If missed bill payments indicate consumers’ lacking economic security, we may be in for a bumpy ride.

Last week’s news about January’s consumer spending sharply up from the previous month was a welcome change after seemingly endless gloomy economic forecasts. However, any celebrating may have been premature once disclosures about how consumers are paying for these purchases were also released.

Just as consumer spending news was splashing across digital headlines worldwide, the two biggest banks in the U.S. stated in Securities and Exchange Commission (SEC) filings that their credit card delinquency rates had risen. From December to January, Bank of America’s Master Credit Card Trust II’s delinquency rate rose from 1.03% to 1.09%. Its net charge-off rate increased from 1.43% to 1.50%. During the same time period, JPMorgan Chase’s credit card delinquency rate rose from 0.76% to 0.83%. However, its net charge-off rate dropped from 1.24% to 1.17%.

Two days earlier (Feb. 13), Discover Financial reported in its SEC filing that its credit card delinquency rates had been steadily increasing. The company’s 30 or more days delinquent loans hit 2.67% in January, from 1.71% the previous May, hitting pre-pandemic levels. Discover Financial’s net principal charge-off rate was 2.81% in January, the highest for the company since February 2021’s rate of 3.15%.

Then, on Thursday (Feb. 16), The Federal Reserve Bank of New York announced that total household debt held at $16.9 trillion as of Q4 2022. This record amount represents a 2.4%, or $400 billion, rise from the previous year. Fed data also noted that credit card balances between December 2021 and December 2022 rose $130 billion, representing the highest growth on record.

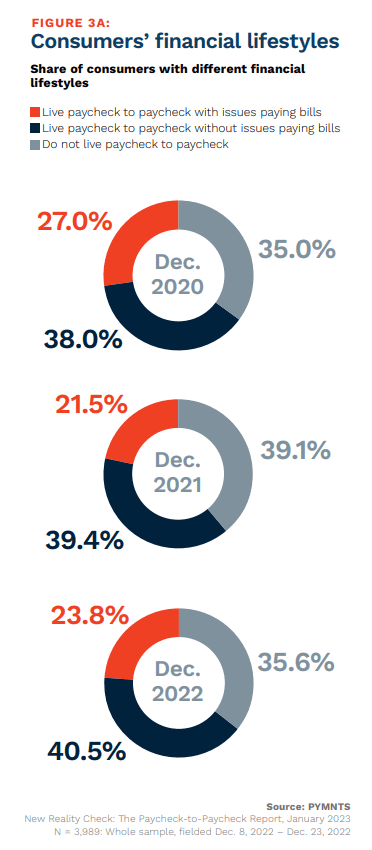

Missing credit card payments is no small matter for most U.S. consumers, as fees and penalties quickly add up. It may also signify how stretched U.S. consumers’ budgets are. The January edition of the PYMNTS and LendingClub collaboration, “New Reality Check: The Paycheck-to-Paycheck Report,” details this by examining the share of consumers currently living paycheck-to-paycheck.

After the welcome bump of fewer consumers living paycheck-to-paycheck in 2021, the rate is back to near-2020 levels at 36%. The good news, however, is the number of consumers living paycheck-to-paycheck without issues paying bills is higher than ever, meaning that though some of their financial situations have worsened, they generally remain stable. We also found that a smaller share of consumers now has issues paying their bills than did in December 2020. Overall, the rising rates of overall paycheck-to-paycheck consumers coupled with the Fed and bank news may signal more to the consumer spending stats than seems at first glance.

The future is certainly uncertain, and the U.S. path to a recession, even briefly, is far from set in stone. If next month’s consumer spending rates remain high, we could very well be seeing a return to “normal.” However, retailers, merchants or any other multiple sectors depending on consumer spending may want to exercise financial caution and pause any further celebrating — at least until the next round of numbers are released.