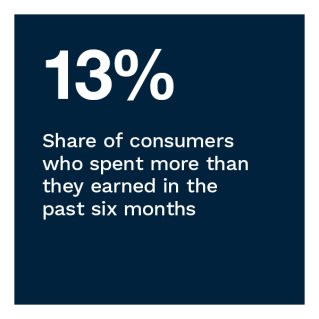

Inflation Bites as 13% of US Consumers Spent More Than They Earned in Last Six Months

As inflation continues its upward swing, consumers worldwide are finding it more difficult to manage spending and put aside savings under mounting financial pressures. In June 2022, 61% of United States consumers were living paycheck to paycheck, a 5.5 percentage-point increase from June 2021. We also found that 36% of consumers annually earning $200,000 or more reported living paycheck to paycheck in June 2022, a 6 percentage-point increase from 30% in May 2022. Meanwhile, nearly one-quarter of U.S. consumers now live paycheck to paycheck with issues paying their bills.

As inflation continues its upward swing, consumers worldwide are finding it more difficult to manage spending and put aside savings under mounting financial pressures. In June 2022, 61% of United States consumers were living paycheck to paycheck, a 5.5 percentage-point increase from June 2021. We also found that 36% of consumers annually earning $200,000 or more reported living paycheck to paycheck in June 2022, a 6 percentage-point increase from 30% in May 2022. Meanwhile, nearly one-quarter of U.S. consumers now live paycheck to paycheck with issues paying their bills.

PYMNTS’ research also found that 13% of all consumers — an estimated 33.5 million individuals — spent more than what they earned in the past six months, up from 12% in May 2022. Having little money left over after monthly bills makes it harder for consumers to cover discretionary spending and maintain or grow their savings. Average savings among all consumers dropped 8%, from $11,724 in May 2022 to $10,757 in June.

These are just some of the findings detailed in the “New Reality Check: The Paycheck-To-Paycheck Report: The Consumer Savings Edition,” a PYMNTS and LendingClub collaboration. The Consumer Savings Edition examines the financial lifestyle of U.S. consumers who live paycheck to paycheck, the factors causing them financial distress and the impact of financial stressors on their ability to manage expenses and put aside savings. The series draws on insights from a survey of 3,583 U.S. consumers conducted from June 8 to June 27, as well as analysis of other economic data.

More key findings from the study include:

• Four out of 10 paycheck-to-paycheck consumers with issues paying monthly bills spent more than they earned in the past six months.

• Four out of 10 paycheck-to-paycheck consumers with issues paying monthly bills spent more than they earned in the past six months.

PYMNTS’ research found that the share of consumers spending more than their income in the six months prior to being surveyed rose to 13% in June 2022, up one percentage point from 12% in May 2022. Financial struggle, or issues paying monthly bills, is strongly correlated with overspending, with as many as 40% of paycheck-to-paycheck consumers with issues paying their bills reporting that they spent more than they earned in the past six months. Just 10% of those living paycheck to paycheck without issues paying their bills spent more than their income, while just 2.6% of consumers not living paycheck to paycheck consumers spent more than they earned.

• Paycheck-to-paycheck consumers are more likely to prioritize easy access to funds when choosing where to hold their savings, keeping an average of 70% of their money in banks, digital wallets or cash.

When deciding how to save, the average consumer has half of their available savings stored in a bank or digital wallets such as PayPal or Venmo. However, among paycheck-to-paycheck consumers with issues paying their bills, 77% keep their available savings stored in a fashion that allows immediate access, such as bank accounts, wallets and cash. This share decreases to 68% among those without issues paying bills and 58% among those not living paycheck to paycheck. While financially struggling consumers are more likely to have cash holdings, those not living paycheck to paycheck store $2 out of every $10 in education or retirement funds.

• While quick access is the dominant factor influencing savings preferences among paycheck-to-paycheck and lower-income consumers, the preference for diversified portfolios increases significantly among high-income consumers.

Thirty-one percent of consumers annually earning more than $200,000 said having a diversified portfolio is the most important reason for choosing how they store their savings, compared to just 8.7% of those earning less than $50,000 per year. Also, 22% of consumers not living paycheck to paycheck cited a diversified portfolio as the most important factor when choosing where to save, while just 12% of those living paycheck to paycheck without issues paying bills and 7.5% of those living paycheck to paycheck with issues paying bills said the same.

Recent stock market volatility and inflation have made easy access to funds more of a priority for financially struggling consumers than for those with higher incomes who may be more able to have a longer-term horizon on their savings portfolios.

To learn more about how inflation impacts consumer savings, download the report.