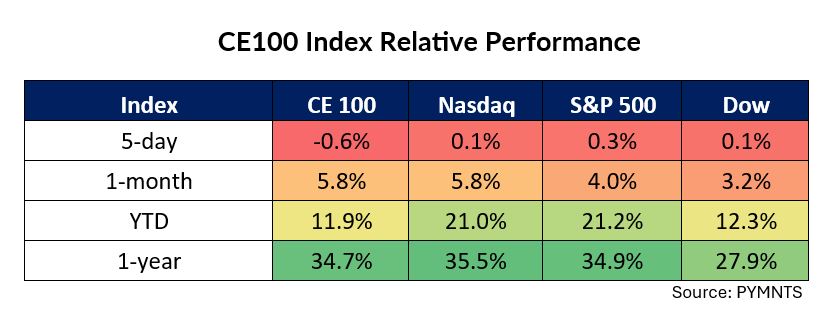

The CE 100 Index slipped 0.6% as October’s first few days of trading brought investors firmly into the fourth quarter while reversing some of the gains seen in the past few weeks.

The continuation of a trend — where Chinese names had led advancing issues through the past several sessions — was not enough to boost overall performance, as only three of the 10 pillars advanced through the past five sessions.

Indeed, this past week, Pinduoduo shares gained 13.9%, helping lead the Shop pillar of the CE 100 Index 3.4% higher. That segment also gained some momentum from investor enthusiasm over Vroom’s long-term strategic plan, documented here, as shares in that company gathered 17.4%. Tencent shares rallied 9.8%

Elsewhere, the “Be Well” pillar of the CE 100 Index was 0.2% ahead for the week, led by CVS, as the healthcare company’s shares surged by more than 5%.

As PYMNTS reported at the end of the month and into last week, the company is in the midst of a strategic overhaul, where it has hired advisors to conduct a strategic review and is laying off 2,900 employees.

J.P. Morgan’s stock was up 0.3% and the Banking segment was up 1.5% overall. The company has said that it wants to open about 100 branches in low-income communities. The new branches will feature the basics of banking — including tellers and ATMs — but also offer services for small businesses and host financial literacy workshops.

Nike lost 8%, as the Have Fun pillar of the CE 100 Index slipped 1.9%.

PYMNTS’s coverage of the athletic retailer’s latest quarter noted that “the consequences of its flawed direct-to-consumer (D2C) strategy continue to haunt Nike.” Fiscal 2025 Q1 revenues of $11.6 billion, down 10% year over year, were driven by declines across its segments.

Nike Direct revenues fell 13% to $4.7 billion, with a 20% drop in Nike Brand Digital sales, though a 1% increase in Nike-owned stores partially offset the decline. CEO Elliott Hill replaced John Donahoe last week, and CFO Matt Friend told analysts at the company’s conference call that “we continue to see opportunities to more profitably run our direct business,” in answer to an analyst’s question about the strategy.

Nike postponed any guidance for the balance of its fiscal year and expected similar revenue drops for the upcoming quarter as it has to revert to promotional pricing on many of its most iconic brands.

PayPal gathered 1.9% but was not enough to offset the Pay and be Paid segment’s relatively slight 0.6% loss for the week, which was driven in part by declines in the Buy Now, Pay Later names Sezzle, down 10%, and Affirm, which lost a bit more than 4%.

PayPal announced that it has reportedly completed its first business payment with its in-house stablecoin. The payment — PayPal did not disclose the amount — was to accounting giant Ernst & Young on Sept. 23 using PYUSD, the stablecoin the firm launched in 2023.

Mastercard’s 0.8% gain within that same segment came as Mastercard agreed to acquire subscription management service Minna Technologies. The deal aims to ease the frustration consumers feel when dealing with subscription services, as reported at the beginning of the month.

Visa shares were 1% higher, as the payments network said it had introduced a way for customers to tap the multi-trillion-dollar commercial payments market.

The Visa Commercial Solutions (VCS) Hub is designed to help financial institutions and businesses efficiently access a range of commercial payment solutions, “complementary capabilities and integrations into a range of FinTech services,” Visa said.

Nvidia’s stock was up by nearly 3%, as the Enablers segment of the CE 100 Index was off by 0.6%, and Samsung shares declined by 8.2%, overshadowing its peers.

Samsung’s share drop came this week as news came at the end of September that Epic Games is accusing Samsung and Google of a scheme to block their competition.

The maker of the popular Fortnite video game said it would sue the companies in federal court. The suit will contend that a Samsung mobile security feature known as Auto Blocker was designed to steer users away from downloading apps from places other than Google or Samsung. This behavior, Epic alleges, violates antitrust law by hindering consumer choice and preventing competition.

Nvidia, for its part, expanded its partnership with Accenture to help companies scale artificial intelligence adoption. The expanded joint efforts come as generative AI demand helped drive $3 billion in Accenture bookings in its latest fiscal year.