New PYMNTS Data Show Sharp Regional Variations In Disposable Income

A large number of American bridge millennials — consumers born between 1978 and 1988 — find themselves in unenviable financial positions. Many are at stages in life in which they are taking on various forms of debt, from student loans to sizable mortgages to college funds for their children. Largely as a result of these and other financial obligations, 29 percent of bridge millennials in the United States report living paycheck to paycheck.

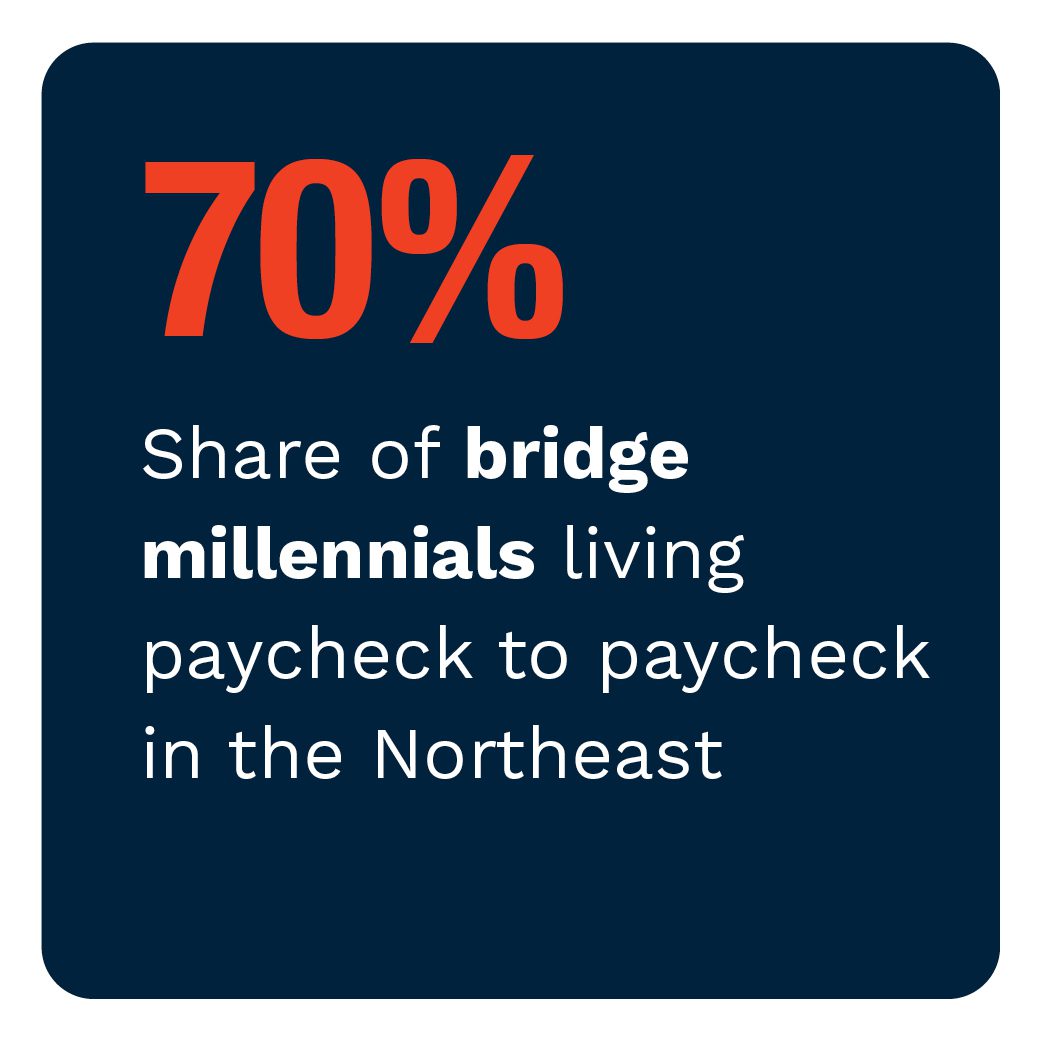

Bridge millennials in ce rtain regions can be particularly prone to facing precarious financial situations while juggling their expenses. Those in the Northeast, for example, must contend with relatively high costs of living, and because of this, bridge millennials in this region are 20 percent likelier to be living paycheck to paycheck than those in the Mountain states. In fact, 70 percent of Northeast consumers from this age bracket report living paycheck to paycheck, which equates to almost 6 million residents.

rtain regions can be particularly prone to facing precarious financial situations while juggling their expenses. Those in the Northeast, for example, must contend with relatively high costs of living, and because of this, bridge millennials in this region are 20 percent likelier to be living paycheck to paycheck than those in the Mountain states. In fact, 70 percent of Northeast consumers from this age bracket report living paycheck to paycheck, which equates to almost 6 million residents.

But bridge millennials are hardly the only generational group whose financial situation varies depending on where they live. The August edition of Reality Check: The Paycheck-To-Paycheck Report, a PYMNTS and LendingClub collaboration, examines just how dramatically U.S. consumers’ financial situations vary depending on where they live. PYMNTS surveyed 7,116 U.S. consumers in the second quarter of 2021 to learn more about their finances and to determine how many of those in different regions are living paycheck to paycheck.

