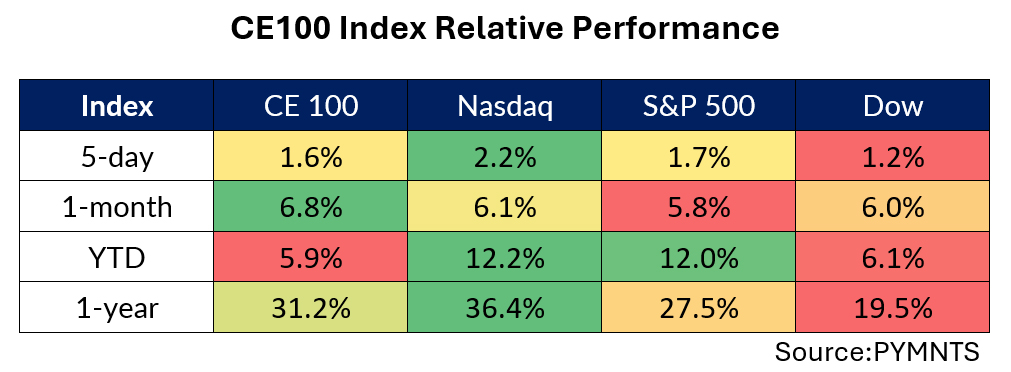

The CE 100 Index gathered 1.6% in a week that saw nine of the 10 pillars gain ground.

The lone pillar to decline was the Move segment, which gave up 0.9%.

As has been seen with past weeks, earnings reports were dominant in the headlines.

In the Pay and Be Paid segment of the CE 100 Index , which was 0.9% higher, Tencent shares were up 15.5%.

Tencent posted earnings this past week, detailing that consolidated revenues of 159.5 billion Chinese yuan (RMB) were 6% higher than last year. Revenues from Online Advertising were RMB26.5 billion for the first quarter of 2024, up 26% year-on-year, the company said. Revenues from the FinTech and Business Services segment increased by 7% year-on-year to RMB52.3 billion from last year. Video Accounts’ total user time spent increased over 80% year-on-year, the company noted. International games’ revenues was 3% higher in the most recent period.

Sezzle shares offset those gains in the payments vertical, slipping 20.1%. As reported this past week, Celerant Technology now enables the users of its eCommerce platform to offer their customers buy now, pay later (BNPL) options when checking out in-store as well as online. The company has implemented additional integration functionalities with Sezzle to allow these options at the point of sale, in-store.

The two companies had already partnered to offer BNPL options online, having launched that collaboration in April 2023.

As with the eCommerce solutions, the BNPL options that retailers can offer customers in their brick-and-mortar stores include “pay-in-2,” “pay-in-4” and longer-term financing options ranging from three months to 48 months, the companies said.

The Enablers segment was 3% higher through the week.

Within that group, Vodafone shares were higher by 12.5%. The company reported that group service revenue increased by 6.3%, with Europe, Africa and Business all growing through fiscal year 2024. B2B revenues were 5% higher through the same period.

Porch Group shares slid 10.5%, continuing its trend of volatile trading in the wake of earnings that were disclosed earlier in the month. As we noted after those earnings were disclosed, Porch reduced its GAAP net loss to $13.4 million, down from $38.7 million in first quarter of 2023, and improved its adjusted EBITDA loss to $16.8 million, down from $21.9 million a year earlier.

The company attributed these improvements in part to the unique data provided by its software-as-a-service (SaaS) products used by inspection, mortgage and title companies.

Vroom shares gave up 10%. The company’s results showed that interest income was 49% higher, to $51 million. The company has substantially completed its eCommerce wind-down, according to corporate materials. Within the UACC segment, the adjusted EBITDA loss came in at $10.1 million, compared to a a negative $4.4 million in adjusted EBITDA loss last year.

Walmart added 6.7%, helping move the Shop segment 2.2% higher.

As PYMNTS detailed in its earnings coverage, Walmart reported better than expected Q1 earnings. By the numbers, Walmart’s Q1 results exceeded expectations with a 5.7% increase in sales and a 12.9% rise in adjusted operating profit, driven by unit growth and transaction counts across all segments. Comparable-store sales in the United States rose by 3.8%. eCommerce sales were up 22% in Q1. This growth is driven by store-fulfilled orders and marketplace sales. Walmart’s advertising business, Walmart Connect, experienced a 24% growth in Q1.

During the Q&A session of the earnings call, executives provided additional insights into the company’s performance and strategy. CFO John Rainey emphasized the company’s approach to managing gross margins: “We’re having a conversation inside the company about the fact that the composition of [gross margin] is changing … business mix is changing, which does change gross margin performance.”