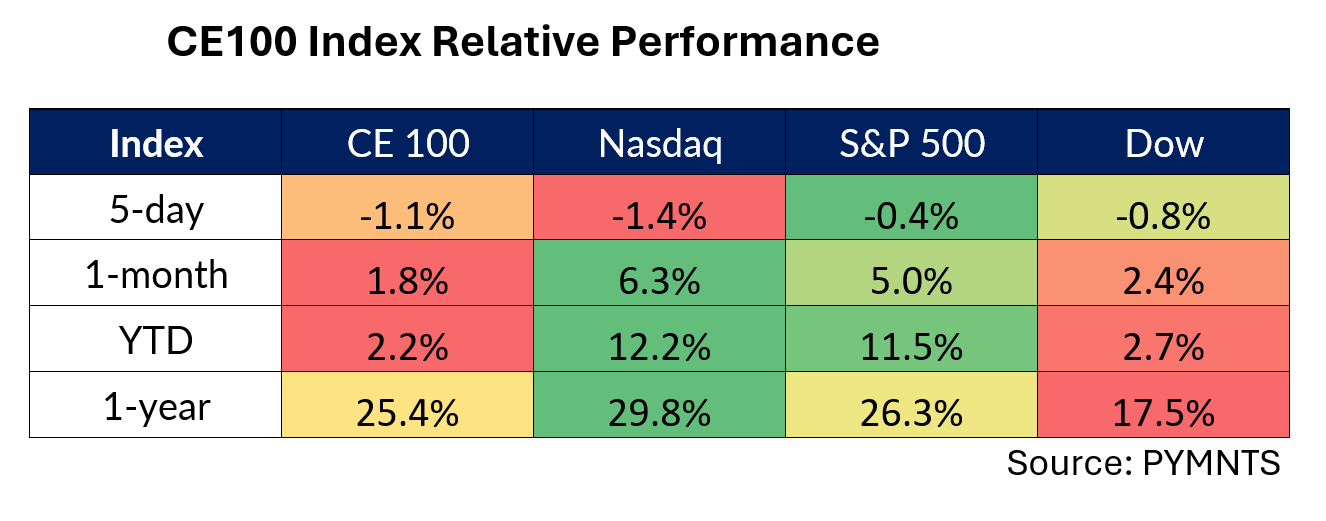

The CE 100 Index slipped 1.1%, as AI names were – to put it mildly – volatile in the wake of earnings reports.

MongoDB shares sank 32.5% and led the Enablers segment 2.6% lower in the holiday shortened trading week.

The shares plummeted after the company reported earnings that detailed first-quarter revenue growth of 22% year over year to $451 million. But that growth rate marked a significant slowdown from the roughly 57% top line increase that had been seen only a few quarters ago. Net losses expanded to more than $80 million from a bit more than $54 million last year.

“We had a slower than expected start to the year for both Atlas consumption growth and new workload wins, which will have a downstream impact for the remainder of fiscal 2025,” MongoDB’s president and CEO Dev Ittycheria said in the most recent earnings release.

Salesforce shares gave up 13.9% as the Work segment lost 4.6%. The company reported earnings this past week that saw revenues increase by 11% to $9.1 billion, while subscription revenues were up a bit more than that, at 12%, to $8.6 billion. Forward-looking guidance disappointed investors, as management said that the current fiscal year’s second quarter growth will come in at between 7-8% and full year subscription and and support revenue growth will come in at roughly 10%.

DraftKings lost 13.9% as the Have Fun segment slipped 1.4%. As widely reported, the Illinois Senate passed legislation this past week boosting taxes on sports betting, where the tax rates could be as high as 40% from a current 15% level.

Elsewhere, and turning attention to positive performers, while demonstrating the volatility in the AI space, C3.ai soared 23.1%.

As reported this past week, the enterprise-focused AI software firm posted strong growth in its subscription business, which accounted for 92% of the consolidated top line. Total revenues gained 20% year over year to $86.6 million, while subscription revenues surged 41%.

The federal defense and aerospace sector proved to be a significant growth driver for C3.ai, accounting for approximately 50% of its bookings in the fourth quarter, as we reported. Over the past year, the company closed 65 agreements with federal agencies and made inroads with ten new federal organizations in Q4.

Looking ahead, C3.ai expects revenue growth to accelerate to approximately 23% in fiscal year 2025.

Sezzle gained 15.8%, continuing to ride a wave of momentum in the wake of its announcement of an expanded relationship with Celerant Technology. Celerant now enables the users of its eCommerce platform to offer their customers buy now, pay later (BNPL) options when checking out in-store as well as online.

The company has implemented additional integration functionalities with Sezzle to allow these options at the point of sale, in-store, Celerant said earlier in the month. The two companies had already partnered to offer BNPL options online, having launched that collaboration in April 2023.

Peloton shares gathered 15.6%, retracing at least some of the company’s recent stock slides. The company announced that it completed a “holistic refinancing that reduced overall debt, extended debt maturities and achieved more flexible loan terms.” The refinancing included a new $1 billion five-year term loan facility.