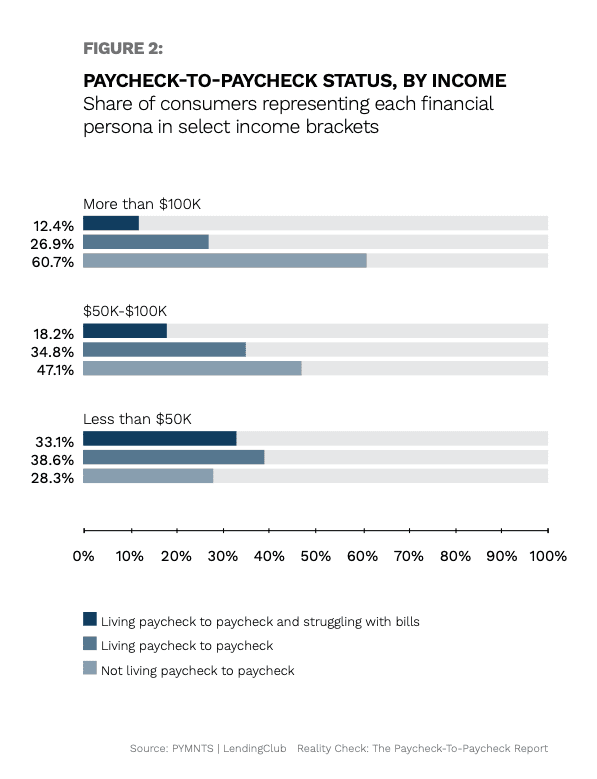

New research reveals that among those living paycheck to paycheck in America are higher earners — including many in the six-figure salary range — painting a landscape of consumer financial wellness in startling hues, casting a spotlight on a disquieting set of issues.

To get a handle on reasons why some consumers are barely making ends meet while others are far less pressured financially, PYMNTS is collaborating with LendingClub on Reality Check: The Paycheck-To-Paycheck Report, a series of market soundings based on periodic surveys of nearly 29,000 U.S. consumers conducted between March 2020 and May 2021.

There are hard truths in the data, with the June 2021 Impacts Of A Changing Economy edition of Reality Check finding that “54 percent of consumers in the U.S. have little or no money left over after spending their earnings. This means 125 million U.S adults are currently living paycheck to paycheck,” and noting that “a key distinction separates this massive population into two groups: whether consumers are typically able to pay their bills easily.”

With just over 60 percent of the paycheck-to-paycheck population capable of paying bills and having sufficient earnings remaining, “close to 40 percent struggle to keep up.”

A number of root causes are uncovered in Reality Check, giving innovators in the lending space food for thought as a post-pandemic economy continues along an bumpy road to recovery.

Contributing Factors And Root Causes

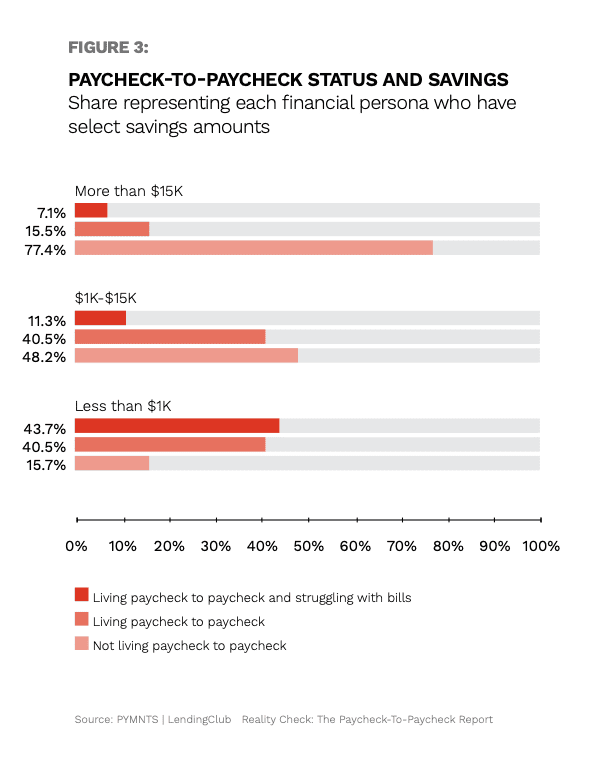

It’s been said for years — “American’s don’t save enough” — but the proof is in this new data, finding strong correlation between one’s savings cushion and the paycheck living experience.

