New Study: 60% of US Consumers Have Cut Spending Due to Inflation

With inflation reaching a 40-year high in June, nearly all consumers report noticeable increases in the cost of everyday purchases. PYMNTS’ research finds that 92% of consumers have noticed higher product prices, while 74% saw increases in their monthly bills. Consumers across all income levels cited increases in products or bills at similar rates, but financially struggling consumers were more likely to consider such increases to be widespread and distressing.

As a result of such inflationary pressures, in August 2022, 60% of United States consumers were living paycheck to paycheck, and close to one-quarter of U.S. consumers now live paycheck to paycheck and also struggle to pay their bills.

Despite the financial challenges, many paycheck-to-paycheck consumers are doing what they can: Our data finds that 60% of consumers say inflation has altered how they manage their finances, with many tapping credit products to make things work.

These are just some of the findings detailed in this edition of “New Reality Check: The Paycheck-To-Paycheck Report,” a PYMNTS and LendingClub collaboration. The Inflation Edition examines the financial lifestyle of U.S. consumers who live paycheck to paycheck and explores how inflation impacts their spending. The series draws on insights from a survey of 3,495 U.S. consumers that was conducted from Aug. 10 to Aug. 29, 2022, as well as analysis of other economic data.

More key findings from the study include:

More key findings from the study include:

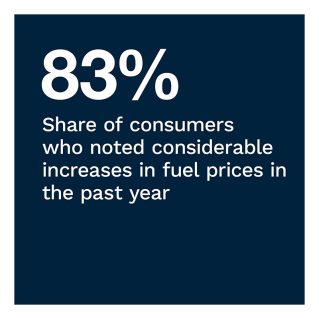

• The rising costs of fuel and groceries are significant to huge swaths of the population.

We asked consumers to share how considerable price increases were to them. Although between one-third and one-half of consumers reported significant price increases for most categories, 83% cited significant increases in fuel prices, and 69% said the same about grocery purchases. Also notably high were the shares noting significant increases in the costs of home improvement and garden supplies, at 55%, and food from restaurants, at 51%.

• Financially struggling consumers are facing tough choices regarding their monthly bills. Utility, entertainment and insurance are the top bills paid by all consumers, yet those living paycheck to paycheck and having issues paying bills are less likely to pay these. In fact, rent and mortgage is the only expense more likely to be paid by paycheck-to-paycheck consumers than those not living paycheck to paycheck. Health insurance also shows the strongest differential between financially struggling consumers and those of other financial lifestyles. While less than half of consumers living paycheck to paycheck with issues paying bills paid for health insurance, 64% of consumers not living paycheck to paycheck and 59% of consumers living paycheck to paycheck without difficulty paid health insurance bills.

• Most consumers have not noticed changes to the interest rates of credit products, even though consumers are increasingly using credit while tightening budgets. PYMNTS’ research finds that significant shares of consumers living paycheck to paycheck have used credit products in the last 90 days. Credit cards top the list: 67% of those living paycheck to paycheck without issues paying bills and 51% of those living paycheck to paycheck with issues paying bills report that they made credit card payments in the last 90 days. Mortgages are the second most common credit product used by paycheck-to-paycheck consumers. Thirty-one percent of those living paycheck to paycheck without issues paying bills and 27% of those living paycheck to paycheck with issues paying bills made a mortgage payment in the last 90 days.

As living costs are on the rise, consumers of all financial lifestyles find it increasingly difficult to make ends meet. With inflation expected to continue, it will likely press consumers even further, and time will tell how well they adapt.

To learn more about how inflationary pressures impact paycheck-to-paycheck consumers, download the report.