle and Affirm led the Pay and Be Paid segment higher, up a respective 13% and 10.7%, boosting the segment ahead 2.4% Sezzle said last month it now offers consumers the option to split purchases into two payments.

As reported, the installment payment platform’s new Pay-in-2 buy now, pay later (BNPL) product lets shoppers pay 50% at the time of purchase and the remaining 50% two weeks later.

Affirm, for its part, said last week that Amazon had added Affirm’s pay-over-time option to Amazon Pay. Eligible United States merchants using Amazon Pay can allow their customers to choose the pay-over-time option at checkout.

Tesla led the Move segment, which gained just under 3%.

Shares in Tesla were 14.2% higher. The company’s stock rallied after General Motors and Ford agreed to adopt Tesla’s North American Charging Standard (NACS) for their electric vehicles, making it the primary network in the country.

As had been reported here, GM CEO Mary Barra said, per Reuters, that there is a “real opportunity here to really drive (the NACS) to be the unified standard for North America, which I think will enable even more mass adoption.”

Shares of Porch lost 9.3%, leading the “Live” pillar 1.4% lower.

C3.ai continued its winning streak, extending over several weeks, and was up 14.6%. But AI-related news did not seem to lift all boats. GoDaddy lost 4.9%, as the Work pillar sank 0.6%. In an announcement at the end of May, GoDaddy said that it had debuted three new AI products that now use generative AI, geared towards small businesses. Those products span online store product descriptions, customer service messages and the conversations app.