CE 100 Index: AI, Banks and BNPL Names Were Standouts During 2023’s 42% Rally

The CE 100 Index soared in 2023, largely on the wings of widespread rallies among banking and buy now, pay later (BNPL) names, up double digit and, in some cases, triple digit percentage points.

The key themes?

Consumer spending has remained resilient. Interest rates have likely peaked. The banking runs of earlier this year are but a memory. The rise of AI has been a catalyst for the rise of our Enablers group.

Every single pillar finished the year handily in the black — even the Work pillar, up 14.8%, trailing all segment brethren. In this case, WeWork’s spectacular 99% flameout, where the firm filed for bankruptcy, proved to be a headwind for the group.

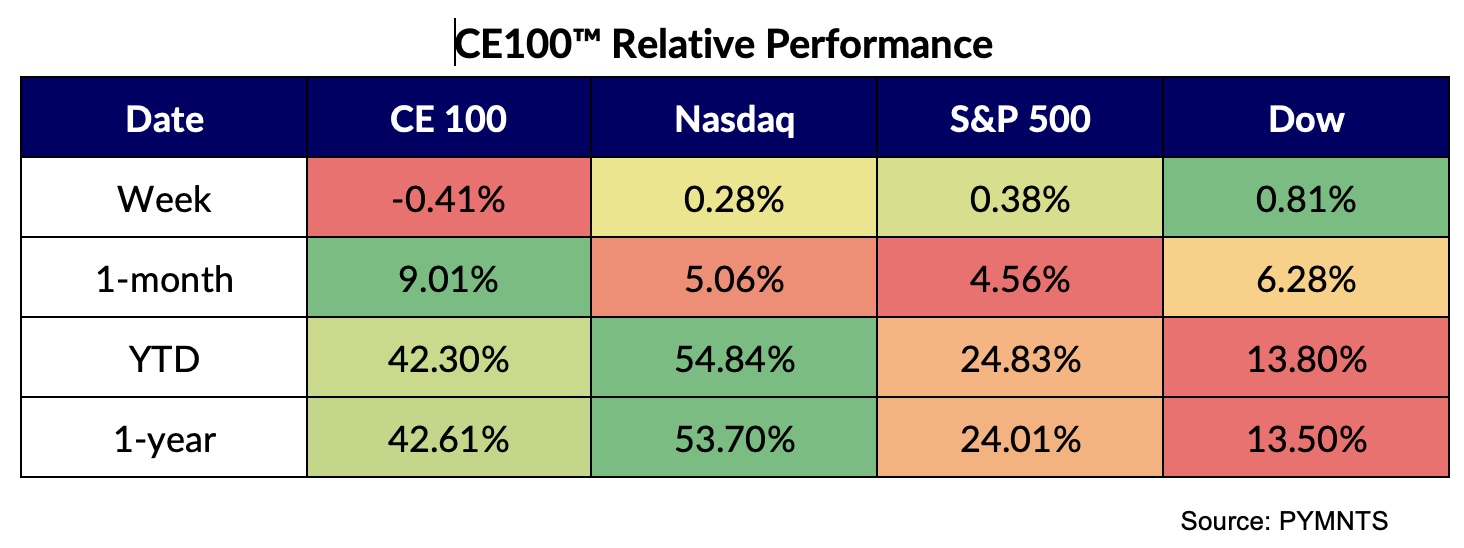

As a result, the overall Index was up 42.6% from the end of 2022. The CE 100 Index outpaced all of its benchmarks, as seen in the chart below, save the NASDAQ, which added more than 53% over the same timeframe.

Enablers: A Love Story on Wall Street

The Enablers, altogether, were up more than 81%. And it’s within this segment that AI ruled. Nvidia shares leaped 239%, as the company makes chips that help power the advanced technology, and as the firm has invested in dozens of AI companies. Meta’s stock bumped ahead 194% as it has captured its own slew of AI-related news, bringing generative AI to ad creatives. C3.ai shares surged more than 103%. Microsoft was up 54% as investors have looked to AI as a significant revenue generator for the firm.

Paying Over Time Pays Off

The Pay and Be Paid pillar was up 43% for the year. In that group, Affirm was up more than 408% for the year, followed by Sezzle, which added nearly 104%.

The rise of buy now, pay later (BNPL) has been well-documented by PYMNTS, as the waning weeks of the year brought significant attention and headlines to the ways in which consumers have embraced the payment option. Black Friday and the advent of the holiday shopping season saw payments-over-time being used as a key option to make sure the gifting all got done. But as noted here, BNPL is also being leveraged as a tool for grappling with emergency expenses.

Traditional payment methods showed significant traction, too. Card networks, including Visa and Mastercard, were up a respective 22% and 25% through the year, while American Express was up 27%. And through the slew of earnings reports through 2023, with high-single digit percentage point growth in card transactions and double-digit growth in contactless and cross-border spending, the willingness of consumers to keep the “great snapback” in travel-and-experience spending was a highlight.

The banks got a boost too, up nearly 25% in 2023 as a group. That’s where the money is, as the old quote goes, and Ally Bank led the pack, adding more than 43%, with JPMorgan Chase surging 27.8%.

Inflation has been cooling, and the Fed has signaled that interest rates may be cut in the year ahead, which in turn may spur loan demand again among consumers and businesses. In the meantime, these mainstays of financial services have been riding the great digital wave toward mobile banking.

By all accounts, 2023 was a memorable one for the CE 100 Index. But it’s in the rearview mirror, and what comes next for the connected economy will bear watching.