Mounting inflationary pressures continue to weigh on United States consumers’ economic prospects, even as pandemic restrictions continued to lift in late March 2022. The U.S. government reported that inflation climbed to 8.5% in the past 12 months, with energy and food prices experiencing the most significant increases.  With inflation still on the rise, consumers of all income brackets are feeling the financial crunch, increasing the share of consumers living paycheck to paycheck.

With inflation still on the rise, consumers of all income brackets are feeling the financial crunch, increasing the share of consumers living paycheck to paycheck.

Recent PYMNTS research finds that 64% of consumers lived paycheck to paycheck in March, a two-percentage-point increase from 62% in February. Additionally, 49% of Americans earning more than $100,000 per year were living paycheck to paycheck in March, a slight decrease from 50% in the prior month. Living paycheck to paycheck means devoting all of one’s salary to expenses with little to nothing left over at the end of the month. Despite this, these consumers remain creditworthy, actively managing their cash flows in real time. Close to one-quarter of consumers living paycheck to paycheck report a credit score higher than the FICO average of 750.

These are just some of the findings to emerge from New Reality Check: The Paycheck-To-Paycheck Report, a PYMNTS and LendingClub collaboration. The Credit Edition examines the growing shares of U.S. consumers in all economic brackets living paycheck to paycheck and the impact on their ability to access credit and other expense management tools. The series draws on insights from a survey of 2,326 U.S. consumers that was conducted from March 9 to March 11, as well as an analysis of other economic data.

More key findings from the study include:

• In March 2022, 49% of consumers earning more than $100,000 per year reported living paycheck to paycheck, a slight decrease from 50% in February. The share of those earning between $50,000 and $100,000 who reported living paycheck to paycheck also decreased to 63% in March from 65% in February. Meanwhile, the share of those earning less than $50,000 who live paycheck to paycheck rose to 82% from 80% in the same time frame.

• Consumers living paycheck to paycheck average “fair” to “good” credit scores. Paycheck-to-paycheck consumers without issues paying their bills have an average credit score of 694, while those struggling to pay bills each month have a below-average credit score of 613. The average credit score for all paycheck-to-paycheck consumers is 664, more than 90 points below the average for consumers not living paycheck to paycheck.

• Consumers living paycheck to paycheck average “fair” to “good” credit scores. Paycheck-to-paycheck consumers without issues paying their bills have an average credit score of 694, while those struggling to pay bills each month have a below-average credit score of 613. The average credit score for all paycheck-to-paycheck consumers is 664, more than 90 points below the average for consumers not living paycheck to paycheck.

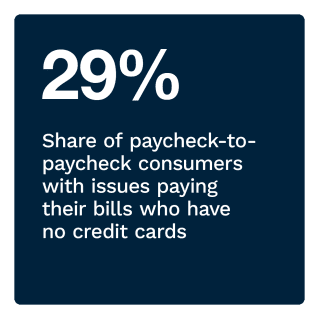

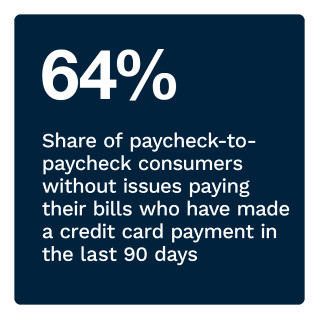

• Paycheck-to-paycheck consumers are three times as likely to revolve credit card debt and carry higher monthly balances overall. Among cardholders living paycheck to paycheck, 34% of those without issues paying monthly bills and 47% of those who struggle to pay their bills “always” or “usually” have a revolving balance. Just 12% of consumers not living paycheck to paycheck “always” or “usually” revolve credit.

To learn more about how paycheck-to-paycheck consumers of different income brackets are faring in today’s changing economic times, download the report.