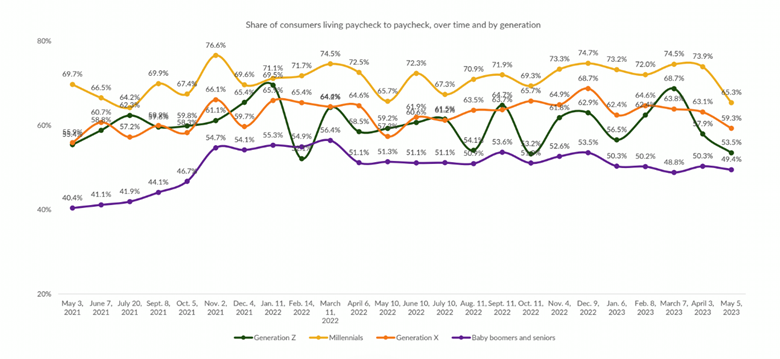

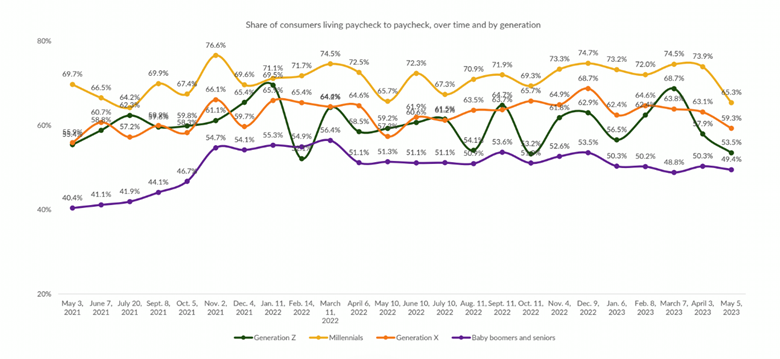

The share of Generation Z consumers living paycheck-to-paycheck has more resembled a roller coaster than a traditional economic trajectory. This financial insecurity has impacted the demographic’s adult members, born between 1997 and 2005, and their ability or willingness to spend. Research carried out for the June edition of PYMNTS’ collaboration with LendingClub, “New Reality Check: The Paycheck-To-Paycheck Report,” shows the generation’s share of consumers living within this lifestyle going from its second highest point to its second lowest point in the space of three months.

It will be another few months of PYMNTS paycheck-to-paycheck data to determine if Gen Z’s share will continue to stay low. However, there may be other factors already in place that may provide a measure of near-future financial security for the age group — and buoy their willingness to spend.