According to Reality Check: The Paycheck-To-Paycheck Report, “Having savings inherently mitigates paycheck-to-paycheck challenges, ensuring consumers have resources for large, unexpected or discretionary purchases. Most Americans have limited savings, however: 70 percent of consumers have less than $15,000 in savings, and one-third of all consumers have less than $1,000. This modest financial cushion helps explain why such a large portion of the population lives paycheck to paycheck.”

COVID-era government stimulus disbursements brought numbers down drastically, but it’s looking more and more like a band-aid on underlying issues of paucity in U.S. savings.

By the numbers as of today, Reality Check data shows that 52 percent of consumers with savings of between $1,000 and $15,000 live paycheck to paycheck, “including 11 percent who have difficulty paying bills,” while fully 84 percent of those with less than $1,000 in savings live paycheck to paycheck, “and more than half of them struggle to pay their bills.”

Disorienting Demographics Of Paycheck-To-Paycheck Living

As would be expected, life choices shape the stats on paycheck living. For example, cohabitating (dual incomes) and having children have profound impacts on how far a paycheck goes, with June’s Reality Check noting that 64 percent of those living with children full-time live paycheck to paycheck, “and 28 percent who do so struggle to pay their bills,” while just 47 percent of respondents who do not live with children live paycheck to paycheck.

Marital and partnership status also plays a major role.

“Half of cohabitating couples live paycheck to paycheck, compared to 62 percent of those who are single and have never been married,” per the latest data. “Other differences in relationship statuses, such as whether one has never been married or is divorced, seem to have little bearing on whether one lives paycheck to paycheck.”

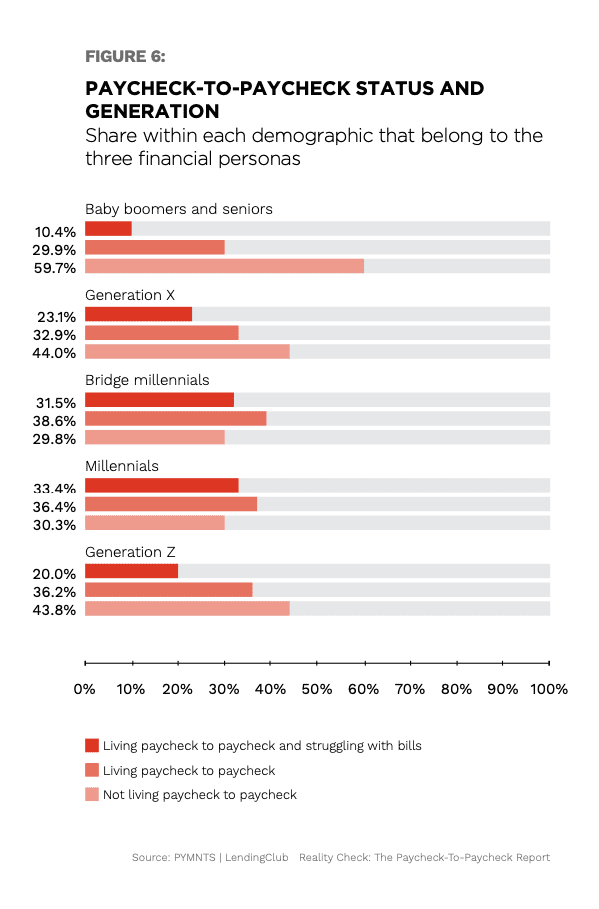

Demographics, as always, have a say. As regards paycheck-to-paycheck living, the new report notes that “millennials make up the largest share of consumers who live paycheck to paycheck: 70 percent are in this situation, and 33 percent struggle to pay their bills. The same pattern is found among bridge millennials — those 33 to 42 years old. Seventy percent this group live paycheck to paycheck, and 32 percent struggle to pay their bills.”