The Connected Economy (CE) 100 Stock Index was launched in February 2022.

It was introduced as an equity index of 100 publicly traded companies across 11 categories, aiming to track the digital transformation and the growth of the connected economy.

At the time, though we were emerging from the pandemic, and that the CE had some tailwind, what we’ve seen in the ensuing two years has been nothing short of a tsunami of digitally linked online and offline connectivity, global in scope.

But that depends on where you look.

The CE 100, then, as now, includes 11 pillars of commerce and daily life — as well as daily financial life. The segments touch the many facets of connected economy, from working to dining to commuting/mobility, banking and paying for all of these activities.

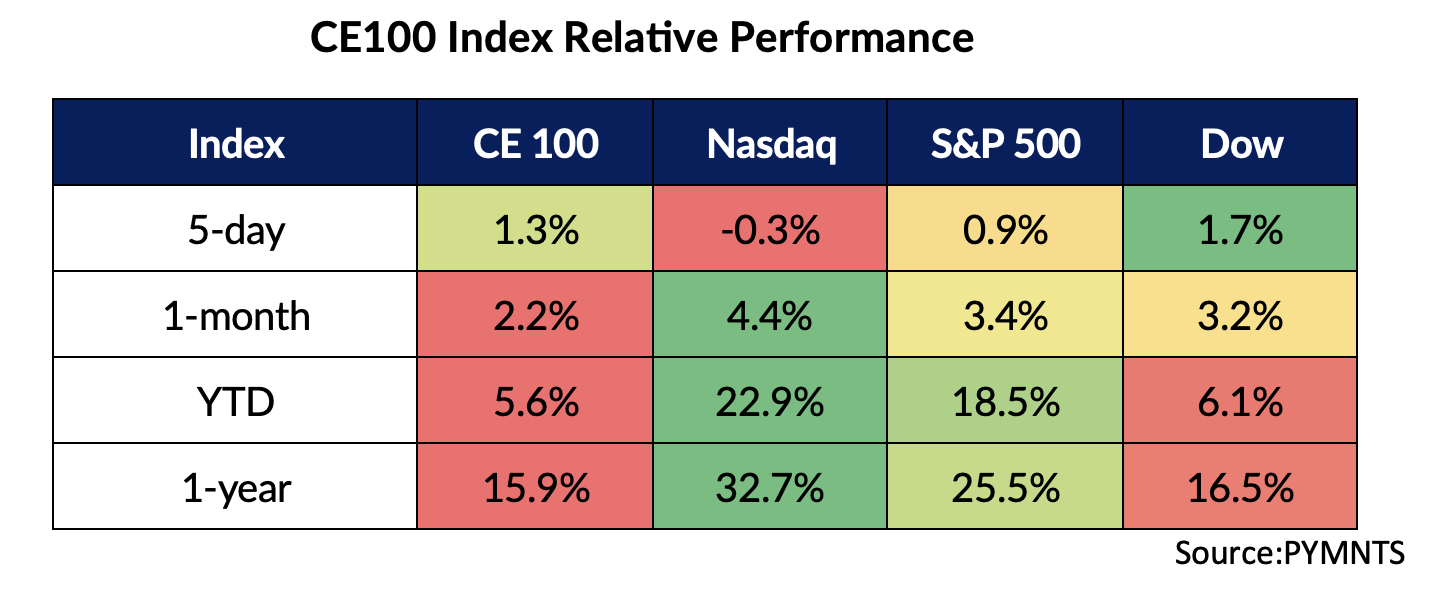

The scorecard thus far — as of the end of last week — is shown below, and shows that the CE 100 Index has been trailing its broader market brethren. The S&P 500 has among the largest “cut” of companies across a variety of industries, and is up 25% year to date. The tech-heavy NASDAQ Index is up nearly 33%, while the CE 100 Index is up about 16%.

The CE 100 Index is equal weighted, which means, arguably, that no one component has more of an outized effect than any other. By adopting equal weights, the CE100 Index summarizes the performance of diverse companies across the connected economy.

As to where things stand now, the Banking segment is up about 38% year to date, buoyed by the likes of JPMorgan, having added 45% his year alone, to date, Goldman, having added 41% and Citigroup, which tacked on 37% in 2024, as measured through last week.

As has been detailed in the most recent earnings reports, the banks have been the beneficiaries of strong consumer spending trends (on credit cards, especially). But there have been some pockets of weakness, particularly among lower income consumers.

The Pay and Be Paid segment is up a staggering 58% year to date, reflecting the digital, contactless, platform-based shifts that are leapfrogging in store and online channels. Buy Now, Pay Later’s a standout here, as Sezzle’s surged roughly 495% through 2024, followed by Affirm, up about 158%. The payment networks, including Mastercard and Visa, are up roughly 20% as 2024 enters the home stretch.

The Live segment exists as the only segment to have lost significant ground year to date, slipping 10%, as iRobot plunged after its takeover by Amazon was scuttled in the wake of increased regulatory scrutiny. The stock is down 70%.

There’s an old saying that Wall Street is a voting machine over the short term, and a weighing machine over the longer term.

The voting aspect might be likened to a popularity contest — where quarterly results are a quick litmus test for how companies are fairing. As a result, the stocks remain volatile. The weighing machine gives consideration to the long-term prospects of a company or a sector.

The long-term trend of the connected economy is a positive one. As has been detailed in separate PYMNTS Intelligence research, and specifically through “World Does Digital” report, which spans 11 countries, 97.3% of consumer surveyed engaged in at least one digital activity in a given month. But the granular insight indicates that there is significant room for improvement, given the fact that only 15% of consumers overall engaged in video streaming; 10.4% with online banking and about 6.4% with a restaurant’s website or app.