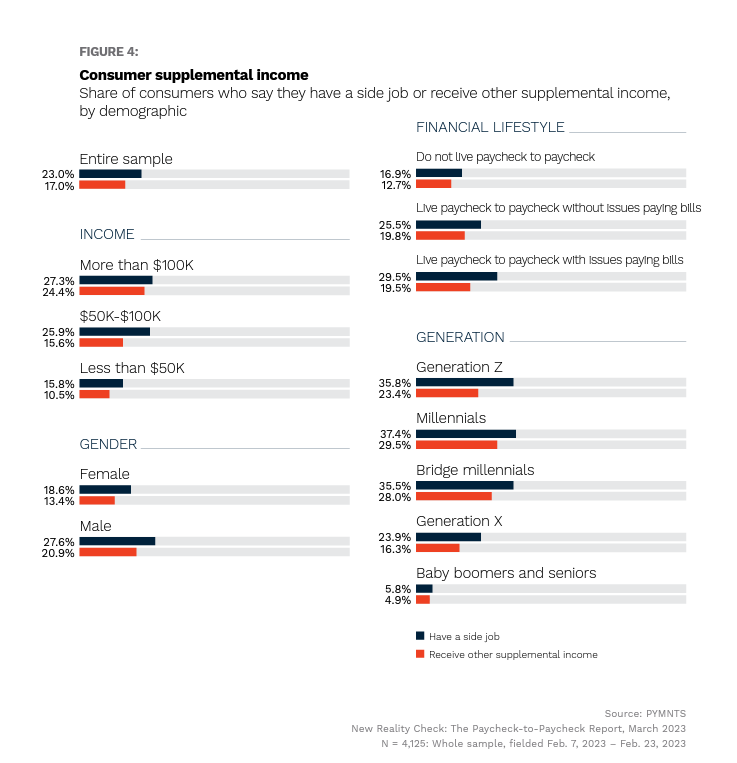

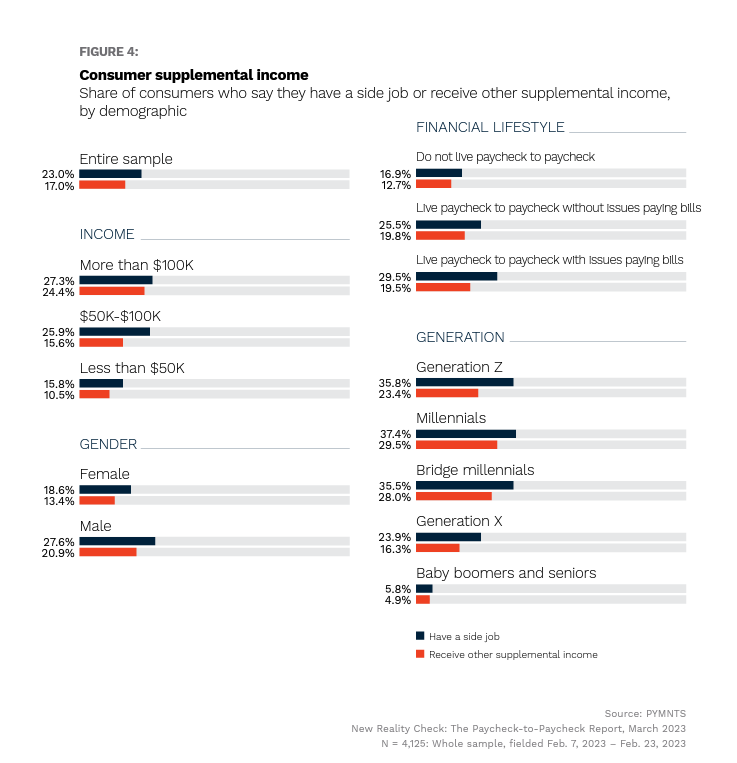

One of these is featured in the March edition of PYMNTS’ collaboration with LendingClub, “New Reality Check: The Paycheck-to-Paycheck Report”: supplemental income. Gen Z’s share of consumers with side jobs, at 36%, is the second largest across all demographics. If one of the motivators for the generation’s interest in extra work is greater financial security, the strategy may be working.

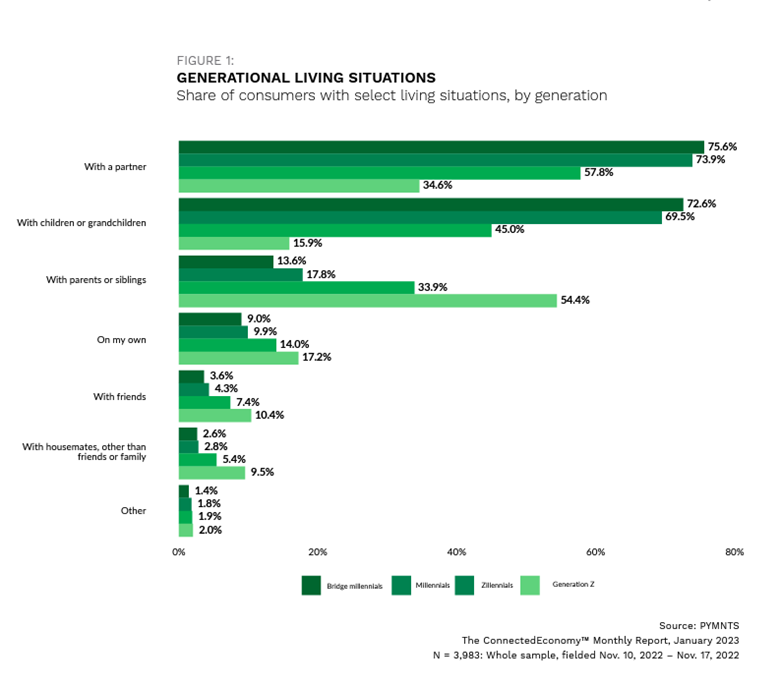

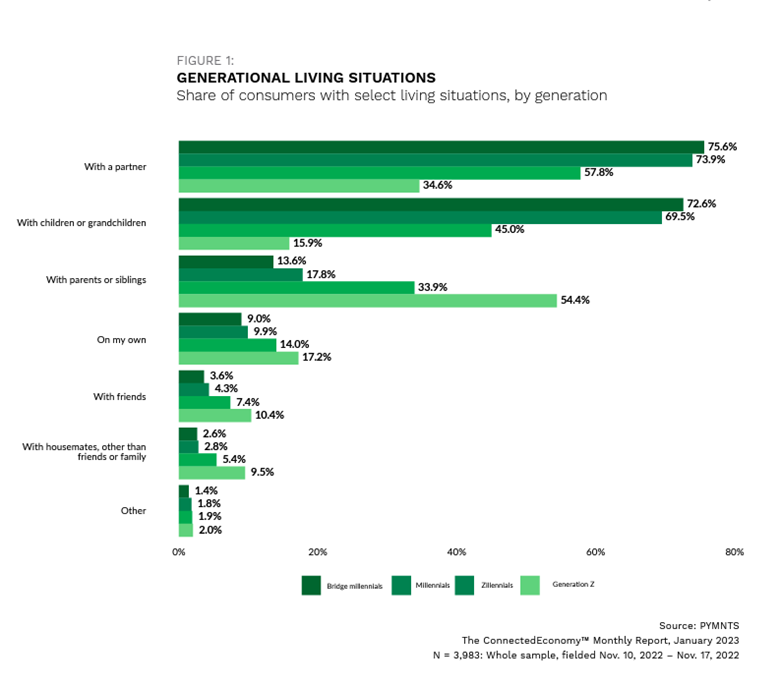

Another financial factor that could be contributing to Gen Z’s spending ability is their living situations, noted in PYMNTS’ January edition of “The ConnectedEconomy™ Monthly Report.” The greatest share of Gen Z consumers by far live with parents and/or siblings, at 54%, and the second greatest share live with a partner, at 35%. Shouldering reduced expenses in the case of living with family or splitting the costs of housing and utilities with a partner could be adding to Gen Z’s recent improvement in financial lifestyle, which may contribute, in turn, to an increased inclination to spend.

Side jobs and supplemented housing costs may help explain Gen Z’s increased economic security and could mean these consumers feel freer to spend. Although past volatility in the share of Gen Z consumers living paycheck-to-paycheck makes the generation’s future difficult to predict, the generation is proving to be resourceful. The supplemental income earned from side hustles and any money saved by cohabitating serve as building blocks being laid now that could set the generation on the path to a more stable financial future.

See More In: buying power, ecommerce, economy, Featured News, Gen Z, LendingClub, New Reality Check: The Paycheck-To-Paycheck Report, News, paycheck to paycheck, PYMNTS Study, Retail, Retail sales