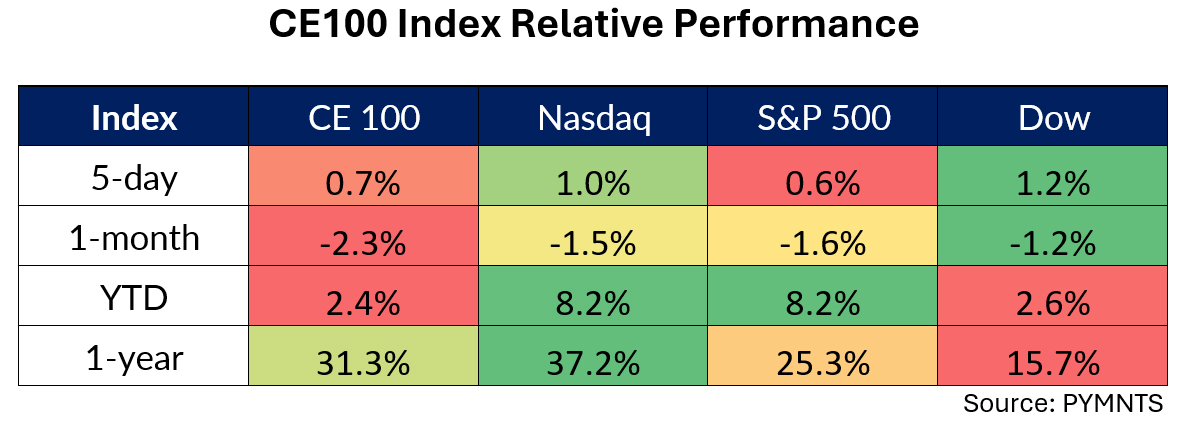

The CE 100 Index gained 0.7%, buoyed by continued earnings reports that boosted the fortunes of the Shop and Live pillars.

Shares of Koninklijke Philips N.V. (Philips) were 27.6% higher, as the Live segment of the CE 100 Index was 4.2% higher.

The company said comparable sales were 2% higher year over year, to 4.1 billion Euros, driven by the Diagnosis & Treatment and Personal Health segments. Diagnosis & Treatment comparable sales increased 3%. At the end of last month, the announcement came that Philips settled personal injury and medical monitoring claims in the U.S. for $1.1 billion.

iRobot followed, also boosting the Live sector, with a 21.1% gain. As reported this week, The Chair of the House Oversight Committee, Republican Representative James Comer, has announced an investigation into the Federal Trade Commission’s (FTC) involvement with the European Commission regarding Amazon.com’s failed attempt to acquire iRobot Corp in a $1.4 billion deal.

Comer expressed concerns that the FTC’s actions could harm America’s standing in the global personal robotics market while potentially benefiting foreign competitors, particularly those based in China.

Live Pillar Surges on Pinterest Gains

Pinterest shares gathered 19%. The company posted results that helped move the Shop pillar of the CE 100 Index 7.7% higher. Revenue was up 23% year over year in the period, to $740 million. Global Monthly Active Users increased 12% year over year to 518 million. Average revenue per user was up 10% year over year to $1.46 in the most recent quarter. The company expects second quarter revenue growth to be in the range of 18% to 20% year on year.

But Fastly shares plunged nearly 34%, while the Enablers segment lost 1.1%.

The company’s latest earnings notched total revenue of $133.5 million, representing 14% year-over-year growth. Network services revenue of $106.0 million, up 12% year-over-year. Current quarter guidance came in below expectations, as the guided range of $130 million to $134 million fell short of consensus estimates of more than $140 million.

Coursera shares gave up about 20%, leading the Work segment 1.9% lower.

In PYMNTS’ exploration of earnings-related puts and takes in the EdTech sector, Coursera reported a 15% increase in total revenue compared to the previous year.

However, despite this growth, lower-than-expected revenue forecasts for the second quarter sent shares lower.

The Pay and Be Paid segment was active with earnings, as the pillar sank 1.9%

As noted in our coverage this past week, Mastercard said in its most recent earnings report that worldwide gross dollar volume (GDV) increased by 10% year over year to $2.3 trillion. In the U.S., GDV increased by 6% to $712 billion with credit growth of 6% with credit growth of 12% and debit growth of 13%. Overall, cross-border volume increased 18% globally.

CEO Michael Miebach said that in terms of macroeconomic trends, the picture remains “mixed.” Solid wage growth is supporting healthy consumer spending, and inflation has been moderating. But rate cuts in the U.S. have been delayed. Mastercard is “monitoring … consumer balance sheet health.”

Mastercard shares were 3.9% lower through the week.

Visa shares were 2.2% lower. As reported here, Reem Finance, a financial services provider in the United Arab Emirates (UAE), has partnered with Visa to expand its offering of digital payment solutions.

Block shares slipped 6.7%. During the company’s most recent earnings results, the company’s $200 million investment in bitcoin grew by around 160% and stood at $573 million at the quarter’s end.

Square alone processed $50.5 billion in gross payment volume for the quarter, a 9% jump year over year.

The Cash App Card reached 24 million monthly actives, up 16% YoY, while Cash App Pay continued to grow during the quarter, with volume up more than 40% QoQ.