Who Bank Overdraft Fees Hurt Most

Overdraft protection is doing little to protect the best financial interests of young consumers and is forcing many to leave the banking system, Pew research has found.

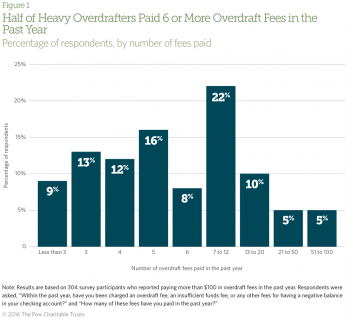

The research, which surveyed 304 “heavy overdrafters” in 2014, found that they were likely to incur about $35 per incident or over $100 per year in multiple overdraft charges by big banks. Over 22 percent of the surveyed base paid for an overdraft charge on seven to 12 occasions, according to Pew. These heavy overdrafters were mostly millennials and Gen Xers — two-thirds of whom paid the fee for an overdrawn debit card transaction.

On average, users paid around $24 in overdraft fees for debit withdrawals averaging $50, which is $11 less than the $35 median fee charged by the largest banks.

Among millennials, the group that was found likely to take a stronger hit from overdraft charges was students, as The New York Times pointed out. Many of the students receive their financial aid refunds from universities in newly opened bank accounts, which are more susceptible to overdraft charges spurred from less knowledge on terms of use or availability of funds.

While the Department of Education enforced new rules last year to prevent overdraft charges on accounts associated with financial aid, the rules have reportedly left out other campus-affiliated bank accounts that a student might be using for financial aid purposes.

While the Department of Education enforced new rules last year to prevent overdraft charges on accounts associated with financial aid, the rules have reportedly left out other campus-affiliated bank accounts that a student might be using for financial aid purposes.

The findings come on the heels of mounting pressure from the CFPB’s initiative to keep a check on overdraft fees. In February, the CFPB reported that 628 large banks reportedly pocketed $11.2 billion in revenue from overdraft fees, which equates to two-thirds of the banks’ earnings from deposit accounts and 8 percent of their net income.

The heightened oversight from the CFPB has also led numerous credit unions to panic. They have argued that any income they make off of overdraft fees is not obtained by predatory methods employed by other financial institutions.

Last month, the National Association of Federal Credit Unions (NAFCU) urged the CFPB to not take any actions that would jeopardize the future of overdraft protection. “Credit unions are unique, and their track record as good actors within the financial services industry proves they should not be grouped together with entities that the bureau seeks to restrict,” wrote NAFCU Executive Vice President Carrie Hunt.