Report: 36% of Consumers Earning $250K+ Now Live Paycheck-to-Paycheck

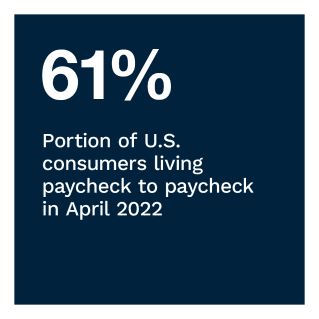

With inflation driving up costs everywhere, consumers in all income brackets — including those who make more than $250,000 annually — live paycheck to paycheck. PYMNTS’ research finds that 61% of U.S. consumers lived paycheck to paycheck in April 2022, a nine percentage-point increase from 52% in April 2021.  This increase means approximately three in five U.S. consumers devote nearly all their salaries to expenses with little to nothing left over at the end of the month.

This increase means approximately three in five U.S. consumers devote nearly all their salaries to expenses with little to nothing left over at the end of the month.

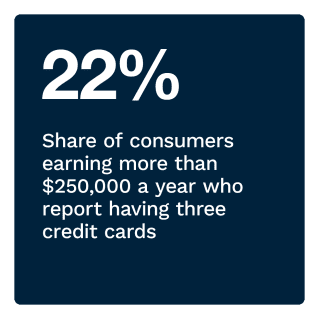

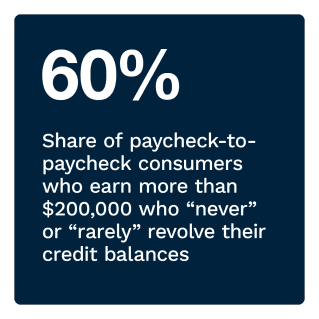

Our data also reveals that slightly more than one in three consumers annually earning $250,000 or more currently live paycheck to paycheck. These top-earning consumers handle their financial lifestyles in interesting ways, however, as they are associated with stronger credit scores and more intense credit usage and are likely to moderate their cash flows. Those earning more than $250,000 are 40% more likely to use financial products than consumers in the lowest bracket, and as many as 63% of them have an above-average credit score exceeding 750 points.

These are just some of the findings to emerge from this edition of New Reality Check: The Paycheck-To-Paycheck Report, a PYMNTS and LendingClub collaboration. The High Earners Edition examines the financial lifestyle of the growing share of high-income U.S consumers who live paycheck to paycheck and the impact on their ability to access credit and other expense management.  The series draws on insights from a survey of 4,048 U.S. consumers conducted from April 6 to April 13, as well as an analysis of other economic data.

The series draws on insights from a survey of 4,048 U.S. consumers conducted from April 6 to April 13, as well as an analysis of other economic data.

More key findings from the study include:

• Close to two-thirds of the U.S. population — approximately 157 million adults — currently live paycheck to paycheck, making it the main financial lifestyle in the U.S. Though lower incomes generally correlate with financial distress, 36% of consumers who annually earn $250,000 or more live paycheck to paycheck. Our data finds that, in April 2022, 36% of consumers earning $100,000 to $150,000, 31% earning $150,000 to $200,000, 26% earning $200,000 to $250,000 and 24% earning more than $250,000 were living paycheck to paycheck without issues paying their bills. Between 10% and 12% of consumers in these higher-income brackets lived paycheck to paycheck with issues paying their bills in April 2022.

• Credit scores strongly correlate with income, yet one-third of those earning more than $250,000 report average or below-average credit scores. PYMNTS’ research finds that consumers’ average credit scores tend to increase by income: 63% of those earning more than $250,000 a year report having an above-average credit score. The average credit score for these respondents is 758. Yet, our data also finds that 18% of consumers earning more than $250,000 a year report having an average credit score, while 13% report having a below-average credit score.

Yet, our data also finds that 18% of consumers earning more than $250,000 a year report having an average credit score, while 13% report having a below-average credit score.

• Consumers earning more than $250,000 are 40% more likely to engage with financial products than consumers in the lowest income bracket. Credit products are a cash flow management tool for paycheck-to-paycheck consumers, especially those in higher income brackets. Approximately three-quarters of consumers earning more than $100,000 have made a credit card payment in the past three months, with those earning between $200,000 and $250,000 the most likely to do so. Higher-income consumers also have made a personal loan payment at an above-average rate of 14%.

To learn more about how paycheck-to-paycheck consumers in the top income brackets are faring in today’s changing economic times, download the report.