Vroom and Roblox were notable double-digit decliners, more than offsetting the positive impact of stock surges seen from the likes of Cogent.

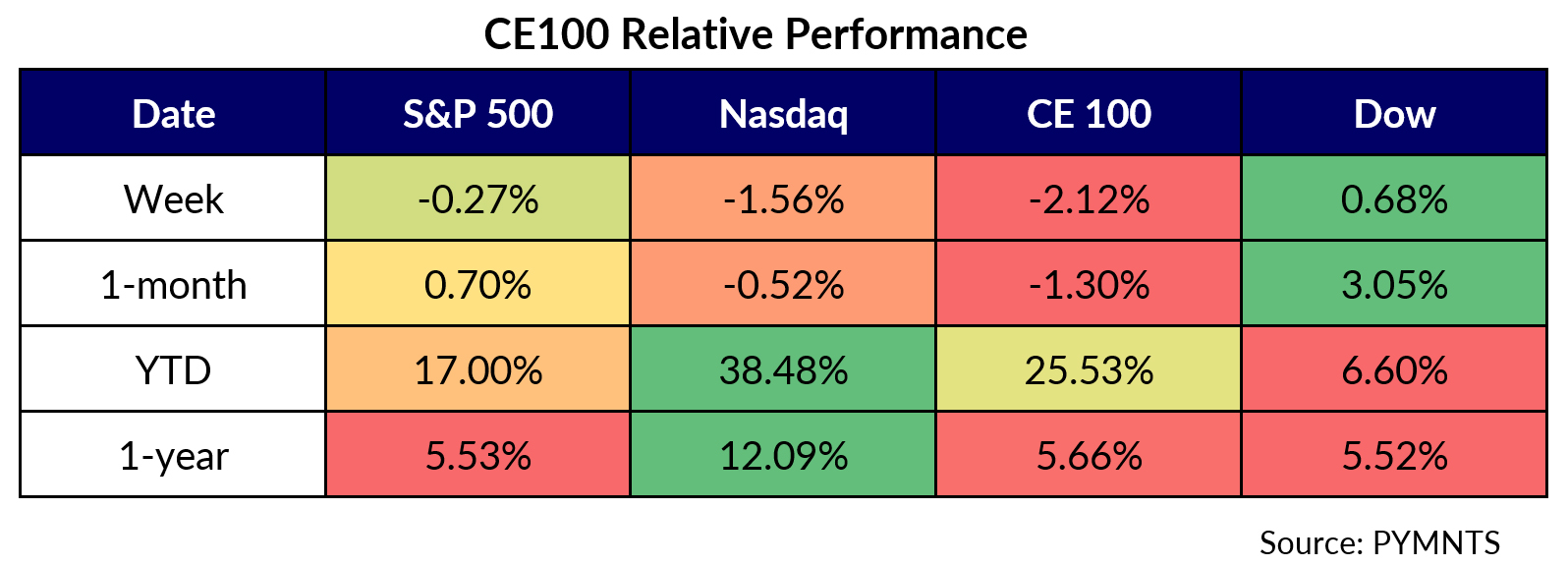

The CE 100 Index lost 2.1% this past week, and in what seems to feel like it might be a bit of a trend, all pillars declined.

And as has been seen in recent sessions, earnings were the prime mover, pretty much no matter where you looked.

The Shopping pillar sank the most, slipping 4.2% through the past five trading sessions.

Vroom skidded more than 30%.

As noted in our own earnings coverage, Vroom said its efforts to work through its aging inventory are proceeding apace.

Per Vroom CEO Tom Shortt:

“As we execute our strategy in 2023, we are resuming responsible growth, selling through aged inventory, improving variable costs per unit, continuing to reduce fixed costs, and converting balance sheet items into cash,” he said. “Our long-term roadmap remains unchanged.” As much as 80% of the company’s sales logged in the most recent quarter were tied to these aged vehicles, which is higher than the 77% tally seen last year.

The company’s eCommerce units sold in the quarter came in at 4,144, which was down about 81% from a year ago. Vehicle-related revenues were down a roughly commensurate 81.7% to $131 million. The company’s eCommerce average days to sale came in at 244 days, up from 76 days last year.

Shopify lost 4.6% in the week that followed its latest earnings report, the first earnings announcement since divesting itself of its logistics operations. The company reported that sales surged 31% year over year to nearly $1.7 billion, tied to a 17% boost in gross merchandise volume. The company said, too, that there was a 61% rise in B2B gross merchandise volume in the first half of 2023.

Coupang was among the few positive performers within the Shopping pillar, adding 8.1%.

The company reported net revenues of $5.8 billion, up 16% year over year, buoyed by continued demand among key markets in South Korea for eCommerce and faster (one-day) delivery speeds. Active customer counts were up 10% year over year to 19.7 million in the second quarter. A total of 80% of subscription members utilized the company’s meal delivery service, according to results and commentary on the conference call with analysts. The company is also earmarking $400 million to expand in Taiwan and further develop its streaming and meal delivery businesses.

Roblox lost more than 20%, leading the “Have Fun” segment 3.5% lower. The company said this past week that it is making inroads with users over 13.

CEO David Baszucki said the gaming platform’s “13 and over cohort is five times larger than our under 13 cohort. And our 13 and over cohort is growing at 33% year on year for DAUs. Our 17 through 24 cohort is growing at 36% year on year for both DAUs and hours.”

Bookings were up 22% year on year to $780 million. But those results were below consensus, we noted, which helped send the shares lower. In other metrics tied to the Roblox ecosystem, developers are on track to earn $800 million this year, as the company’s DevX payouts in the second quarter were $165 million, up 16% year on year.

These losses in the names discussed above swamped the positive impact contributed by Cogent Communications, which surged 18.1%, as the Enablers segment lost 3%. Cogent’s results this past week showed that services revenues were up 61% year on year to roughly $240 million in the wake of its acquisition of Sprint’s U.S. long-haul fiber network.

Investor materials reveal that “on-net” service — provided to customers located in buildings that are physically connected to Cogent’s network by Cogent facilities — realized revenues of $127.7 million, up 9.9% from the three months ended March 31, 2023, and 14% year on year.