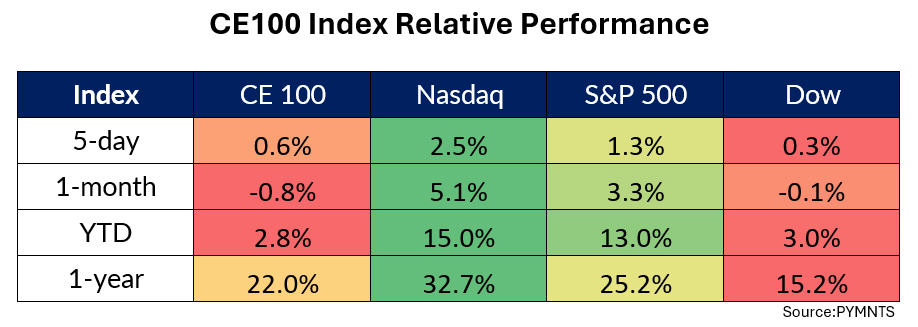

The CE 100 Index gained 0.6% in a week that saw some continued post-earnings-report momentum and investor enthusiasm for AI-related names.

CrowdStrike shares rallied 11.3%, driving the Work segment 2% higher on the week.

The company reported earnings results that detailed net new annual recurring revenue, at $212 million, up 22% year over year. Total revenues of $921 million were 33% higher than a year ago, while subscription revenues surged by 34%. CrowdStrike’s module adoption rates were 65%, 44% and 28% for five or more, six or more and seven or more modules, respectively, as of April 30.

Nvidia Notches a $3 Trillion Milestone

Nvidia was 10.3% higher, as the Enablers segment of the CE 100 Index gathered 0.5%. The rally, as reported here, helped the company notch a $3 trillion market cap, ahead of Apple and trailing only Microsoft on that metric. Both Microsoft and Nvidia have benefited from investor interest in AI infrastructure; Nvidia, of course, makes AI chips and holds about an 80% share of the market for chips for data centers.

The chipmaker reported that its revenue for the quarter ended April 28 was up 18% compared to the previous quarter and up 262% from the same period a year earlier. Management said earlier this month that Nvidia aims to update its AI accelerators each year, with the Blackwell Ultra chip due in 2025, and will debut a next-generation AI platform in 2026.

News about looming antitrust violations did not blunt gains in the Enablers pantheon. The Justice Department and Federal Trade Commission (FTC) have come to an agreement that lets them proceed with probes into the dominant roles OpenAI, Microsoft and Nvidia hold in the segment. Microsoft shares were 2% higher through the week.

Visa shares were up 4.5%. As PYMNTS reported, Visa has issued its 10 billionth payment token, noting that tokenization has saved $650 million in fraud in the last year while driving over $40 billion in incremental eCommerce revenue for businesses globally.

“The security properties of the token enable merchants to embed it in virtually any payment experience. It does its magic in the background in making sure that the good transactions are getting through, but also in powering up these experiences that the modern consumer is seeking,” Mehret Habteab, senior vice president of Product and Solutions at Visa Europe, told Karen Webster.

Cogent Communications slipped 6.9%. The company reported that Cogent Communications Group, LLC and Cogent Finance, Inc. have priced a private offering of $300 million in aggregate principal amount of 7% senior notes due 2027.

American Express shares lost 3% in the Pay and Be Paid segment, which gained 2%. Amid the headlines last week, eBay is dropping American Express as a payment option beginning Aug. 17 of this year.

“At a time when payment processing costs should be declining because of technological advancements, investments in fraud capabilities and customer protections by merchants like eBay, credit card transaction fees continue to rise unabated because of a lack of meaningful competition,” eBay said. The two companies have reportedly been negotiating merchant discount rates (also known as interchange fees).

Elsewhere, in the Shopping segment, which lost 1.5%, shares of MercadoLibre were 7.3% lower. Reuters reported that MercadoLibre expects its investments in Brazil this year to exceed the 23 billion reais ($4.35 billion) initially planned due to higher-than-expected sales.