Though the immediate threat of the pandemic began to thaw in late February in the United States, mounting inflationary risks weighed on consumers’ economic prospects. The U.S. government reported that inflation climbed to 7.9% in the past 12 months, with energy and food prices experiencing the most significant increases. These inflationary pressures impact consumers of all income brackets, increasing the share of those living paycheck to paycheck.

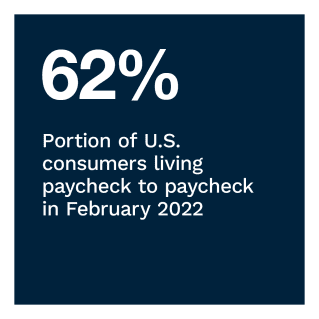

Recent PYMNTS research found that 62% of consumers lived paycheck to paycheck this February, a slight drop from 64% in January. After witnessing an uptick in the last two months of 2021 into early 2022, the share of consumers living paycheck to paycheck has eased to levels just above those seen in December 2021. Consumers in urban areas, however, are more likely to live paycheck to paycheck, and the wealthiest consumers comprise a growing share.

These are just some of the findings from New Reality Check: The Paycheck-To-Paycheck Report, a PYMNTS and LendingClub collaboration. The Regional Divide Edition examines the growing shares of consumers living paycheck to paycheck in urban, suburban and rural areas of the U.S. and the impact on their ability to both build savings and afford emergency expenses. The series draws on insights from a survey of 3,250 U.S. consumers conducted from Feb. 7 to Feb. 14, as well as analysis of other economic data.

More key findings from the study include:

More key findings from the study include:

• The share of paycheck-to-paycheck consumers earning more than $100,000 rose by two percentage points to 50%, and more consumers in lower income brackets are also living paycheck to paycheck. Thirty-seven percent of consumers earning more than $100,000 per year, 44% of consumers earning $50,000 to $100,000 and 42% of those earning less than $50,000 reported living paycheck to paycheck without issues paying their bills in February. Ten percent of consumers who earn more than $100,000 reported living paycheck to paycheck with issues paying their bills in February. This rate is significantly higher among those in the middle-income bracket (18%) and those earning less than $50,000 (36%).

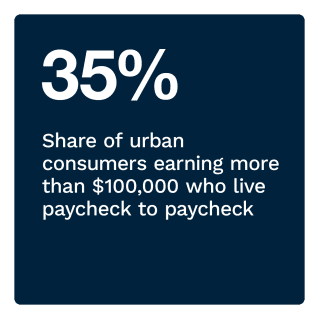

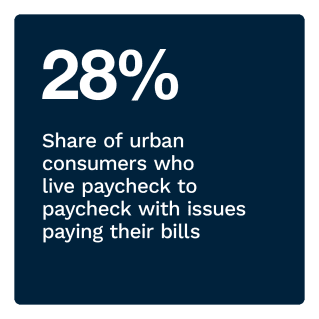

• Consumers in urban areas are more likely to live paycheck to paycheck and earn more than $100,000 a year. This seems to correlate with the relatively younger demographics of urban dwellers. At 28%, urban consumers are the most likely to live paycheck to paycheck with issues paying bills, followed by rural consumers at 24%. This is in spite of the fact that many of these consumers fall into higher income brackets.  Among paycheck-to-paycheck consumers living in urban areas, 35% earn more than $100,000 per year and 20% of those living in rural areas earn the same.

Among paycheck-to-paycheck consumers living in urban areas, 35% earn more than $100,000 per year and 20% of those living in rural areas earn the same.

• Urban dwellers who live paycheck to paycheck and struggle to pay their bills report holding significantly more savings than those in rural areas. Urban consumers report the highest savings ($9,890) among those living paycheck to paycheck without issues paying monthly bills. They also report the highest savings ($4,569) among consumers living paycheck to paycheck struggling to pay bills. In contrast, rural consumers living paycheck to paycheck without issues paying their bills report average savings of $7,437, while those with issues report the lowest average savings: $705.

To learn more about how paycheck-to-paycheck consumers of different income brackets are faring in today’s changing economic times, download the report.