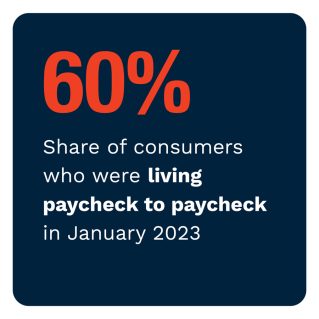

Rising prices continue to affect consumers’ purchasing power, making it more difficult for those in all income levels to live within their means, put aside savings and manage their debts. Regardless, consumers appear to be settling into the current financial environment by finding ways to adjust their behavior to lessen inflation’s impact. PYMNTS’ research finds that in January 2023, 60% of United States consumers lived paycheck to paycheck, down 4 percentage points from January 2022. Moreover, the share of consumers expecting their financial situation to worsen has also decreased, and more people are optimistic about 2023.

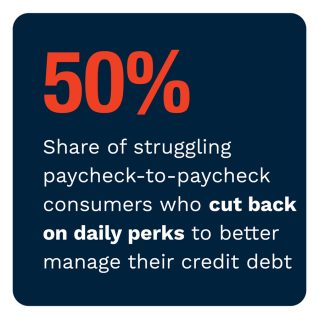

This confidence comes at the expense of discretionary retail spending. Consumers have continued tightening their belts in early 2023, just as they did during the 2022 holiday shopping season. Seven in 10 consumers report taking additional measures to manage their credit card debt. Consumers most cited budgeting and lowering spending as strategies they are using to manage their debt. Among paycheck-to-paycheck consumers, 84% are taking extra steps to manage debt, even as 20% of them are using credit cards less due to their tight financial situations.

These are just some of the findings detailed in this edition of “New Reality Check: The Paycheck-to-Paycheck Report,” a PYMNTS and LendingClub collaboration. The Debt and Credit Deep Dive Edition examines the impact of U.S. consumers’ 2022 holiday spending on their credit card debt. The series draws on insights from a survey of 4,163 U.S. consumers conducted from Jan. 6 to Jan. 27, as well as analysis of other economic data.

More key findings from the study include the following:

• Fewer consumers expect their financial standing to worsen, indicating that they have settled into the new economic environment, adjusting their spending behavior to lessen the impact on bottom lines.

According to PYMNTS’ data, just 25% of consumers in January 2023 said they believed their financial situation would decline in 2023, down from 27% who said the same in December 2022. This increase in consumer optimism comes at the expense of discretionary spending, however. As reported in November 2022, 15 million consumers said they would refrain from making holiday-related purchases, a 10% decrease compared to 2021.

• Credit cards are a popular choice for consumers in periods of high spending, yet struggling paycheck-to-paycheck consumers are less likely to have credit cards available in such situations.

PYMNTS’ research finds that 72% of consumers used a credit card for at least one holiday purchase, suggesting they commonly use cards to cover periods of high spending. Cardholders across all financial lifestyles were likely to use credit cards to finance holiday spending, although those in greater financial distress were the least likely to do so. Just 56% of consumers living paycheck to paycheck with issues paying bills made holiday purchases with a credit card last year.

PYMNTS’ research finds that 72% of consumers used a credit card for at least one holiday purchase, suggesting they commonly use cards to cover periods of high spending. Cardholders across all financial lifestyles were likely to use credit cards to finance holiday spending, although those in greater financial distress were the least likely to do so. Just 56% of consumers living paycheck to paycheck with issues paying bills made holiday purchases with a credit card last year.

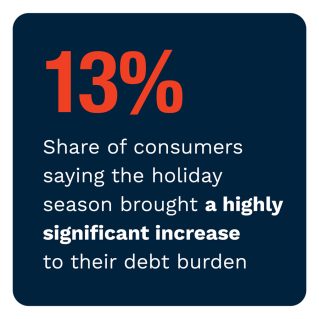

• Eighty-seven percent of cardholders report not experiencing a significant financial hangover from their 2022 holiday season spending, though struggling paycheck-to-paycheck consumers are less likely to agree.

With the increased use of credit cards in periods of high spending, one might expect credit card balances to balloon. However, while 86% of cardholders used their credit cards to make purchases in the last holiday season, just 13% reported that the holiday season brought a very or extremely significant increase in their debt burden. In comparison, just 16% reported it had at least a somewhat significant impact.

To learn more about how U.S. consumers’ 2022 holiday spending impacted their credit card debt, download the report.