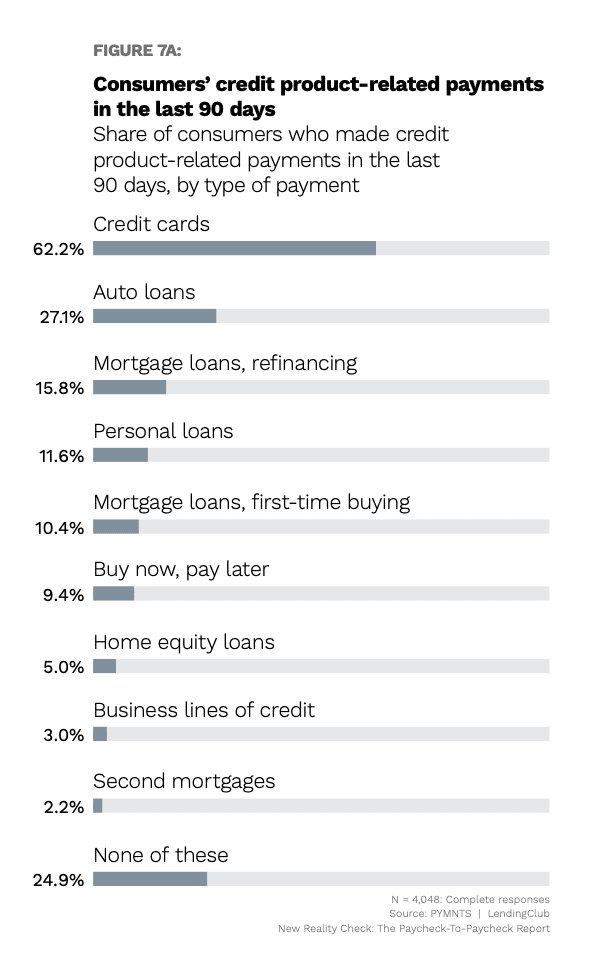

Credit cards are the most common credit products that U.S. consumers use.

In fact, 62% of consumers made credit card payments in the last 90 days, according to “The New Reality Check,” a PYMNTS and LendingClub collaboration based on a survey of 2,326 U.S. consumers.

Get the report: The New Reality Check

The next most common credit products are auto loans, mortgage loans (refinancing) and personal loans. The shares of consumers who made payments on those in the last 90 days are 27%, 16% and 12%, respectively.

