There’s a kind of World Cup of digital transformation playing out right now.

PYMNTS ongoing ConnectedEconomy™ Index research into digital transformation trends across 11 countries that comprise roughly 50% of global gross domestic product (GDP) found different nations pulling ahead or falling behind in key areas.

Using data collected from over 30,100 individuals and analyzing roughly 3 million data points, the latest CE Index findings as presented in the PYMNTS study “How the World Does Digital: Different Paths to Digital Transformation” found serious efforts to increase digital commerce among world economies, with some performing better than others.

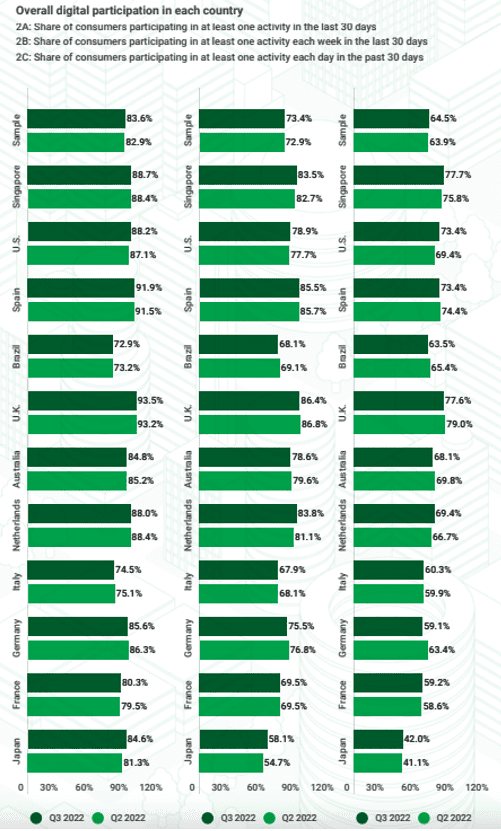

We define digital transformation as the number of consumers who use digital methods to engage in any activity, the number of digital activities they engage in, and how frequently they engage. Using that definition, we’re tracking a lot of progress and a little lagging.

Germany, Brazil, the United Kingdom and France logged the steepest declines in the latest sounding, the study found. These large economies had slowdown that included “a 4.5% reduction in grocery subscription engagement, followed by a 2.2% drop for telemedicine and a 2.1% drop for restaurants’ websites and apps.”

Advertisement: Scroll to Continue

Germany, France, the United Kingdom, and Brazil made fewer digital transactions than consumers in the rest of the 11 countries measured by the CE Index.

Moving the transformation ball downfield at a faster clip in the latest findings is Japan. While consumers in seven of the 11 countries in the Index saw higher digital wallet adoption for in-store payments, Japan took the cup here with a whopping 20% increase in digital wallet adoption, far outpacing other nations in Q3.

Japan is hardly alone in digital wallet adoption though. PYMNTS found that consumer use of mobile wallets to pay for in-store transactions “also increased in the United States by 13%, Australia by 14%, and Singapore by 18%. The difference is that global wallets dominate these markets, accounting for 47%, 74% and 43% of in-store mobile payments, respectively.”

In terms of monthly participation in the 37 digital activities we track, the U.K., Spain, Singapore and the U.S. pulled ahead of competitor countries in both monthly and daily participation rates. Meanwhile, U.S. connected activity engagement was up 10% in Q3, with consumers averaging 4.6 digital activities each day, second only to Brazil in this regard.

Looking at levels of engagement that were hot in 2022 like travel, consumer engagement with digital tools for travel and commuting spiked by 3.2% in Q3, with only France, the Netherlands and Brazil logging declines in these areas.

At the country level, the study found that “Germany, the U.K., France and Brazil reduced digital transactions in Q3, unlike their counterparts elsewhere. Elevated inflation is hurting consumers everywhere, but those in Europe have more reason to cut spending due to spiking fuel costs caused by the war in Ukraine. Brazil, meanwhile, suffered from wider macroeconomic and political uncertainties stemming from the contentious presidential election in Q3, dampening consumer sentiment.”

Consumers in Brazil and France cut back hard with online grocery shopping, as 14% and 11% fewer consumers in Brazil and France, respectively, used digital grocery subscriptions in Q3.

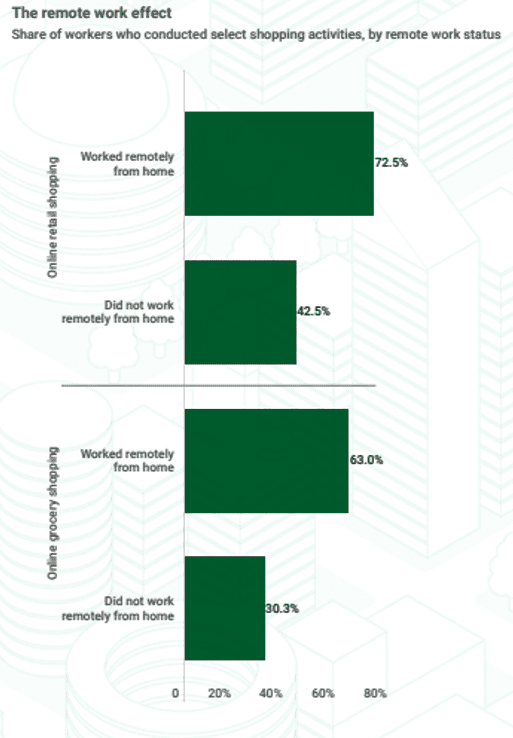

That stands in stark contrast to the fact that remote work remains high, and those working remotely are far more likely to shop for groceries online. We found that 63% of remote workers used a digital channel to order groceries for delivery at least once in Q3, equating to an estimated 137 million people across the 11 countries. An even greater share of remote workers — 73%, or approximately 157 million consumers — shopped online for delivery.