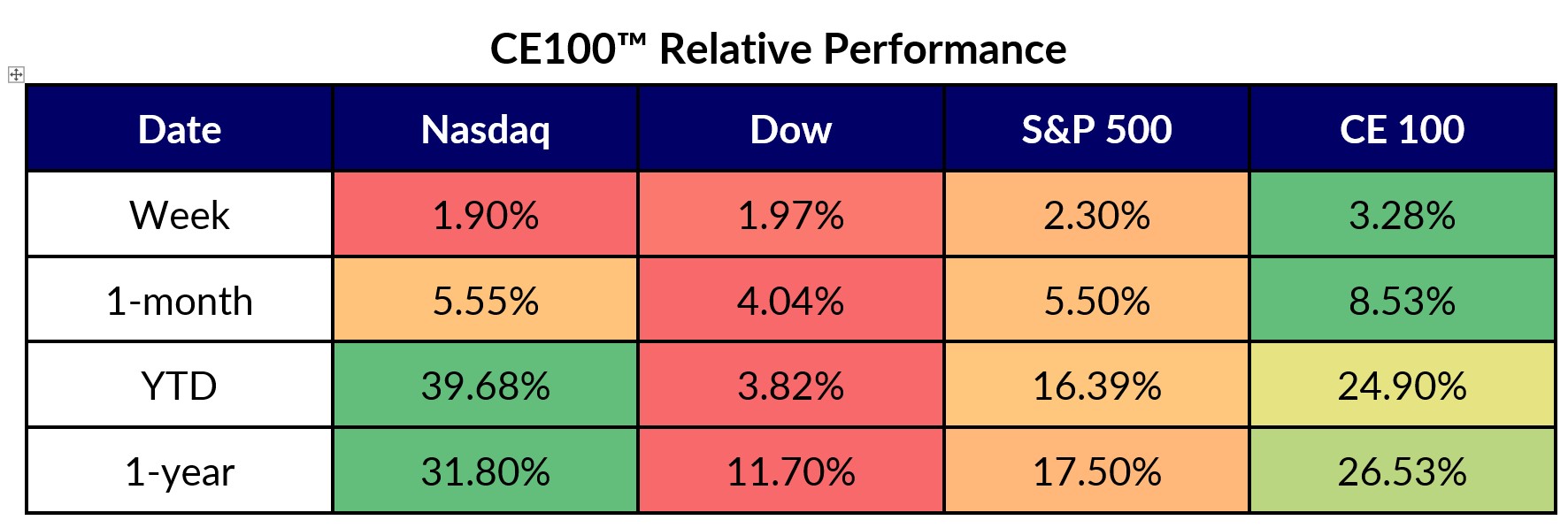

June’s over, and thus far, two quarters in, the year’s been notably strong for the CE 100 Index.

All indices were in the black, again, this past week, continuing a string of positive performances.

And it was the Move sector, this time around — with a sanguine outlook on travel spending — that, well, helped move the index.

The latest weekly push brings the year-to-date performance to just under a 25% gain.

The Move pillar was up 5.4%, buoyed by XPO shares, which surged 14.7%. The name was on the receiving end of bullish sentiment on Wall Street, where Bank of America boosted its target price on the company by about 10%, to $57. Citigroup kept its buy rating on the name, and raised its price target to $68 from $53. In company-specific news, XPO said this past week that it completed its Salt Lake City terminal expansion, which is tied to the Pacific Northwest market.

Delta gained 10.9%. Barron’s reported that the company’s investor meeting “kindled hope” that the pandemic is firmly in the rearview mirror, and that a more robust profit outlook is in the cards. Presentation materials from the company from that day show that air travel is returning to its “long term trend,” and is on track to reach its historical average this year. There’s a growing demand for premium seats, Delta disclosed, and that category now represents 35% of total sales in 2023, up from 32% last year.

The decline in consumer spending on goods, Delta has said, is funding travel spending. Management tightened key financial metrics — such as operating profit — to the top end of guidance. For the current year, operating margin should be in the 10% to 12% range.

Revenue for the fiscal year should grow by 17% to 20%, a firming up of the range that had been 15% to 20%.

FedEx gathered 6.7%. As reported by Yahoo Finance, an investment firm, The London Company, released its “London Company Large Cap Strategy” first quarter 2023 investor letter. And in that letter, the firm said noted that its holdings in the company reflect “its global parcel and freight networks, as well as the company’s potential to improve operating results to peer levels that would create significant shareholder value.”

In the Pay and Be Paid segment, which was the “laggard” of the group with a relatively muted 1.8% return, Sezzle lost 8.6%. The company, as we reported late last month, has launched a subscription-based service that lets shoppers use its Virtual Card anywhere Visa is accepted. Consumers also can earn 1% back on eligible transactions and opt-in to build credit through Sezzle Up, per the company’s announcement.

Elsewhere, shares in Alphabet were 1.7% lower. As reported here, Google is reportedly laying off an unspecified number of employees at its mapping app Waze. Waze had been acquired in 2013. The newest moves would consolidate the unit with its own map products.

It was reported in December 2022 that Google was merging two of its mapping teams — Waze and Maps — as it was under pressure to reduce costs. The company will merge the more than 500 people working on Waze with Geo, the organization that handles Maps, Google Earth and Street View, The Wall Street Journal reported in December of last year.