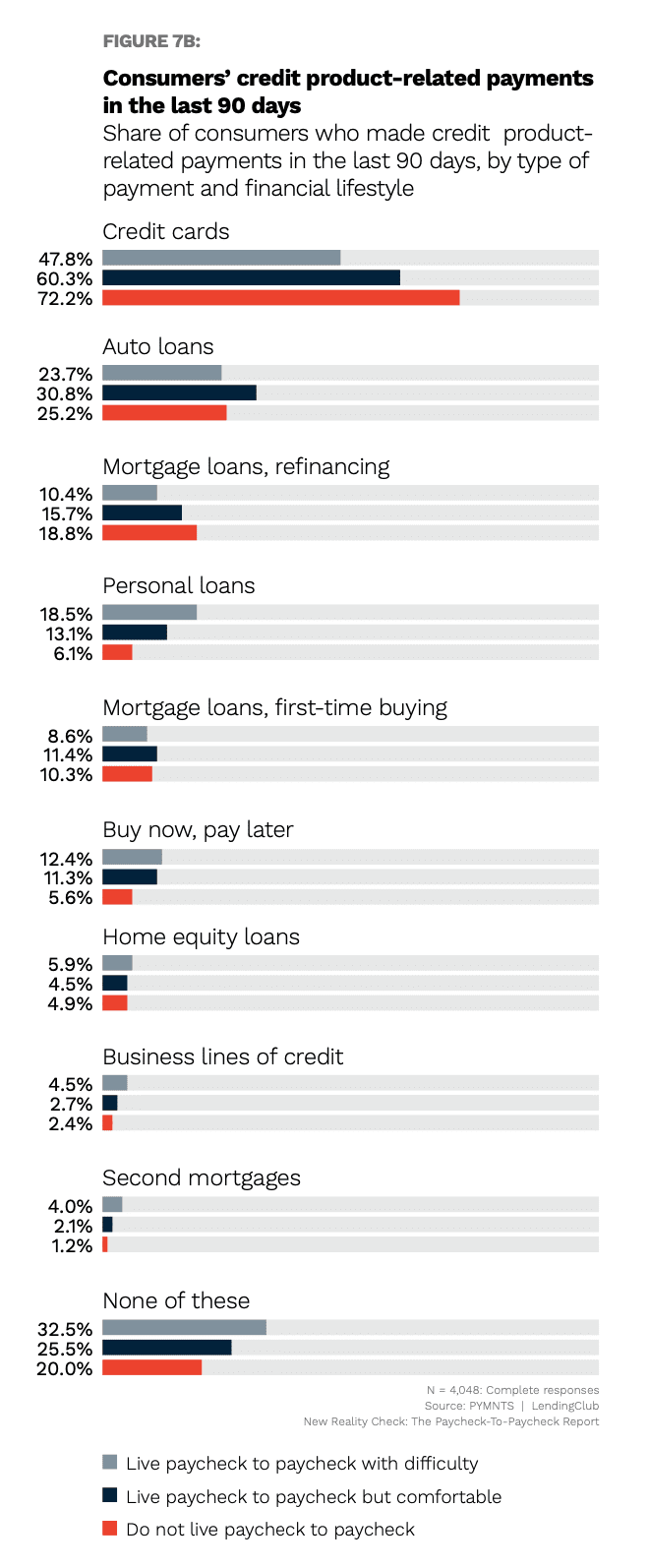

Among consumers who live paycheck to paycheck with difficulty, the credit products that are especially popular are credit cards, auto loans, personal loans and buy now, pay later (BNPL). The shares of these consumers who made these payments in the last 90 days are 48%, 24%, 19% and 12%, respectively.

For those who live paycheck to paycheck, but comfortably, the top four credit products are credit cards, auto loans, mortgage loans (refinancing) and personal loans, with 60%, 31%, 16% and 13%, respectively, reporting that they made these payments in the last 90 days.

Advertisement: Scroll to Continue

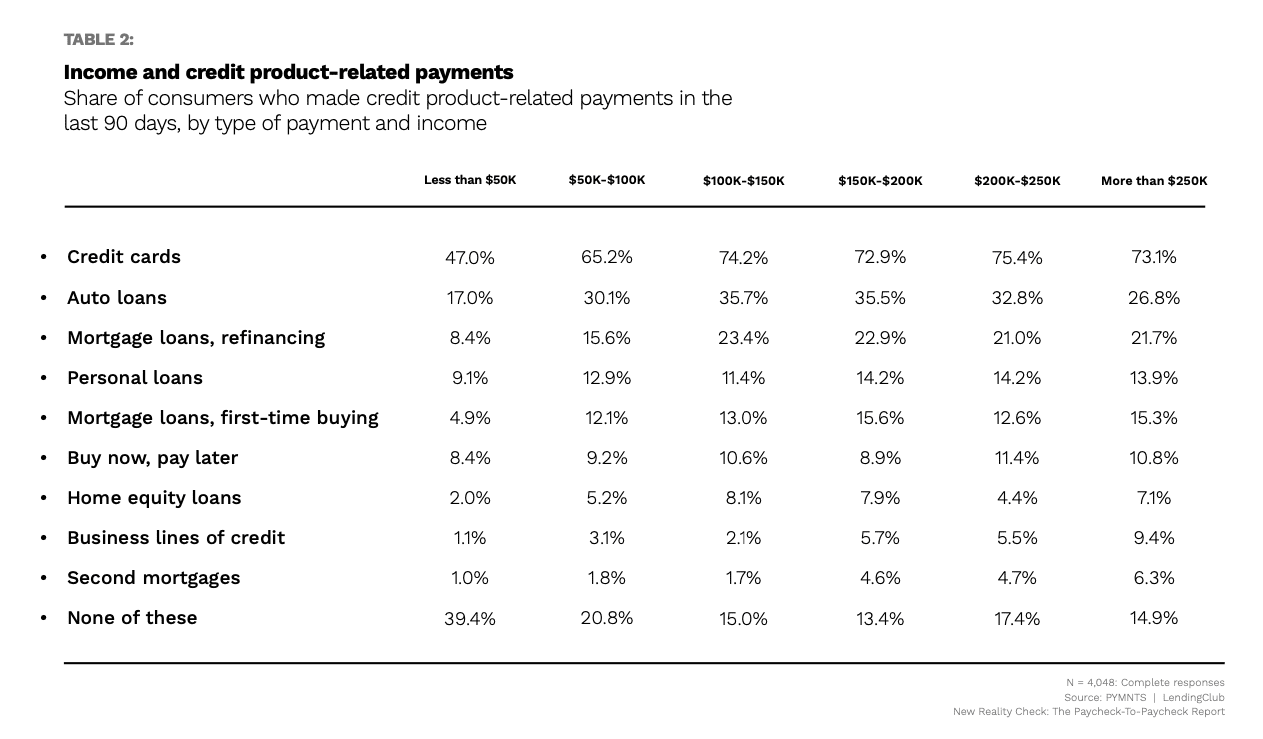

Some different credit products are commonly used by consumers of different income levels.

Among those earning less than $50,000 in annual income, the most popular credit products are credit cards, auto loans, personal loans and mortgage loans (refinancing). The shares of these consumers who made payments on these products in the last 90 days are 47%, 17%, 9% and 8%.

For consumers earning more than $250,000 in annual income, the most popular credit products are credit cards, auto loans, mortgage loans (refinancing) and mortgage loans (first-time buying), with 73%, 27%, 22% and 15%, respectively, reporting that they made these payments in the last 90 days.

Credit products are a cash flow management tool for paycheck-to-paycheck consumers — especially those in higher income brackets, PYMNTS found.