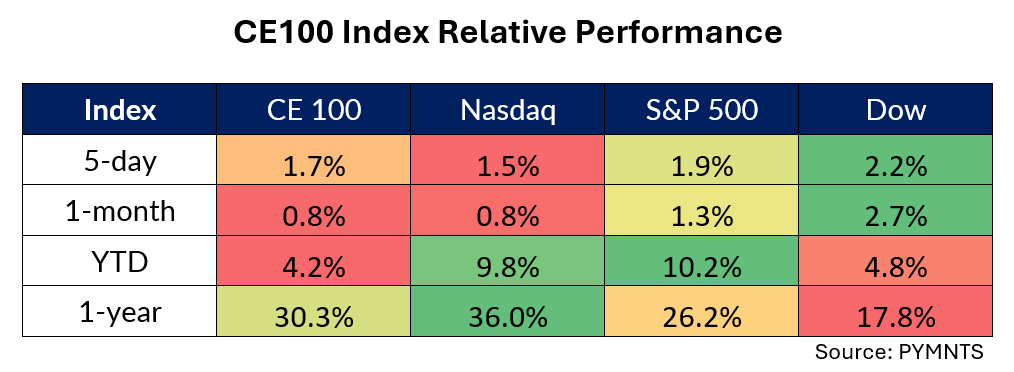

The CE 100 Index was up 1.7% through the past week, and earnings were the dominant theme across all pillars.

Pillar by pillar performance was mixed.

Within the Pay and Be Paid segment, which gained 7.7%, Sezzle surged 65.9%.

The company’s massive rally came on the heels of first quarter earnings, which detailed that the company added 229,000 subscribers to 371,000.

Repeat usage as a percentage of total cumulative orders was 95.6%. Quarterly purchase frequency was 1.5 times greater than had been seen a year ago. As a result, total income year over year (YoY) was 35.5% higher to $47 million.

Underlying merchant sales were 33.2% higher in the same period, to $492.7 million. The provision for credit losses was 1% as a percentage of underlying sales, compared to 1.7% at the end of last year.

Affirm lost 9.3% through the week, which offset at least part of Sezzle’s climb within the payments segment. As noted during our own coverage of earnings, Affirm saw its gross merchandise volume (GMV) surge 36% YoY to $6.3 billion.

The general merchandise category led the way with a 49% increase, followed by travel and ticketing at 35%. Direct-to-consumer GMV also experienced a significant boost, growing 49% YoY to reach $1.6 billion. Affirm’s active consumer base expanded by 13% YoY to 18.1 million, and its active merchant count rose 19% to 292,000. Total revenue grew 51% YoY to $576 million.

Elsewhere, Peloton gathered 22.9%, helping drive the Be Well segment 3.1% higher. As reported here, Peloton may be in the crosshairs of private equity firms considering a bid for the company.

At least one firm has talked with Peloton about going private, and a number of other firms have considered an acquisition but may or may not have talked with the company, according to media reports.

iRobot shares got a 19% boost as the Live segment was 2.8% higher.

The company announced that Gary Cohen will serve as the company’s new chief executive officer, effective immediately. He had previously held chief executive positions at Timex and Qualitor Automotive.

But Shopify shares sank nearly 21%, as the company posted first quarter results that indicated that, per guidance, company growth would slow to the high teens percentages. Those growth rates had previously been higher than 20%. Margins will also be pressured by higher expenses. Gross merchandise volume was up 23% YoY to $60.9 billion.

Roblox shares gave up 19.9% as the Have Fun vertical slipped 0.6%.

The company lowered its full-year bookings guidance to between $4 billion and $4.1 billion, down from $4.1 billion to $4.3 billion. Roblox’s average monthly unique payers was 15.6 million, up 13% YoY, and average bookings per monthly unique payer was $19.68, up 6% YoY.

Porch Group shares slid 9.6%. This past week, as PYMNTS reported, the company has sued China Construction Bank, alleging reinsurance fraud.

Airbnb shares were 8.4% lower through the week. In the most recent earnings report, management had said demand for international travel remains robust — enough so that the firm is looking ahead to a “record” summer season, tied to sporting events such as the Olympics.

But stable growth, forecast by management for the current quarter, sent shares lower.

CEO Brian Chesky said during the call that the 133 million nights booked marked the company’s highest first quarter in its history. Revenues of $2.1 billion were up 18% YoY. Active listings for accommodations grew 17% YoY overall. The average daily rate was $173 in the first quarter, up 3% and nights booked were up 9.5% YoY to 132.6 million, and a gross booking value was $22.9 billion.