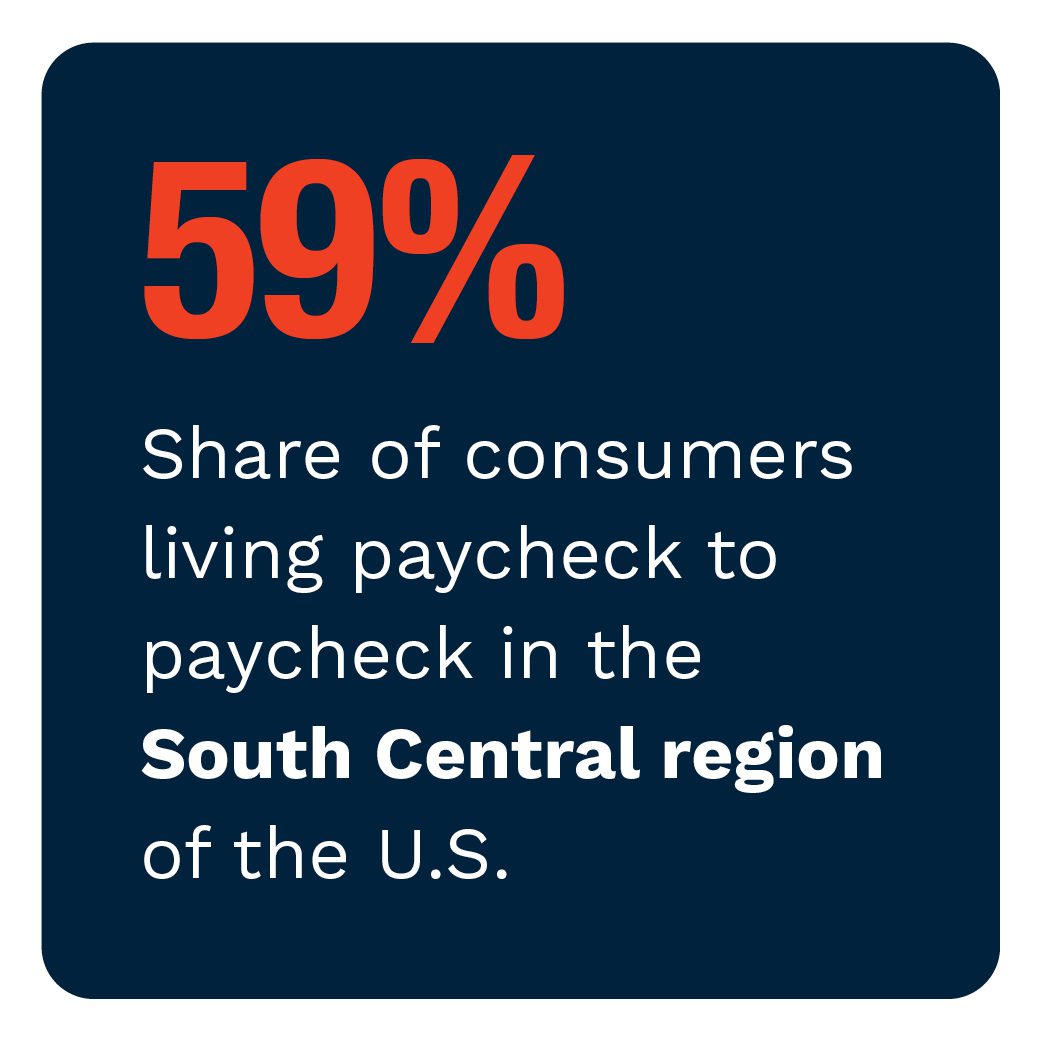

Whi le bridge millennials in the Northeast are likelier to be living paycheck to paycheck than those in other regions, PYMNTS found that living paycheck to paycheck is most common in the South Central region of the U.S. Almost 59 percent of South Central consumers live paycheck to paycheck, with Northeast consumers coming in second at 56 percent. Consumers in the Mountain region, meanwhile, were those least likely to report living paycheck to paycheck, at 49 percent.

le bridge millennials in the Northeast are likelier to be living paycheck to paycheck than those in other regions, PYMNTS found that living paycheck to paycheck is most common in the South Central region of the U.S. Almost 59 percent of South Central consumers live paycheck to paycheck, with Northeast consumers coming in second at 56 percent. Consumers in the Mountain region, meanwhile, were those least likely to report living paycheck to paycheck, at 49 percent.

There is also a noticeable divide between the share of consumers in metropolitan areas who live paycheck to paycheck compared to their rural counterparts. Sixty-three percent of consumers who live in metropolitan areas reported living paycheck to paycheck, while just 51 percent of rural consumers say the same. Cost of living is considered a key factor in this discrepancy, as consumers who live in cities and metropolitan areas often face much higher prices than those in rural or farming areas.

Interestingly, consumers with higher incomes are not necessarily out  of the woods when it comes to financial uncertainty, particularly in the Northeast. Forty-five percent of consumers in this region who earn more than $100,000 annually report living paycheck to paycheck, in fact, while 19 percent even say they struggle to pay their monthly bills. Cost of living is once again a major reason for this issue, as just 29 percent of high earners in the Mountain region say they are living paycheck to paycheck.

of the woods when it comes to financial uncertainty, particularly in the Northeast. Forty-five percent of consumers in this region who earn more than $100,000 annually report living paycheck to paycheck, in fact, while 19 percent even say they struggle to pay their monthly bills. Cost of living is once again a major reason for this issue, as just 29 percent of high earners in the Mountain region say they are living paycheck to paycheck.

These findings offer just a glimpse of the insights uncovered in our survey. To learn more, download the report.