The tech guru’s newest venture aims to be everything to everyone. But is it possible?

Months of rumblings kicked off in November with Twitter reportedly filing with the Financial Crimes Enforcement Network to begin the registration process for processing payments. This first step for the social media platform to conduct money transfers, exchange currency or cash checks was followed by months of silence on the matter.

That is, until earlier in April, when Elon Musk finally released his plans for Twitter’s transformation from social media platform to financial institution and “everything app.” Envisioning Twitter’s current valuation ballooning to $250 billion, Musk plans to turn the company into a PayPal rival and considers it possible for it to one day “become the biggest financial institution in the world.” With Twitter now rolled into Musk’s shell company X, there may be a long road still ahead before the platform realizes its goal.

Super apps are currently popular in Asia but have yet to catch on in the West. These offerings can handle everything from ride hailing and eCommerce to mobile payments, photo sharing, video chatting and government services in one place. WeChat is regarded as the super app to beat in the space.

But as Microsoft has found out, it may be one thing to attempt being the go-to super app and quite another to fulfill that goal. Consumers demand quite a lot from these potential providers, as detailed in the PYMNTS collaboration with PayPal, “The Super App Shift: How Consumers Want to Save, Shop and Spend in The Connected Economy.”

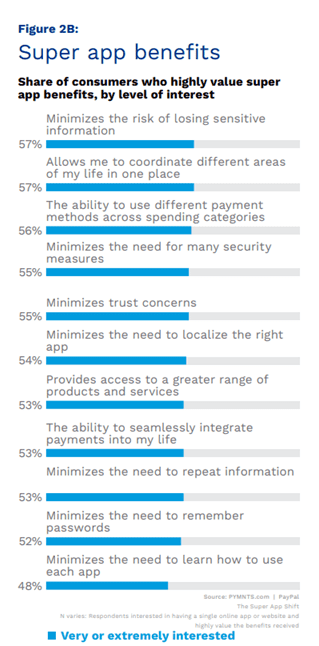

Of a super app’s benefits included in the survey, 10 out of 11 features received a “very or extremely interested” by more than 50% of consumer respondents. And with only two of these features directly related to payments services, Musk may have his work cut out for him to seamlessly and successfully offer most (or even many) of the additional features. One big obstacle facing X’s plan is the trust factor, as over half of consumers trust their financial institutions most to provide a safe super app.

Americans, especially millennials, are highly interested in the benefits a super app may provide as a major step towards a more frictionless retail and payment experiences. The jury’s still out if it will be Microsoft, X or a still-unnamed organization to be first to U.S. market. But if consumer enthusiasm is any hint, all signs point to the platform’s high probability of widespread adoption.