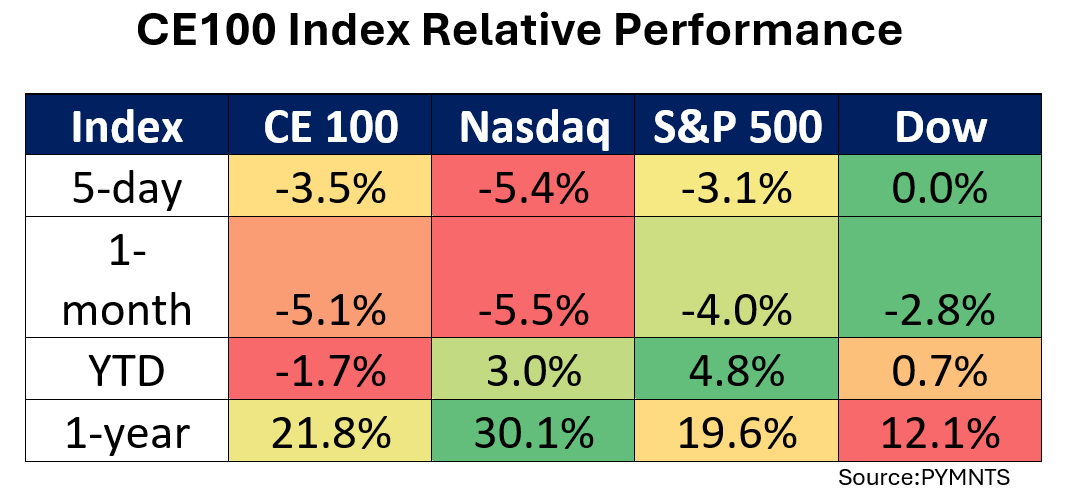

The CE 100 Index gave up 3.5% for the week as earnings season began in full swing.

Stock market gains were few and far between. The banking group eked out a 1% gain.

Goldman Sachs shares were up 3.8%. The company reported earnings that got a boost from Wall Street-related activities. During the conference call with analysts, CEO David Solomon said that capital markets-related activity has been robust as “CEOs need to make strategic decisions for their firms, companies of all sizes need to raise capital and financial sponsors need to transact to generate returns for their investors.”

The reopening of the capital markets, he said, remains in its “early stages.” Refinancing activity has also been strong, he said.

Drilling down into the Platform Solutions business, revenues were $698 million in the most recent quarter, up 24% year on year, and the segment’s pre-tax net loss was $117 million for the quarter. Credit card loans on the books were $19 billion in the most recent quarter, unchanged from the end of the year. The net charge-off rate on consumer loans was 8.4%, which is higher than the 7% rate that had been detailed for the fourth quarter.

United Healthcare was up 14%, but the “Be Well” segment of the CE 100 Index declined by 1.2%. The company reported that sales grew 8.6% to $99.8 billion in the quarter. Operating costs of 14.1% included approximately 0.3% of the impact due to costs incurred to support the company’s direct response efforts against the Change Healthcare cyberattack.

But those gains were offset by Peloton’s 14.6% loss in the “Be Well” segment of the CE 100 Index. As PYMNTS detailed, Peloton has stopped offering an unlimited free membership tier that was once a key part of its growth strategy.

The free tier for the company’s app was added in May 2023 to attract new customers but was dropped within the last few weeks after failing to convert these new users into paid subscribers.

American Express was up 5.9%, but Sezzle’s 14.2% slide blunted that positive impact within the “Pay and Be Paid” pantheon. The segment was 3% lower on the week.

American Express said in its latest results that younger, affluent consumers are showing notable resilience when it comes to spending on experiences and travel — and using their credit cards to do so. Amex said the majority of its account openings have been from Gen Z and millennial consumers. U.S. consumer billed business, which represents cardmember spending tied to transactions and card advances, was up 8% year on year, to $153 billion in the first quarter.

Spending on goods and services grew by 8% and on travel and entertainment by 8% as well. Millennial and Gen Z spending was up 15% — far outpacing other cohorts where spending growth was up in the high single digits.

Elsewhere, Tesla shares gave up 14%, dragging the “Move” vertical down by more than 5%. The company has cut prices for vehicles sold in the U.S., including the Model Y, Model X and Model S, by as much as $2,000 per vehicle.

“Affordability is key to our mission,” Tesla North America said in a post that debuted on X last week. X is, of course, the social media platform owned by Musk.